Monday 31 January 2022

This Is When the End Game for the Dollar Will Really Kick In - Youtube.

From 21 Mrt 2016: Milton Friedman Speaks: Money and Inflation (B1230) - Full Video - Youtube.

The obvious question now is how high US interest rates need rise to stop inflation running away. Up to 2001, interest rates (red) had to increase to levels comparable to the growth in money supply (blue). In 2006 interest rates (red) again rose to 5%, the same level as money growth (blue), but that was not high enough as money supply (blue) continued to grow by up to 10% in 2009. Since then the US government allowed credit to grow with zero interest rate, whilst money supply (blue) grew around 6% until 2019, when an attempt to raise interest rates (red) failed again. Money supply shot up in 2020. It doesn't look like the US government will try to stop higher money supply growth.

It looks like M3 money supply is expanding exponentially:

"Biden chose Harris as his VP because of the color of her skin and sex—not qualification. She's been a disaster. Now he promises to choose Supreme Court nominee on the same criteria. Identity politics is destroying our country." - Trading Economics. Politicians are only motivated by election results.

Sunday 30 January 2022

According to official inflation statistics, the US has had high economic growth for the more than 50 years. It is difficult to find an absolute measure of inflation. The number of vehicles sold (red) has not increased for 45 years. If people were wealthier, they would have bought a new car more often. Wealthy people also tend to collect cars. Since an increase in money supply usually only leads to inflation, and not economic growth, the velocity of money flow (blue) would be the real economic output.

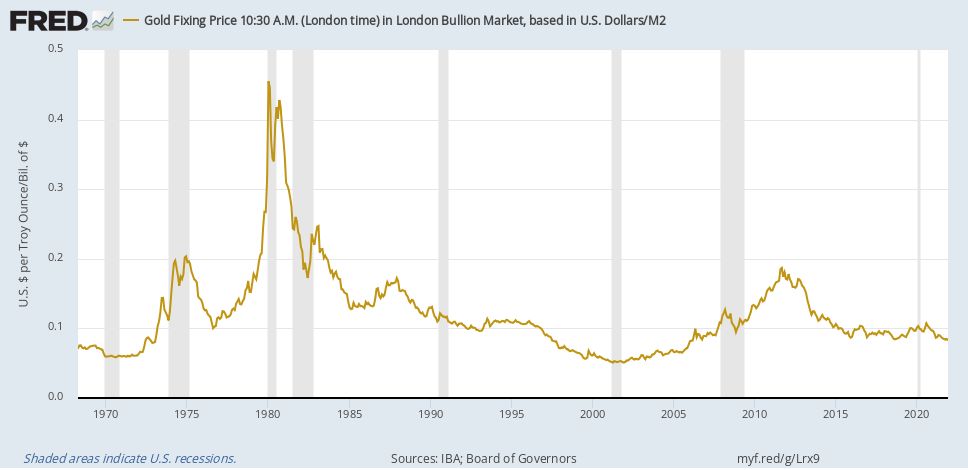

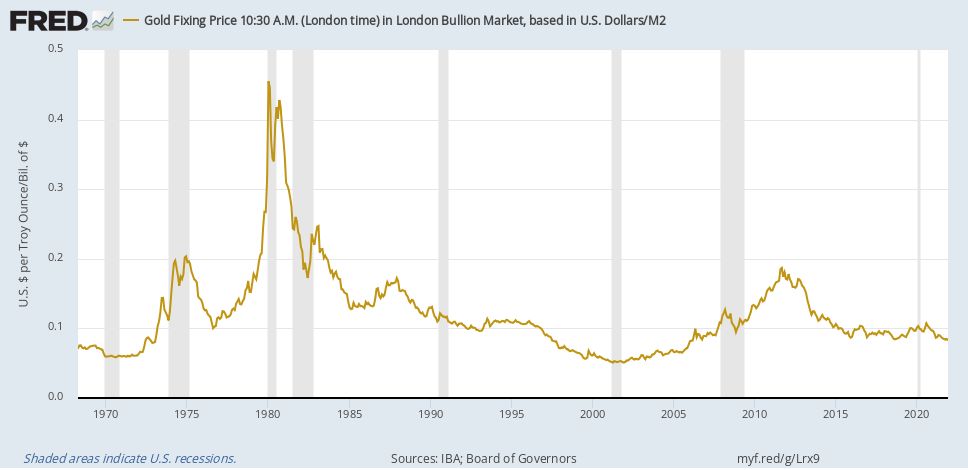

Another measure of actual inflation, is to compare the gold price to money supply (below). The gold price is volatile, but shows the gold price increased at the same rate as the money supply over 54 years. That means inflation is equal to money supply growth. The gold price series will be removed from FRED as from tomorrow.

Saturday 29 January 2022

The Baltic Exchange Dry Index has fallen back to the average level for the last 3 decades - Trading Economics.

