Friday 31 May 2024

"Blackstone has agreed to sell Turtle Bay Resort in Oahu Hawaii for $725M. They acquired the hotel in 2018 for $332M" - Twitter. Some office buildings sell for less, but here is inflation of 13.9% per year. The increase in money benefits the wealthy.

France government debt increased from €200.7B in 1990 to a peak of €2820B in 2020 (blue), whilst Euro area bond interest rates declined from an 11.14% peak in 1990 to a low of -0.092% in 2020 (red).

Thursday 30 May 2024

The world’s first tooth-regrowing drug has been approved for human trials - Engadget.

Zacks Earnings Trends Highlights: Target and Walmart - Yahoo Finance: "Total earnings for the 481 S&P 500 members that have reported Q1 results are up +7.0% from the same period last year on +4.4% higher revenues .... For 2024 Q1, 'Magnificent 7' earnings are up +51.2% on +14.0% higher revenues. Excluding the Mag 7 contribution, 2024 Q1 earnings for the rest of the index would be down -1.5% from the year-earlier period".

Wednesday 29 May 2024

"YouTube's Ad Blocker Offensive Now Mutes Videos, Skips to the End" - Twitter.

"House bill would ban Chinese connected vehicles over security concerns" - Twitter.

"The FBI said it has dismantled what is likely the world’s largest botnet — an army of 19 million infected computers — that was leased to hackers for cybercrimes" - Twitter.

Tuesday 28 May 2024

"The Magnificent 7 generated revenue of $460B in Q1, up 14% from $404B a year ago" - Twitter.

Monday 27 May 2024

Stocks vs. Gold and Silver - Longtermtrends. Over 50 years, since June 1974 the gold price is up 15.1x or 5.6% per year, and the S&P 500 is up 58.2x or 8.5% per year. US money supply increased by about 7.9% per year. Gold is a poor investment. The gold price is suppressed by some loss making mining.

US - Federal Funds Rate vs. S&P 500 - Macromicro. Interest rates have not risen enough to limit the stock market rise – the asset appreciation which contributes to inflation. Investors are mocking the FOMC.

From 24 March 2024: Charted: Luxury Goods Investments vs. S&P 500 in the Last 10 Years. The wealthy spend their gains from asset appreciation on spirits.

Sunday 26 May 2024

"OMFG. They just tried to erase the entire history of new home price declines. Never forget." - Twitter.

Zillow has a chart that shows US house value is still rising: United States Housing Market

$358,734 - Zillow. They have a vested interest in reporting positive numbers.

According to Zillow, Los Angeles house values were 9.43% higher in April: Housing Data - Zillow.

From 30 April: How Much Does It Cost to Build a House in 2024? - House Beautiful. "The average cost to build a house in 2024 is $329,000 .... Those numbers are higher than they were last year, when Home Advisor put the average cost to build a house in the U.S. at $293,542." That is 12.1% higher.

Thursday 23 May 2024

Mining stocks are expensive, because profits have fallen, but the market thinks the good times will return soon. The dollar price of nickel (grey) and copper (orange) relative to US total debt as nominal inflation rate showed no sign of high profit margins up to Dec 2023.

Wednesday 22 May 2024

INSANE TORNADO PIPE intercept with windmills toppled near Greenfield, Iowa! - Youtube.

Monday 20 May 2024

Debt to GDP for Italy (green), France (red) and Spain (blue). Spain's debt to GDP halved from 64.3% in 1998 to 31.8% in 2007.

It declined because GDP (blue) almost doubled at 1.93x over the period, whilst the value of debt remained the same. GDP (blue) increased with money supply (red). Then debt to GDP shot up from 31.8% in 2007 to 105.6% in 2024, and GDP (blue) fell behind money supply (red).

The way countries usually reduce debt is to increase money supply. Governments do not necessarily print more money. Lower interest rates lead to asset appreciation and more debt. When interest rates can't go any lower and reach zero, like it did in the EU and the US, then government creates more money with QE (Quantitive Easing).

Saturday 18 May 2024

"The Economics Just Don't Work": Demand For Electric Semis Plunges Due To High Costs - Zero Hedge.

Friday 17 May 2024

Ben Affleck and Jennifer Lopez Are Living Separately amid Marriage Strife: Sources - People. Those faces are like the hundred year old black-and-white photos of couples living through hard times, like the depression.

"Iconic Dow Jones Industrial Index just blew through a new historic milestone: 40,000" - Twitter.

