| The Mother Of All Financial Bubbles: "This Is The Very Definition Of Unsustainable" - Zero Hedge. |

Trump’s Rosy Scenario - Paul Krugman, NY Times. Die skuld wat Trump geërf het is wel 'n gemors. Vir die VSA om te groei sal meer skuld vereis, en 'n verdere gebruik van goedkoop arbeid in ander lande.

Norway Central Banker Warns Of Massive 50% Drop In Wealth Fund Assets To Cover Budget Deficits - Zero Hedge.

Is 50% Of Western Central Bank Gold Gone? - Talk Markets. Goud lyk interessant.

How to use Instagram, Snapchat on a PC or Mac - USA Today.

Perovskite mixed into solar ink can print 20.1% efficient solar onto glass or plastic - Next Big Future.

China counting on high speed rail to drive domestic tourism to about 10% of GDP - Next Big Future. Hoë spoed treine kan baie voordelig wees.

Op die internet - Suid Afrika

Does it make sense to buy a home or invest in property in Sandton? - BusinessTech. 'n Eiland van ontwikkeling in 'n oseaan van verval.Take the burn out of your medical scheme membership - Moneyweb.

How much blood can you buy for $13 billion? (Zimbabwe) - Moneyweb.

Vrydag 17 Feb 2017

Op die internet

It Is About Time That We Had A President That Was Willing To Go To War With The Mainstream Media - The Economic Collapse. Media is gewoonlik liberaal, en liberalisme lei tot die verval van 'n beskawing.Australian Conservatives Attack Chief Scientist For Failing To Toe Fossil Fuel Party Line - Clean Technica.

The Biggest Myths In Investing, Part 5 – Bonds Lose Value If Rates Rise - Talk Markets.

Trump just used Boeing's new global airliner to attack globalization - Business Insider. World Class Supplier Quality - Boeing. "On the 787 program, content from non-U.S. suppliers accounts for about 30 percent of purchased parts and assemblies." Van 9 Sep 2016: China manufacturer delivers components for new Boeing airplanes - China.org.cn. Van 12 Aug 2014: Two-thirds of Boeing’s $6Billion Cost Cutting Will Come from Its Supply Chain - Supply Chain 24.

Trump's most chilling economic lie - Joseph Stiglitz, Vanity Fair. "A so-called trade war with China would be an absolute disaster for the United States and its citizens."

NO HOLDS BARRED: Trump, in unprecedented fashion, airs grievances in an epic 77-minute press conference - Business Insider UK.

Chasing the Canadian dream: The real force driving the housing boom in our big cities - Financial Post. "An average new single-family detached home in the Greater Toronto Area (GTA) was $1,264,604 in 2016". Dit is R12.6M.

“Glassy carbon” electrodes transmit more robust signals to restore motion in people with damaged spinal cords - Next Big Future.

Juno spacecraft gives up, decides to take the long way around Jupiter - Popular Science.

JSE aandele

Die JSE het -0.69% laer gesluit. Die Rand/$ is swakker op R13.08. Brent olie is af na $55.42. Die goudprys is op na $1239.50. Yster erts verhandel teen $85.72.Groot stygings: Phoenix +10.2% na 65c, Adcorp +6.6% na R18.49 (R0.68M), Truworths +5.7% na R89.00 (R770M), Amplats +4.5% na R327.59 (R486M), DRDGold +4.5% na R8.63, Northam +3.7% na R53.50.

Groot dalings: WBHO -3.9% na R146.35, Aspen -2.6% na R288.82 (R513M), Sanlam -2.1% na R18.90.

Blue Label Telecoms (BLU) verwag vir die 6m tot Nov 'n wesens VPA van 80.96c tot 83.09c, +52% tot +56% hoër, en kern 81.90c tot 84.63c, +50% tot +55% hoër. Sonder die toename in die waardasie van Oxigen sou die kern wVPA 62.25c tot 63.34c wees, +14% tot +16% hoër. As die totale kern wVPA herhaal sal die prys/verdienste rondom R17.81/~R1.64 ~ 10.8 wees.

Murray & Roberts (MUR) verklaar dat 22% van hulle aandele gister verhandel was, teen 'n gemiddelde prys van R14.91, deur onbekende kopers. (Dalk 'n aandeel houer wat genoeg gehad het van verliese deur die bestuur).

Why struggling MTN is a 'buy' - BusinessLive. Daar is te veel mededinging. Die plaaslike en nasionale regerings in Suid Afrika skep hulle selfoon netwerke wat gratis dienste bied. Die sterk Rand gee swakker buitelandse syfers. Die Nigeriese boete word oor 3 jaar afbetaal.

Op die internet - Suid Afrika

Nearly 200 more unit trusts registered in SA last year - Moneyweb. "These structures save a lot of money due to the fact there is no CGT when changes are made to portfolios" - dit is wat gebeur wanneer regering inmeng. Die aantal fondse relatief tot die getal aandele is belaglik. 'n Groot mark val is nodig om 'n einde te bring aan hoër waardasies as gevolg van die fondse.DStv 2017 price hike coming in April - Channel24. Die Rand het 25% versterk sedert verlede jaar. Pryse behoort af te kom.

How electric cars could change everything - Techcentral. Dit is onprakties vir elektrisiteits verskaffers om elektriese voertuig batterye as stoor te gebruik, want die voertuig eienaars wil nie batterye hê wat pap of half-pap is nie.