What causes inflation? Increasing money supply is the main cause of inflation. It is very difficult to add money to the supply without causing inflation. Usually some people receive money or benefits for which they have not produced anything. More money without an increase in economic output is inflationary by definition.

Regardless of money supply, if there is a lot of competition in an economy, wages and product prices experience downward pressure. This encourages businesses to produce more at lower cost, which is economic growth. There is intense competition amongst many small businesses in China, which is why China has high economic growth. The US economy consists of old, large corporations with limited competition, which is one reason why the economy is declining. The other is a large, interfering government. Both cause inflation.

Friday 28 January 2022

The scramble for cargo aircraft as shipping costs soar - BBC. That would explain the performance of Atlas Air Worldwide (AAWW) airfreight business.

Apple (AAPL) smartphones Investor Relations: first quarter profit margin increased to 33.2%. Since the last quarter of 2020 iphone sales included model 12 and 13 which operate on 5G, which could be the reason for the present demand.

Epic Games gets significant new backing in fight with Apple - TechCentral.

The total revenue of all companies cannot grow faster than the economy, and profit margins are limit. Therefore the ratio of all company profits to economic output should stay the same. Until 2001, US Corporate Profits (blue) remained around 5% of the economy (red). Since 2001, profit margins (blue) have improved.

This has push the stock market (blue) far above the historical 60% of Gross Domestic Product (red). Profit margins can't improve forever.

Relative to money supply (red), US natural gas prices (blue) are extremely cheap:

Thursday 27 January 2022

"This Fed is as trapped as it could ever be." - Twitter.

It is difficult to know what would happen if reserve banks reversed quantative easing by withdrawing money out of circulation. A decline in money supply almost never happens. According to Lumen: "The decrease in the money supply is mirrored by an equal decrease in the nominal output, otherwise known as Gross Domestic Product (GDP). In addition, the decrease in the money supply will lead to a decrease in consumer spending. This decrease will shift the aggregate demand curve to the left. This reduction in money supply reduces price levels and real output, as there is less capital available in the economic system."

People are predicting that Electric Vehicle (EV) will take over the car market in the future. The cheapest EVs are twice the price of fuel cars. In poorer countries the public will still buy fuel cars. The biggest percentage sales is in Norway (86%), but its EVs are still only 22% of existing vehicles. In Germany EVs make up 26% of sales, and 1.2% of vehicles in use (Wikipedia).

Cops: 84-year-old man was driving without a license for 72 years - Foxnews.

US GDP nominal growth of 11.7% over a year in the fourth quarter (blue) is no Gouda when money supply is growing at 13% (red). The economy will never recover from the big spike in money supply Mar 2021 to May 2022:

Wednesday 26 January 2022

The Fed Has No Real Plan, and Will Likely Soon Chicken Out On Rate Hikes - Mises Wire.

U.S. House leaders unveil chips, China competition bill - Reuters. Subsidizing is not competing. US made products are much more expensive than those made in China. A small subsidy is not going to make a difference.

New home sales end 2021 with a surge, climbing almost 12% - Seeking Alpha.

"With an absence of media coverage the U.S. merchandise trade deficit "unexpectedly" surged to a record shattering $101 billion in Dec. This is the first monthly deficit to exceed $100 billion, but it won't be the last. The U.S. economy has never been weaker. The #dollar is toast!" - Twitter. Capital being pulled back into the US dollar usually occurs before stock markets collapse.

If the US Federal Reserve balance sheet (Quantitive Easing) is deducted from M2 money supply (blue), money supply drops to the red line. This would have a massive impact on the US economy. It is unlikely that this money will be withdrawn, but instead the money supply will be increased permanently (printed). In countries like Venezuela and Zimbabwe goverment hands out money to pay for support, and to overcome the inflation this causes, they have to print more and more causing hyperinflation. How the US is going to overcome the increase poverty caused by the inflation remains to seen. Interest rates have already been reduced to zero so the public can boost their standard of living with as much debt as possible.

Is house price inflation reflected in the exchange rate? This FRED chart compares the ratio of the house prices in Australia and the prices in US (blue), with the exchange rate (red). They deviate substantially at times, but do eventually intersect again. The Australian dollar was too weak around 2001, and too strong around 2012.

Tuesday 25 January 2022

Verizon Loses 69,000 Pay TV, Adds 55,000 Broadband Subscribers in Fourth Quarter - Hollywood Reporter.

Using Our Money To Steal Our Money - Talk Markets.

Google sued over tracking user locations despite opt-out - Mybroadband.

The dividend yield on the S&P 500 is down to 1.37%: Multpl, which is far too low to compensate for inflation. To that should be added stock buybacks, which is another 2.03%, given a total yield of 3.40%: Yardeni. Dividend yield of common stocks on the New York Stock Exchange from 1871 to 1969:

Monday 24 January 2022

ProShares Short QQQ ETF: How To Short Strategically - Seeking Alpha. Shorting a stock market is betting against constant inflation, which only works sometimes.