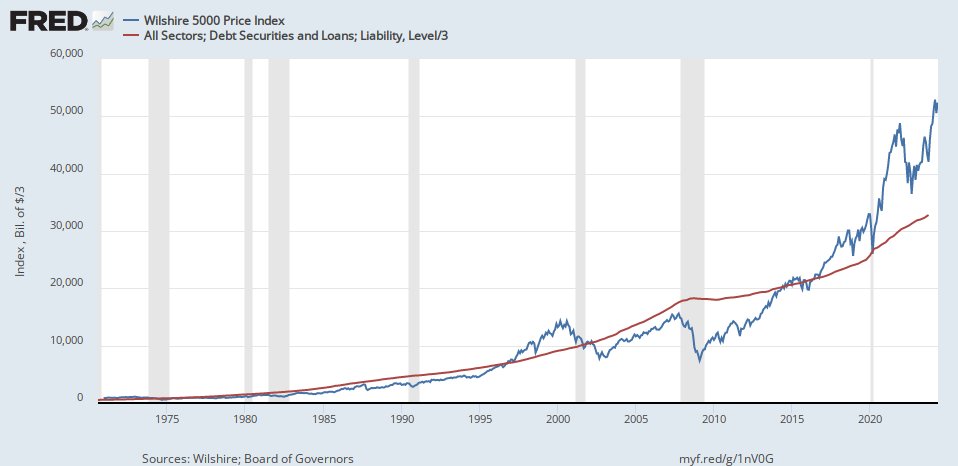

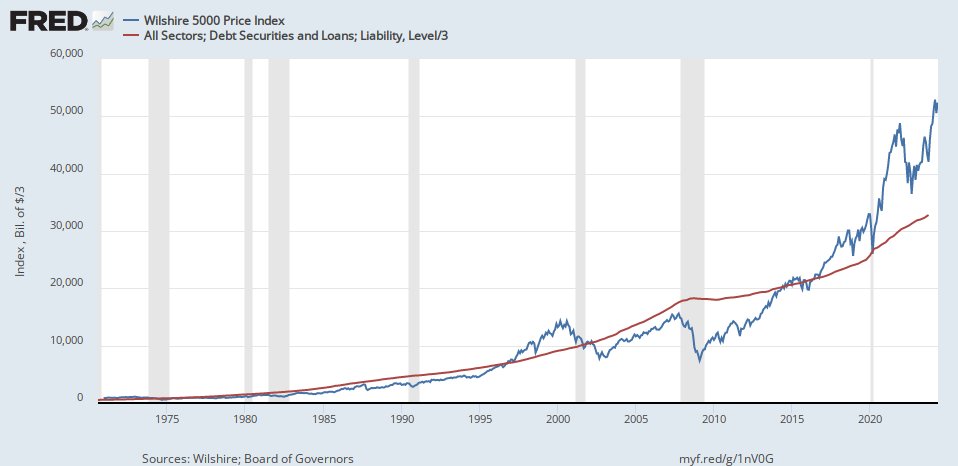

FRED (Federal Reserve Bank of St. Louis) has also removed the S&P 500 index from its charts, like the Wilshire 5000. Gold was removed years ago. Apparently they don't want any evidence of the bubbles caused by interest rates that are too low.

"BlackRock's Rieder says cut rates, not hike, would tame US inflation" - Twitter. This is like the lower taxes to grow revenue idea, as described in one of the best articles ever: How “Voodoo” Caused Most of the National Debt - Zfacts.

Thursday 16 May 2024

Hope, guts and pride: The new right-wing Dutch coalition plans - Dutch News.

"In a milestone, the US exceeds 5 million solar installations" - Twitter. With 80% of the sun's energy converted to heat, the solar panels make the earth's temperature nice and cosy.

Fast food inflation - Twitter.

"President Biden wants to give middle-class first-time homebuyers a $10,000 tax credit" - Twitter. A small step towards the price of a house, a big step for voter support. Subsidies increase the price of the product.

Wednesday 15 May 2024

Beijing vows retaliation against Biden's hikes of tariffs on Chinese imports - VOA.

"Canada’s housing market posted a surge in the number of properties available for sale" - Twitter. Must be those foreign buyers. Stop the foreigners from selling.

"Will Biden's new 100% tariffs on Chinese electric vehicles affect e-bikes?" - Twtter. Cyclists will be able to claim back for the periods they pedal.

Tuesday 14 May 2024

US opens probe into Alphabet's Waymo over 'unexpected behavior' of self-driving vehicles - Reuters.

"Extreme weather is devastating China’s crop of lychees, the jelly-like tropical fruit that’s worth $4 billion a year to the country’s farmers" - Twitter. Sell coffee and cocoa, buy lychees.

"I just imposed a series of tariffs on goods made in China: 25% on steel and aluminum, 50% on semiconductors, 100% on EVs, And 50% on solar panels." - Twitter. It strenghtens the dollar, and lowers exports. Import duties have the same effect as taxes – it lowers economic output, because the buyer has less money left over, and instead government hands out the money as benefits without production. The US has already priced itself out of the market for most products.

Monday 13 May 2024

A high dividend yield and share buybacks could give enough total return in the short term, but in the long run revenue growth must exceed the rate of money supply growth as nominal inflation rate. Walt Disney (DIS) reported revenue growth of 1%, and Apple (AAPL) a -4.3% decline. The US stock market (blue) needs to growth at a higher rate that total debt (red). It did from 2009 onwards. Now stocks are extremely expensive for the poor growth.