Donderdag 16 Feb 2017

JSE aandele

Die JSE het +0.19% hoër gesluit. Die Rand/$ is sterker op R12.95. Brent olie is af na $55.69. Die goudprys is op na $1238.40.Groot stygings: M&R Hold +34% na R15.00 (R139M verhandel), Phoenix +9.3% na 59c, WBHO +5.1% na R152.30, Aveng +3.8% na R7.36, Naspers +2.2% na R2166.45 (R1753M), MTN +2.1% na R119.50 (R501M).

Groot dalings: Aspen -4.0% na R296.57 (R596M), Woolies -3.9% na R70.50 (R756M), CityLodge -3.6% na R147.12, ARM -3.3% na R109.12, Amplats -3.1% na R313.40.

Truworths International (TRU) se inkomste vir die 6m tot Des was +21% hoër, en vwVPA -3% laer na 391.9c. Die jaar se dividend opbrengs is (175c+270c)/R84.23 -15% = 3.5%.

Mpact (MPT) verwag vir die 6m tot Des 'n wesens VPA van 225c tot 255c. Lae handel.

Stellar Capital Partners (SCP) se netto bate waarde was R1.66 op 30 Nov 2016.

City Lodge (CLH) se inkomste vir die 6m tot Des was +5% hoër, en wvVPA +1% hoër na 455.8c. Die dividend opbrengs is (248c+272c)/R151 -15% = 2.9%. "Negatief geraak word deur die heersende lae sake- en verbruikersvertroue". (Die ekonomie lyk nie goed nie).

South32 (S32) se inkomste vir die 6m tot Des was +8.1% hoër, en vwVPA $0.115 teenoor -$0.06 verlies 'n jaar gelede. As dit herhaal is die prys/verdienste R26.65/(2x $0.115 xR13) ~ 8.9. Die dividend opbrengs is ($0.01+$0.036)xR13/R26.65 -15% = 1.9%. (Goeie herstel. Met die netto wins marge nou 19% is die beste groei verby).

Woolworths (WHL) se inkomste vir die 6m tot Des was +7.1% hoër, en wvVPA -4.1% laer na 241.3c, of verstel -2.4% na 244.9c. Die dividend opbrengs is (180c+133.0c)/R73.39 -15% = 3.6%.

Gold Fields (GFI) se inkomste vir die jaar 2016 was +8.1% hoër in dollar, en vwVPA $0.26 teenoor -$0.04 verlies in 2015 ($0.11 vir 6m tot Des 2016).

What’s happening in the platinum market sounds like fake news - Moneyweb.

Resource markets through the eyes of Allan Gray - Moneyweb.

Hospitality Property Fund targets up to 30 hotels - BusinessLive.

Op die internet - Suid Afrika

What a R10,000 a month home looks like in Gauteng, KZN and the Western Cape - BusinessTech. Huur huise is skaars in die Wes-Kaap.Foreign investors have pulled billions out of SA thanks to government - BusinessTech. ('n Sterker Rand kan dit aantreklik maak om wins te neem op beleggings). Australian government uses investment collapse to push Trump-style corporate tax cuts - World Socialist Web Site. "... the Australian government is trying to use a dramatic drop in foreign direct investment since 2014 to ramp up its campaign to slash the company tax rate from 30 to 25 percent over the next decade". Een moontlike teken van 'n komende VSA aandeelmark ineenstorting is ontrekking uit ander lande.

Competition Commission probe into banks’ currency trading - Intellidex. "Only about 30% of rand-dollar trade takes place in South Africa". (Zuma weet daar is te min transformasie by banke want hulle werk nog).

Ex-cyclone Dineo has SA disaster management teams on high alert - Newcastle Advertiser.

Satellite TV Is Fueling Zimbabwe's Cash Shortage: Central Bank - Bloomberg. Gedeel deur die bevolking, is dit lae subskripsie. Dit is die armoede wat volg wanneer mense "rykdom" probeer versprei.

Google told former ANC mayor’s wife to take a hike - Mybroadband. "The wife of the mayor of Johannesburg requested we delist articles from Google Search suggesting that her husband used his position to advance her economic interests."

Zuma weighs in on decision to prosecute banks - Fin24. Die ANC wil die eksklusiewe reg op korrupsie behou.

Op die internet

George Church indicates reversal of aging will be a reality within ten years - Next Big Future.“Seriously Delinquent” Auto Loans Surge - Wolf Street.

Here are the Top “Sell Markets” in an Overpriced World as “the Apartment Cycle Draws Closer and Closer to the End” - Wolf Street. "Commercial Property Bust to hit Multifamily Rentals in San Francisco & New York, the Most Expensive Markets in the World".

You can now ask your Google Home to buy things - The Verge.

Alphabet no longer wants to blanket the earth with internet balloons - The Verge.

Greek Bank Run Re-accelerates: Massive Deposit Withdrawals Despite Capital Controls - Zero Hedge.

Sir Vince Cable: There are 'parallels' between Trump's trade wars and the 1930s - Business Insider UK.

Earth has a brand-new continent called Zealandia, and it's been hiding in plain sight for ages - Business Insider UK.

REPORT: The EU is terrified that Brexit will allow people to sell 'British Champagne' - Business Insider UK.

Woolly mammoth on verge of resurrection, scientists reveal - The Guardian. No, the wooly mammoth won't actually be resurrected by 2019 - Popular Science.

Found: A Drug Catapult at the U.S.-Mexico Border - Atlas Obscura.

Woensdag 15 Feb 2017

JSE aandele

Die JSE het +0.04% hoër gesluit. Die Rand/$ is sterker op R13.02. Brent olie is af na $55.87. Die goudprys is af na $1225.90.Groot stygings: Comair +15.8% na R5.85, EOH +9.0% na R155.85, Raubex +5.6% na R23.92, MrPrice +2.9% na R171.30.