Billionaire Mark Cuban launches online pharmacy aimed at lowering generic drug prices - NPR.

Sunday 23 January 2022

"MUST READ. “We are fully convinced that these historic valuation extremes have removed decades of investment returns from the future, and strongly suspect that the Fed has amplified future downside risk as well.” " - Twitter. The stock market only needs to fall until it reaches the nominal economy, which is pushed up by inflation. At this stage it looks unlikely that inflation will be stopped, only the rate of growth slowed.

The reason stocks or stock markets drop sharply these days is probably due to the forced closure of leveraged positions, unlike decades ago when there were panic selling.

Saturday 22 January 2022

Seeing Red: Is The Heydey Of Pandemic Stocks Over? - Talk Markets.

From Nov 2021: Matt Damon Crypto Commercial for Crypto.com - Youtube. November was the peak for Bitcoin.

The US economy is dominated by monopolies. The pricing power allows them to increase profit margins at will, which does add to inflation. This FRED chart below shows Corporate Profits as percentage of Gross Domestic Product. In Q3 it was 11.7%. The MegaCap-8 has a forward profit margin of 20.4%, or 27.7% without Amazon: Yardeni.

If inflation is equal to the increase in money supply, the velocity of money flow (red) represents the real US economic output. The economy has declined since 2001, whilst corporate profit margins have increased (blue). The biggest real economic growth (red) corresponds to a period of low corporate profit margins (blue). The lack of competition in the US has probably made it more difficult to compete with China.

Friday 21 January 2022

Is Tesla FSD Dangerous? BETA 10.9 San Francisco Stress Test - Youtube.

New step to curb tech giants' power advanced by Senate panel - AOL.

Netflix shares tank 20% on weak subscriber outlook - CNN.

"Zillow Home Value Index: Low Inventory in December, Growing Prices" - Twitter.

"#Bitcoin has finally broken the neckline of a head-and-shoulders top. The scary part for the longs is that the pattern projects a move below $30,000. Once that level is breached Bitcoin will have completed a massive double top. From there a crash below $10,000 is highly likely." - Twitter. Like all other investments, it falls until buyers find fundamental value like profits and dividends.

Planes Equipped With Precise Sensors Can Measure Fertilizer Levels by Flying Over Farms - Modern Farmer.

I took a Soviet steam train in Karelia | My expedition to the Far North of Russia starts! - Youtube.

Thursday 20 January 2022

Something Has to Give in the Housing Market. Or Does It? - The New York Times. The worst articles are behind paywalls. It is a bubble because lenders are not getting a real return on their money. Some of the debt is supplied by the Federal Reserve.

"Permits to build privately owned U.S. housing increased 9.1% to a seasonally adjusted annual rate of 1.87 million in December." - Twitter. Interest rates are too low.

Kathy Griffin Says She Was Fired From Co-Hosting CNN’s New Year’s Eve Show After Demanding Raise - Hollywood Reporter.

Life on Mars: NASA's Curiosity Rover Finds Intriguing Carbon Signatures on the Red Planet - Gadgets 360. It is probably the Vikings. David Bowie – Life On Mars? - Youtube.

Wednesday 19 January 2022

"Stocks typically experience a correction during the early stage of a rate hike cycle." - @thedailyshot. True statement, but the REALLY BIG #Correction, and #recession comes after rate hikes STOP." - Twitter. Interest rates stop going up when it has an impact, which can be seen as an economic decline.

Europe rolled out 5G without hurting aviation. Here's how - CNN.

China mined a record amount of coal in 2021. It might produce even more this year - CNN.

Biden says 'not there yet' on possible easing of tariffs on Chinese goods - Reuters. Lower imports also means lower exports. You only harm your own economy with import duties.

Tuesday 18 January 2022

Activision Blizzard (ATVI) games vir consoles, cellphones and PCs. Offer from Microsoft at $95 per share, which is a price/earnings of 28. Microsoft has a price/earnings of $306/$8.94 = 34. After the acquisition there would be a slight reduction in Microsoft's valuation. Activision has a net profit margin of 31%, and Microsoft 45%. The high profit margins indicate limited competition.

Tesla driver is charged with vehicular manslaughter after running a red light on Autopilot - Electrek.

Euro Area car registrations have decline for 3 years - Trading Economics.

Sunday 16 January 2022

"2022 Kia EV6 Long Range RWD Review: Hard To Not Like - InsideEVs. What matters to buyers is price. The Kia EV6 starts at $45,000 - Car and Driver. This is why people will continue to buy fuel cars, starting at $15,000.