Friday 10 May 2024

Tesla FSD vs Mercedes Driver Assist! Is Mercedes really better? - Youtube.

"Stormy Daniels Offers Hush Money To Courtroom Sketch Artist To Please Stop Drawing Her" - Twitter.

"Travis Kelce makes acting debut! Taylor Swift's boyfriend pictured on set of Ryan Murphy's Grotesquerie - five years after she starred in box office bomb Cats" - Twitter. With the paparazzi after him, he may as well.

US import duties tend to strenghten the dollar. Exports should decline with imports. US auto exports increased up to 2016, and declined since (chart below). In Jan 1993 it was 30,200 units, and in Feb 2024 75,216 units. Exports from China averaged 438,000 per month in 2023 (CNN).

Value of US exports in Jan 1994 was $4970M / 44900 cars = $110,690 per car, and in Feb 2024 $12,400M / 75,216 cars = $164,859 per car (Trading Economics). Those are expensive cars.

Thursday 9 May 2024

Tesla Downgrades Recharging - Oil Price.

"One of the best articles I've read this year is about the business of books. 90% of titles in a given year sold fewer than 2,000 copies and 50% sold less than 12 copies" - Twitter. Doesn't sound right. Millions and millions of books do not sell at all. It is more like 90% sold zero copies.

Tuesday 7 May 2024

Walt Disney (DIS) Q2 revenue was +1% higher, and made a loss of -$0.01. Price/sales is $105.39/~$48.2. It is priced for 10% net profit margin. It did make 15.9% profit in 2019. They have a very creative workforce judging by the entertainment at Disney parks.

The coffee price has fallen back: TradingEconomics, and the cocoa price is falling from an enormous peak: TradingEconomics.

Why are the world’s cities sinking? – podcast - The Guardian.

"BYD Americas CEO says EV maker is not TikTok or Huawei" - Twitter. Henceforth they will be called spy cars.

Why the Fed May Be Forced to Raise Rates, Not Lower Them - Advisor Perspective.

"When did humans first arrive in East Asia? A new study of the Liujiang skeleton re-dates the earliest Homo Sapiens in China. The study has placed the skeleton's age - previously a matter of debate - at 33,000 to 23,000 years old." - Twitter.

"TikTok sued the US over a law that would force ByteDance to sell the app or face a ban on national security concerns" - Twitter.

Monday 6 May 2024

Inflation Was 18% in 2022 - Nextbigfuture.

The internet is full of Apple's (AAPL) share buybacks. If there is no revenue growth, and they use all the profits to buy back shares, at an earnings yield of (1.26 + 1.46 + 2.18 + 1.53)/$183.38 = 3.5%, the share price should rise by 3.5% per year, which is below the growth in money.

Friday 3 May 2024

US total debt increase in bilion of dollars (blue) is greater than the reduction in the Federal Reserve balance sheet (red). The balance sheet was smaller by $1.16 trillion on 24 April compared to a year ago, whilst total debt increased by $4.11 trillion over a year in Q4 of 2023. The latter is the apparent increase in currency, excluding cash not matched by debt.

Whilst US total debt (blue) increased $4113 billion in a year, the increase in total wages (red) was $675 billion, a ratio of 6.1x. Wages (red) are shown 4x larger, which equalled debt growth until 1980. The debt increase benefits the wealthy, but the workers will need to pay the debt.

Thursday 2 May 2024

US E-commerce retail sales shot up in 2020, presumably due to Covid lockdowns. In 2023 it was $1,117,854M. Amazon's sales for 2023 was $574,785M, which is 51.4% of the total. In 2019 Amazon sales was $280,522M, which was 49.2% of the total $569,896M.

E-commerce retail appears to top out relative the all retail sales, or it could be continuing to grow market share at the rate before 2019, in which case malls and other physical retail will continue to struggle:

Wednesday 1 May 2024

According to this data Japan's international debt of $727B in Q3 2023 (red) is small compared to total debt of $12,056B in Q4 2022 (blue). The annual balance of payments surplus (green) or net capital outflow is $229B for 2024. The present capital outflow will pay back international debt in 3.2 years. They can let the Yen fall. It makes imports more expensive, and exports cheaper.

According to Macrotrends Japan's trade to GDP increased from a low of 15.7% in 1993 to 46.8% in 2022. They are dependent on trade. US trade to GDP was 27.4% in 2022. Japan's exports of goods and servies to GDP increased from 8.5% in 1994 to 20.6% in Q4 2023:

Previous webpage

Previous webpage

CONTACT INFORMATION

Commentary to: slandrp@gmail.com

This website is: www.aandele.co.za/AandeleVSA

Disclaimer: No responsibility is accepted for wrong information, or for losses as a result of any information on this website. The contents should not be regarded as financial advice. Website visitors should consult with their own financial advisors before reacting to information.

Copyright @2024