Groot dalings: Amplats -4.7% na R323.50, RBPlat -4.4% na R40.90, AForbes -3.2% na R6.94, Implats -3.0% na R51.30.

Murray & Roberts (MUR) verwag vir die 6m tot Des 'n wVPA van 24c tot 34c, -65% tot -75% laer.

RockCastle Global Real Estate (ROC) se huur uitkering vir 2017 is 'n opbrengs van ($0.04782+$0.05189)xR13.0/R33.85 = 3.8%. Groei van +21% word vir 2017 verwag.

Aveng (AEG) verwag nou vir die 6m tot Des 'n wesens verlies per aandeel van -96.0c tot -101.0c.

New Europe Property (NEP) se uitkering vir die jaar 2016 van €0.405 is +14.6% hoër as 2015, en 'n opbrengs van €0.405xR13.82/R152.87 = 3.7%. Groei in verspreibare VPA van +15% word vir 2017 verwag.

Emira (EMI) se huur uitkering vir die 6m tot Des is 68.93c. Die uitkering vir die jaar tot Jun 2017 word steeds -2% laer verwag.

Wilson Bayly Holmes-Ovcon (WBO) verwag vir die 6m tot Des 'n wVPA van 363c tot 395c, -37.5% tot -42.5% laer.

EOH (EOH) verwag vir die 6m tot Des 'n wVPA van 431c tot 449c, +20% tot +25% hoër. As dit herhaal sal die prys/verdienste R152.98/~R8.80 = 17.4 wees.

Amplats (AMS) se inkomste vir die jaar 2016 was +3.6% hoër, en toeskryfbare vwVPA R7.10, teenoor 41c of -48c in 2015. As die tweede helfte herhaal, sal die prys/verdienste R335.00/~2xR3.12 ~ 54 wees. Die prys/verkope is R335.00/R236 ~ 1.4.

DRD Gold (DRD) se inkomste vir die 6m tot Des was +5.1% hoër, en het 'n verdunde wesens verlies per aandeel van -2.4c gehad.

China iron-ore slips from record high as steel retreats - EngineeringNews.

Op die internet

Whatever Happened to Inflation after All This Money Printing? It Has Arrived! - Wolf Street.Urea May Be Key To Affordable Grid-Scale Batteries - CleanTechnica.

EU Sends Envoy to Salvage Greece Deal as February Deadline Looms - Bloomberg.

Pictures of 'swooning' Ivanka Trump and Justin Trudeau go viral - The Guardian.

'Disturbing' Results Show High Pollution Levels in Mariana Trench - Live Science. Wikipedia: "The Mariana Trench or Marianas Trench is the deepest part of the world's oceans. It is located in the western Pacific Ocean, to the east of the Mariana Islands."

Op die internet - Suid Afrika

Competition Commission prosecutes banks for collusion - Fin24. "price-fixing and market allocation in the trading of foreign currency pairs". Daar is 'n enorme marge tussen die koop en verkoop wisselkoerse wat bank kliente betaal, vir transaksies wat deur rekenaars kan gedoen word.Massive trouble brewing for South Africa’s national broadband network roll-out - Mybroadband.

Eskom load shedding was part of a simple get-rich-quick scheme: report - BusinessTech.

Shocking levels of corruption uncovered at City Power amid allegations involving the chairman’s wife - BusinessTech.

Lobster crash erodes West Coast way of life - Fin24. "The Southern African Sustainable Seafood Initiative (Sassi) has listed the species as endangered and called for the fishery to be closed after Agriculture, Forestry and Fisheries Minister Senzeni Zokwana reneged on a recovery plan for kreef ..."

Dinsdag 14 Feb 2017

Op die internet

Lithium: The Fuel of the Green Revolution - Visual Capitalist.Brazil Retail Sales Collapse as Inflation and Unemployment Whack Consumers - Wolf Street.

The Rare Metal That’s Soaring as Electric Cars Boom - Financial Times. "Prices for cobalt metal have climbed nearly 50 percent since September to five-year peaks ..."

Biggest EU Banks Embark on the Mother of All Debt Binges - Wolf Street.

China iron ore rises on firm steel demand, battle v smog - SMH.

Record-breaking 104 satellites to launch on a single rocket from India tonight - TheVerge.

GM Took Seven Years to Figure Out the Obvious on Opel - Bloomberg. "Struggling to make a profit in Europe, General Motors appears ready to sell its Opel division to French carmaker PSA Group, which makes Peugeot and Citroen cars."

Finally! Scientists discover gene that stops overeating and actually makes you CRAVE exercise - Daily Mail.

JSE aandele

Die JSE het -0.93% laer gesluit. Die Rand/$ is sterker op R13.19. Brent olie is op na $56.32. Die goudprys is op na $1226.70.Groot stygings: KAP +7.9% na R8.90, Phoenix +6.4% na 50c, Adcorp +5.2% na R17.35, CashBuild +4.0% na R380.01.

Groot dalings: Kumba -7.2% na R209.35 (R307M), Northam -5.9% na R51.06, Implats -3.0% na R52.89, ARM -3.0% na R113.55, Naspers -2.8% na R2109.00 (R3058M).

Advanced Health (AVL) verwag vir die 6m tot Des 'n wesens verlies per aandeel van -10.52c.

Adcock Ingram (AIP) verwag vir die 6m tot Des 'n wesens VPA van 145c tot 149c, +45% tot +49% hoër. Die prys/verdienste is rondom R54.49/(129.1c+~147c) ~ 20.

Santam (SNT) verwag vir die jaar 2016 'n wesens VPA van 1033c tot 1125c, -39% tot -44% laer.