"Just FYI, $TSLA's "record, mind-blowing Q4 in China" gave it around a 1.5% share of the passenger car market, with a market cap almost as big as the other 98.5% of the market combined. Enjoy your bubble-stock before it bursts with all the others!" - Twitter. Tesla's sales in China for December was 31,732/2.79M = 1.1%. For 2021 it was 240,000/26.28M = 0.91%.

Friday 14 January 2022

"Keep hearing of train burglaries in LA on the scanner so went to #LincolnHeights to see it all. And… there’s looted packages as far as the eye can see. Amazon packages,

@UPS boxes, unused Covid tests, fishing lures, epi pens. Cargo containers left busted open on trains." - Twitter.

JPMorgan Chase (JPM), bank. Results: website. No revenue growth in Q4. With money supply growing at 12-25%, bank revenue should grow at the same rate. Price/earnings = $168.23/$15.35.

"China’s exports hit a record high" - Twitter.

China's trade surplus (capital outflow) increased to $94.5B in December from around $50B in the past: Trading Economics.

US imports from China (blue) haven't increased much for a decade, thus not the reason for the increase in China exports (red):

Thursday 13 January 2022

Delta Air Lines (DAL) results: Delta.

"Lumber prices are still soaring higher. Will US house prices become even less affordable?" - Twitter. What is the reason for the second spike in a year?

"Australia has provisionally just had its joint hottest day on record. With 50.7°C in Western Australia, it also matches the highest recorded temperature in the Southern Hemisphere (joint from 1960)." - Twitter.

Elon Musk Shares Video of Enormous Tower That Will Catch Rockets - ExtremeTech.

Wednesday 12 January 2022

The Financial Headlines Keep Getting More Ridiculous - Youtube.

"Wage growth versus Fed Fund rate" - Twitter.

The copper price (orange) should fall with higher interest rates which would weaken the economy, but the inflation caused by the increase in money supply (green) should lift it to a higher level long term. Unless money supply shrinks, the increase in the price of goods is permanent.

Tuesday 11 January 2022

World demand has recovered to 2019 levels: EIA.

Tourists Cause Permanent Damage at Big Bend National Park by Etching Names Into Ancient Petroglyphs - Travel + Leisure. The vandals did provide their names. Marking rocks is sign of a return to the stone age.

Monday 10 January 2022

"US used vehicle prices continue to surge." - Twitter.

Mark Mobius Sees ‘Much Much Higher’ U.S. Yields on Inflation Risks - Yahoo Finance.

Top strategist David Rosenberg warns of a massive market bubble that could pop this year — and makes a contrarian call to buy Treasury bonds - Business Insider. Either the asset bubbles must collapse, or inflation go up to match the asset bubbles. So far the government has allowed inflation to run.

Google is manipulating browser extensions to stifle competitors, DuckDuckGo CEO says - IOL.

Friday 7 January 2022

In Absolute And Percentage Terms, Consumer Credit Jumps The Most Ever - Talk Markets.

Up to Q3 US consumer debt did not grow as much as money supply, indicating that people are falling behind inflation:

"Container shipping costs out of China have not peaked." - Twitter.

US mortage rates are rising, which means lower house prices, and less money left over for consumer spending:

US rental vacancies are low:

Thursday 6 January 2022

"For all the “QE isn’t money printing” folks, here’s a nice explanation from the @bankofengland (the literal OG central bank btw) of how QE generates more money and inflates asset prices" - Twitter.

French regulator fines Google and Facebook a combined $238 million over cookies - Engadget.

Wednesday 5 January 2022

"Market Cap of Firms at 20x Sales" - Twitter.

Toyota dethrones GM as U.S. sales leader after nearly a century on top - Reuters.

The market cap of Tesla is entertaining: Companiesmarketcap.

Monday 3 January 2022

"Someone explain this math to me? How is a 41,000 Tesla vehicle beat worth 1.5 times Ford's 5 million vehicles per year when Ford has a more extensive EV lineup and delivers 3X the total revenue of Tesla?" - Twitter. The Tesla share price is gone from around $50 for years until 2020, to $1200 now. Stocks with high growth prospects tend to shoot up, to where years of growth is priced in, and then go sideways

Sunday 2 January 2022

France bans plastic packaging for fruit and vegetables - Fin24. It will dry out without plastic.

Saturday 1 January 2022

Jim Rogers: Next bear market will be ‘the worst in my lifetime’ — here are 3 assets he's using for 2022 crash protection - Yahoo Finance.

Previous webpage

Dec 2021

CONTACT INFORMATION

Commentary to: slandrp@gmail.com

This website is: www.aandele.co.za/AandeleVSA

Disclaimer: No responsibility is accepted for wrong information, or for losses as a result of any information on this website. The contents should not be regarded as financial advice. Website visitors should consult with their own financial advisors before reacting to information.

Copyright @2022