Comair (COM) se inkomste vir die 6m tot Des was +5.7% hoër, en vwVPA 42.7c teenoor 13.1c 'n jaar gelede (en 23.4c vir die 6m tot Jun). Die prys/verdienste is 505c/(23.4c+42.7c) = 7.6. Die dividend opbrengs is (11c+7c)/505c -15% = 3.0%

Brait (BAT) se netto bate waarde per aandeel was op R82.46 op 31 Des 2016.

Spur (SUR) verwag vir die 6m tot Des 'n vwVPA van 109.10c tot 114.20c, +7% tot +12% hoër. Lae handel.

Mustek (MST) verwag vir die 6m tot Des 'n wVPA van 36.17c tot 41.33c, -20% tot -30% laer. Lae handel.

Kumba (KIO) se inkomste vir die jaar 2016 was +11% hoër, of +14% op herverklaarde bedrag. Bedryfs uitgawes was met -24% verminder. Verdunde wesens VPA was R27.16, teenoor R11.82 in 2015. As die 2de 6m wins herhaal, sal die prys/verdienste R225.50/(~2xR17.73) = 6.4 wees.

Jasco Electronics (JSC) se inkomste vir die 6m tot Des -6.6% laer, en vwVPA +10.5% hoër na 6.3c. Min handel.

Op die internet - Suid Afrika

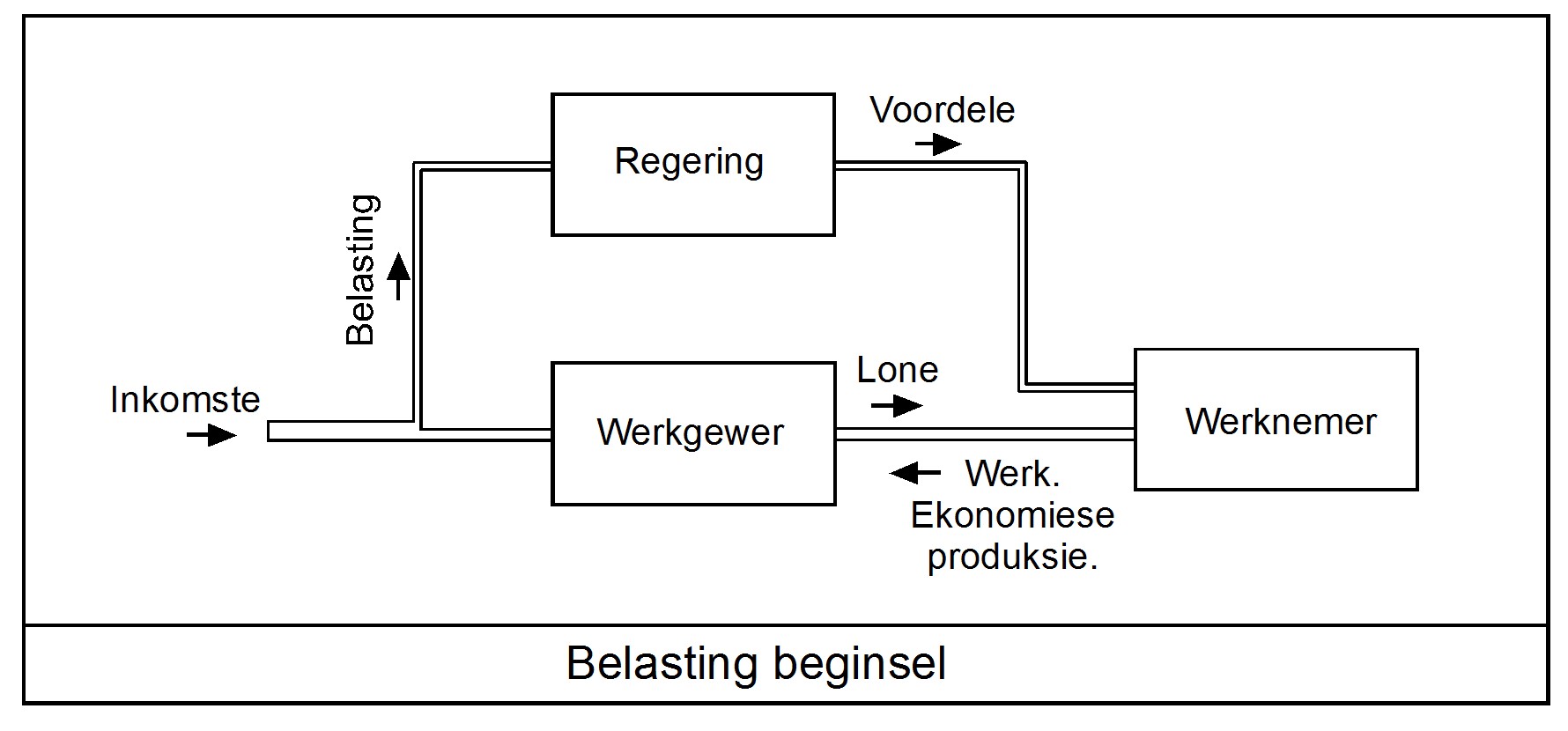

Budget 2017: Experts share tax predictions - Fin24. Die bron van belasting maak min verskil. Die beginsel probleem is dat geld uit die ekonomie onttrek word, en vermors word op onproduktiewe aktiwiteite wat nie verder bydrae tot ekonomiese groei nie.Maandag 13 Feb 2017

Op die internet

Oil Prices Have Doubled Over the Past Year. Here’s Why That Won’t Last - Fiscal Times.Google's New AI Has Learned to Become "Highly Aggressive" in Stressful Situations - Science Alert.

These Brazilian Red Berries Could Hold the Key to Fighting Deadly Superbugs - Science Alert.

If Foreigners Are Dumping Treasuries, How Should You Respond As An Investor? - Talk Markets. Wie wil geld leen aan mense wat alreeds so baie skuld opgehoop het, om op te lewe, en geld sal moet druk om dit terug te betaal?

Why Donald Trump Needs The Next Recession To Start As Quickly As Possible - Zero hedge.

Infrastructure failures exacerbate Australian heatwave conditions - World Socialist Web Site. 'Last week, the Australian Energy Market Operator (AEMO) blacked out supplies to various heat-affected areas. Such practices are euphemistically called “load shedding.” The federal government later claimed the problem was caused by South Australia’s near 30 percent reliance on renewable energy supplies—wind and solar power.'

Op die internet - Suid Afrika

South Africans have found an alternative to leaving the country – move to Cape Town - Businesstech.Chamber welcomes court decision on Winelands toll roads - Fin24. Volgens die grondwet: "Schedule 5. Functional Areas of Exclusive Provincial Legislative Competence. Part A: Provincial roads and traffic". Western Cape government: "South African roads are divided into three authorities: Provincial, National and Municipality. Each authority or government body is responsible for the roads within its jurisdiction. A road authority must declare/proclaim a road if it wishes to take responsibility for that road. The South African Constitution states that provincial roads are a provincial competence and municipal roads are a municipal competence but does not specify which roads should be provincial or municipal."

Millions of rands lost to traffic fine “dumping” fraud in Tshwane - BusinessTech.

SABC signs off on dozens of dodgy contracts worth millions: report - BusinessTech.

What Rio 2016 venues look like six months after the Olympics - Mybroadband.

JSE aandele

Die JSE het +0.51% hoër gesluit. Die Rand/$ is sterker op R13.34. Brent olie is af na $55.91. Die goudprys is af na $1221.40.Groot stygings: Kumba +6.4% na R225.50, RBPlat +5.9% na R43.40, Assore +5.7% na R280.00, KAP +3.8% na R8.25, MMI +3.7% na R25.49, Tsogo Sun +3.2% na R27.72, Northam +3.2% na R54.25.

Groot dalings: AdaptIt -6.2% na R13.79, Cashbuild -5.6% na R365.53.

Bidvest (BVT) verwag vir die 6m tot Des 'n wesens PA van 508.0c tot 512.0c, +4% tot +5% hoër. Dan is die prys/verdienste rondom R167.04/(561.4c+~510c) ~ 15.6.

Aveng (AEG) verwag vir die 6m tot Des 'n wesens verlies per aandeel van -73c tot -78c.

Implats (IMP) verwag vir die 6m tot Des 'n wesens verlies per aandeel van -65c tot -79c.

Kap Holdings (KAP) se inkomste vir die 6m tot Des was +10% hoër, en vwVPA +18% hoër na 25.0c. Die prys/verdienste is 821c/(26.1c+25.0c) = 16.

PPC (PPC) en AfriSam bespreek 'n moontlike samesmelting (Geen melding of dit mededinging in die sement mark beinvloed nie).

NEPI en Rockcastle wil steeds saamsmelt (aangekondig 14 Des), in die verhouding 4.5 Rockcastle aandele vir elke 1 NEPI aandeel.

Adapt IT (ADI) se inkomste vir die 6m tot Des was +47% hoër, en vwVPA +2% hoër na 24.41c, of genormaliseerd +20% hoër na 37.74c. Die prys/verdienste is R14.70/55.66c = 26.4, of genormaliseerd R14.70/80.54 = 18.3.

Premier Food and Fishing (PFF), voorheen Sekunjalo Industrial Holdings, gaan op die JSE hoofbord noteer. Aandele word teen R4.50 aangebied.

Sondag 12 Feb 2017

Op die internet - VSA groei op skuld

|

Geen datum: How “Voodoo” Caused Most of the National Debt - Zfacts. "But how can the government keep spending without that $1 billion in taxes? Simple, they borrow the $1 billion. So yes, tax cuts cause growth and INCREASE the debt, if the government keeps spending". Van 25 Jan 2017: Is It Just A Coincidence That The Dow Has Hit 20,000 At The Same Time The National Debt Is Reaching $20 Trillion? - The Economic Collapse. Van 4 Jan 2016: The Fed And Its Self Defeating Monetary Policy - See It Market. "This divergence in debt and economic growth is a result of many consecutive years of borrowing funds for consumptive purposes and the misallocation of capital, both of which are largely unproductive endeavors". |

Op die internet

Is There Such A Thing As A "Safe" Investment? - Talk Markets.Sears, Kmart Discontinue Online Sales Of 31 Trump Home Items - Zero Hedge.

Op die internet - Suid Afrika

Liquid Telecom’s big plans for Neotel - TechCentral.How much Kings, Queens and other traditional leaders get paid in South Africa - BusinessTech.

SA water department is broke – report - BusinessTech. "... the department is facing an investigation ... for tender and other irregularities ..."

Give and take: Labour and business given key demands for minimum wage - Fin24. Vir party werkers om meer te verdien, moet ander noodwendig minder verdien. In Australië byvoorbeeld waar vakbonde in 'n stadium lone bepaal het, was daar min verskil tussen die salarisse van hoër en laer geskooldes. As werkers deur robotte vervang word, kan dit hoër lone beteken vir die hoër-geskooldes wat nog werk het.

Mining will last another 150 years - Fin24. 'n Mens hoef bloot na Zimbabwe te kyk om te voorspel wat die toekoms inhou.

Saterdag 11 Feb 2017

Op die internet

Trump's 1990 Playboy interview perfectly lays out his view of the world - Business Insider UK.WATCH: These Common Models of Atoms Are Actually Totally Wrong - Science Alert.

Op die internet - Suid Afrika

Pitch invasion‚ ugly fights and stun grenades break up Sundowns-Pirates PSL match - TimesLive.Five futuristic flying cars that have already been built - Mybroadband.

Ekonomiese groei op skuld

In baie lande was ekonomiese groei tot nou bereik deur groeiende skuld. Dit kan nie vir ewig aanhou nie. As die skuld afgewerk word deur inflasie, lei dit tot ekonomiese stagflasie. Dit is inflasie met 'n ekonomie wat reëel krimp. Vir die aandeelmark beteken dit maatskappye het inkomste groei, maar wins groei minder as inkomste. 'n Mens sien dit alreeds. Die inflasie kan aandele steeds aantreklik maak, maar net die maatskappye wie se wins groei inflasie klop. Baie maatskappye kan 'n val in wins ondervind. Maatskappy resultate is 'n beter aanduiding van wat met die ekonomie gebeur, as regerings se fiktiewe ekonomiese statistiek.Vrydag 10 Feb 2017

Op die internet - Suid Afrika

Food inflation by the numbers - BusinessLive.Massive attack on WordPress sites - Mybroadband.

Zuma blames top four banks for controlling economy - Fin24. Dit is alles gemotiveer deur die banke se behandeling van die Guptas.

South Africa’s 2016 Corn Crop Drops 22% to Smallest in 9 Years - Bloomberg. "... the yellow type mainly fed to animals". Daai diere in supermarkte.

Op die internet

South Africa may be the epicenter of a geomagnetic pole reversal in progress - ExtremeTech.What’s behind Ford’s $1 billion on artificial intelligence: self-driving excellence - ExtremeTech.

Finland, Denmark and Iceland have all made hilarious videos pitching Trump: 'America First, but let us be second' - Business Insider UK.

What Voter Fraud? - Mexican Citizen Sentenced To 8 Years In Prison After Illegally Voting In Texas - Zero Hedge. En wat kos die tronkstraf die publiek? Straf moet in verhouding wees met die skade wat die misdaad aangerig het.

Fitch Warns Trump Administration Could Lead To Global Economic Disaster - Zero Hedge.

Kunstler Slams American Schooling's "Epic Failure" Under Federal "Policy Experts" - Zero Hedge.

9th Circuit will not reinstate Trump travel ban - Arstechnica. 'Court: Unchecked presidential power is contrary to "constitutional democracy."'

Australia swelters in heatwave and argues about energy future - The Guardian. Sydney het 40°C bereik 30 jaar gelede. Die weskus van Suid Afrika, Australië, en Suid-Amerika het die koelste temperature weens see strome van die suidpool af (Wikipedia).

6 unexpected ways to decrease your risk of Alzheimer’s - Business Insider.

What drives universe's expansion? - Science Daily.

Drones are setting their sights on wildlife - Popular Science.

JSE aandele

Die JSE het +1.51% hoër gesluit. Die Rand/$ is sterker op R13.40. Brent olie is op na $56.50. Die goudprys is op na $1231.12.Groot stygings: Kumba +7.5% na R212.00, Coronation +5.9% na R66.70 (R352M), Anglo +4.4% na R225.41 (R935M), Fambrands +4.2% na R150.57, Glencore +3.9% na R53.71, Mr Price +3.3% na R167.81 (R431M), Sanlam +3.2% na R64.82.

Groot dalings: Mixtel -8.1% na R3.86, Dis-chem -3.9% na R23.75, GFields -3.4% na R45.40.

Hospitality (HPB) se uitkering vir die 4m tot Des van 56.09c is 'n opbrengs van 3x56.9c/R14.10 = 12.1%.

Pioneer (PNR) se omset vir die 4m tot 31 Jan was +5.1% hoër.

Arcelor Mittal SA (ACL) se inkomste vir die jaar 2016 was +5.1% hoër, en die wesens verlies per aandeel was -244c, teenoor -1338c vir 2015 (-505c op konstante aandele basis). Die inkomste per aandeel is af van R77.7 na R30.8 weens meer aandele uitgereik.

Dis-chem (DCP) se kleinhandel omset vir die 22 weke tot 19 Jan was +14.3% hoër, en groep omset +13.0% hoër.

Italtile (ITE) se eie winkel omset vir die 6m tot Des was +15.7% hoër. Met konsessie winkels was totale omset +13.6% hoër. Verdunde wesens VPA was +7.5% hoër na 46.0c. 'n Dividend van 16c word betaal.

South Africa’s new stock exchange opening soon - Mybroadband. Hoogtyd dat kostes afkom vir funksies wat deur rekenaars gedoen word.

Donderdag 9 Feb 2017

JSE aandele

Die JSE het +0.19% hoër gesluit. Die Rand/$ is dieselfde op R13.44. Brent olie is op na $55.71. Die goudprys is af na $1233.30.Groot stygings: Phoenix +7.0% na 46c, Cashbuild +4.7% na R375.00, MrPrice +3.7% na R162.53 (R243M), Grindrod +3.3% na R14.50, MedClin +3.3% na R137.84, Capitec 2.9% na R687.89, Ascendis +2.8% na R22.00.

Groot dalings: Group5 -8.8% na R22.70, GFields -5.5% na R47.00 (R229M), Harmony -4.5% na R37.05, South32 -3.1% na R26.00, Anglo -2.9% na R216.00 (R825M).

Pinnacle (PNC) verwag vir die 6m tot Des 2016 inkomste groei van +45% tot +47% (Datacentrix gekoop), en 'n wesens VPA van 104c tot 108c, +11% tot +15% hoër. As dit herhaal sal die prys/verdienste rondom R18.71/~2x106c = 8.8 wees.

Group Five (GRF) verwag vir die 6m tot Des 2016 'n verdunde wesens verlies per aandeel van -300c tot -320c.

Fortress A (FFA) se huur uitkering vir die 6m tot Des styg 5% na 67.96c (ekwivalente jaar opbrengs 2x67.96c/R17.23 = 7.9%), en B (FFB) +25.1% na 78.59c (2x78.59c/R33.40 = 4.7%).

Metair (MTA) verwag vir die jaar 2016 'n wesens VPA van 224c tot 230c, -7.26% tot -9.68% laer.

Op die internet

The Crash Will Be Violent - Daily Reckoning.Diarrhea-causing Salmonella can be weaponized to flush out cancer - ArsTechnica.

Renault-Nissan Alliance Extends Electric Vehicle Sales Record - CleanTechnica. "The Renault-Nissan Alliance, with Mitsubishi Motors, cumulatively sold 424,797 electric vehicles through 2016". Dit is 4.3% van alle voertuie wat hulle verkoop het. Die batterye is steeds te duur.

Apple Will Add 200 Megawatts Of Solar For Its Reno Data Center - CleanTechnica. US Installs 8.2 Gigawatts Of New Wind Energy In 2016, Finishes With Second Strongest Quarter Ever - CleanTechnica. Europe Installs 12.5 Gigawatts Of New Wind Energy Capacity In 2016 - CleanTechnica. En wie betaal vir die ander kragstasies wat nodig is wanneer die son en wind nie beskikbaar is nie?

Forget Trump: The Reason For The Economic Boom Is Totally Different, And Deutsche Says It Is About To End - Zero Hedge. VSA groei is danksy 'n 8% p.j. groei in skuld vir die laaste agt jaar, en die benutting van goedkoop arbeid in ander lande wat inflasie afgehou het, waarop ekonomiese groei gemeet word.

Lower lifecycle costs for nuclear power than fossil fuel and lower radiation under normal operation - NextBigFuture.

New, long-lasting flow battery could run for more than a decade with minimum upkeep - Science Daily.

NASA bet the farm on the long-term viability of space agriculture - Popular Science.

The rusty patched bumblebee is probably doomed - Popular Science. "Trump administration feezes endangered species act protections".

Op die internet - Suid Afrika

A modern-day Groot Trek - Moneyweb. Kaapstad was nog altyd meer aantreklik, maar daar was nog altyd 'n gebrek aan werk. Kaapstad se dorpshuise het binne 'n paar jaar opgeskiet.These 4 graphs sum up South Africa’s massive economic challenges - Businesstech. Zuma’s broken promises from SONA 2016 - Businesstech. How to fix South Africa: the DA vs the ANC’s plans - Businesstech. Die Nasionale Party regering was 100 keer meer bekwaam as die ANC. Die DA se beleid hou SA op die pad na 'n primitiewe Afrika land.

Woensdag 8 Feb 2017

JSE aandele

Die JSE het -0.73% laer gesluit. Die Rand/$ is sterker op R13.43. Brent olie is af na $54.68. Die goudprys is op na $1240.90.Groot stygings: DRD Gold +8.3% na R8.70, EOH +4.3% na R144.38, Harmony +4.0% na R38.80, AngGold +3.6% na R183.50 (R416M verhandel), BarWorld +3.5% na R116.61.

Groot dalings: Anchor -5.4% na R7.00, Italtile -3.7% na R13.66, BHP Bill -2.6% na R226.93 (R867M), Ascendis -2.6% na R21.41, Naspers -2.5% na R2135.00 (R2363M).

MTN (MTN) verwag 'n verlies per aandeel, weens 'n boete (-R4.74 effek), onderprestasie van Nigerië en Suid Afrika, en swak Naira.

Sappi (SAP) se verkope vir die 3m tot Des was 1.9% hoër in $, en verdienste per aandeel $0.17.

Brimstone (BRT, BRN) beoog om Sea Harvest op die JSE te noteer. Hulle aandeel houding sal van 85% na 52% daal. Sea Harvest is 'n swart maatskappy. (Die gehalte van hulle vis is nie altyd goed nie)

Op die internet

Tesco's plan bee: spilt supermarket sugar to help feed hungry honey bees - The Guardian.The last thing Europe needs: another Greek crisis - CNN Money.

The Blood Bath Continues In The U.S. Major Oil Industry - Talk Markets.

WTI Holds Losses After 2nd Biggest Inventory Build In History, Production At New Cycle Highs - Talk Markets.

Op die internet - Suid Afrika

New technology tipped to save 200,000 SA mining jobs by 2025 - Miningmx.Billions lost every year due to fraud - IOL. "He detailed cases where one medical aid card can be used over 200 times by different people in one year to visit a doctor". As elke persoon vir sy eie dienste betaal, sal dit die probleem oplos, en ook die fonds administrasie koste bespaar, en die ondoeltreffend van regering dienste uitskakel.

The ANC’s 12-point plan to ‘radically’ change South Africa - BusinessTech.

Nigerian cybercrime crooks caught in South Africa, convicted by US court - Mybroadband. As vervolging van die ANC afgehang het, sou niks gebeur het nie.

Vodacom’s network is the best in South Africa – Tests - Mybroadband.

DStv beating Netflix – but the battle is on - Mybroadband.

BREAKING: Eskom Dentons report shows serious breaches - Fin24.

Ramaphosa signed R20/hr wage agreement - Fedusa - Fin24. Die armes ontvang alreeds meer in voordele, soos behuising, mediese dienste, ens. as wat hulle bydrae tot die ekonomie.

'Tremendous uptick' in Cape Town tourism - Fin24.

Dinsdag 7 Feb 2017

Op die internet

After the crash: Everyone is suddenly worried about this U.S. mortgage-bond whale - Financial Post.A constitutional expert explains the issues at stake in Trump’s travel ban - Vox. In die eerste plek moet Donald Trump bewys lewer dat mense van die lande 'n bedreiging is.

Op die internet - Suid Afrika

This is what a Cape Town ‘gold mine’ looks like - BusinessTech. "The average selling prices of apartments at the V&A Waterfront Marina in Cape Town has hit new historic highs according to property experts."JSE aandele

Die JSE het +0.06% hoër gesluit. Die Rand/$ is swakker op R13.46. Brent olie is af na $54.91. Die goudprys is op na $1232.60.Groot stygings: DRD Gold +8.8% na R8.03, Tharisa +7.2% na R26.00, Lewis +6.9% na R42.76, Cashbil +5.4% na R351.32, Assore +5.2% na R277.35, Harmony +4.8% na R37.31.

Groot dalings: Spar -5.2% na R174.00, Phoenix -4.4% na 43c, Brait -3.8% na R77.45.

Spar (SPP) se verkope vir die 13 weke tot Des was +16.9% hoër, met Suid Afrika se groep verkope +5.8% hoër. Die Ierse verkope was -2.6% laer deur die wisselkoers. Die Switserse besigheid word die eerste keer ingesluit.

UK market 'challenging', says New Look boss - BBC. "company suffered a 37.6% drop in pre-tax profits in the three months to Christmas". (Brait)

Maandag 6 Feb 2017

Op die internet

This Is What America's Top Trading Partners Export To The US - Zero Hedge. Dit wys hoe beperk die tipe goed is wat mense koop – voertuie en brandstof.JSE aandele

Die JSE het -0.22% laer gesluit. Die Rand/$ is swakker op R13.30. Brent olie is af na $56.61. Die goudprys is op na $1227.10.Groot stygings: MedClin +4.3% na R134.35, Pan-Af +2.7% na R2.71, Exxaro +2.6% na R106.44, Brait +2.0% na R80.50.

Groot dalings: Anchor -7.5% na R7.16, Assore -7.1% na R263.67, Merafe -6.2% na R1.83, South32 -4.4% na R26.91, PPC -4.1% na R6.50, Holdsport -3.8% na R60.61, WBHO -3.3% na R143.57, Astral -2.8% na R148.45.

Anchor (ACG) verwag vir die jaar 2016 'n wesens VPA van 55.7c tot 60.4c, +1% tot +10% hoër, of verstel 57.0c tot 61.8c, +4 tot +12% hoër.

Torre (TOR) verwag vir die 6m tot Des 'n wesens VPA van 3.25c tot 4.25c, -72% tot -79% laer, of genormaliseerd 7.0c tot 8.0c, -50% tot -56% laer.

Amplats (AMS) verwag vir die jaar 2016 'n wesens VPA van 625c tot 760c. Dan is die prys/verdienste rondom R340.23/~693c ~49.

ArcelorMittal SA (ACL) verwag vir die jaar 2016 'n wesens verlies per aandeel van -239c tot -249c, teenoor 'n verlies van -1338c in 2015.

DRD Gold (DRD) verwag vir die 6m tot Des 'n wesens verlies per aandeel van -2.66c tot -2.14c, teenoor 2.6c 'n jaar gelede (en 10.1c vir die 6m tot Jun).

Astral (ARL) verwag vir die 6m tot Maart dat wesens VPA nie meer as -75% laer sal wees nie, of ten minste 194c (Dit was 191c vir die 6m tot Sep).

Op die internet - Suid Afrika

Don’t promise 10Mbps if you cannot deliver it - Mybroadband.Cost of Tshwane electricity losses up by 56% - Moneyweb.

It costs R629 500 more to build a house than to buy one - Moneyweb.

Armyworm march a threat to all SA - Times Live.

Sondag 5 Feb 2017

Op die internet

Tax Data for January Again Shows A No Growth US Economy - Wall Street Examiner.Is America In A Bubble (And Can It Ever Return To "Normal")? - Zero Hedge.

Carlson Capital: Border Adjustment Tax Would Lead To "Global Depression" - Zero Hedge.

Op die internet - Suid Afrika

What first-time buyers need to know about the property market right now - BusinessTech.Zuma to push ‘radical’ land redistribution at follow-up SONA rally: report - BusinessTech. As die bevolking nie die bron van hulle voedsel herken nie, sal hulle dit verloor. Dit is tipies Afrika.

Blitzboks thrash England to claim Sydney Sevens - Sport24.

Saterdag 4 Feb 2017

Op die internet

Renewables, Absolution And Deceit - Talk Markets. Die aansprake van son en wind energie gebruikers beteken niks as die reserwe energie bron nie bekend is, wat nodig is wanneer son en wind nie beskikbaar is nie. As son energie geëwenaar moet word deur 'n gelyke hoeveelheid fossiel energie wat aangeskakel is, maar nie gebruik word wanneer die son skyn nie, is die son energie van geen nut nie. Vir 'n elektrisiteits produsent om op 'n grafiek te wys dat hulle 10% wind energie gebruik, beteken niks as 'n ander 10% steenkool krag onbenut gereed moet staan nie.Google, unlike Microsoft, must turn over foreign emails: U.S. judge - Reuters. Die besluit maak nie sin nie. Dit is tipies van die lukrake besluite wat regters maak.

State Department Reverses the Cancellation of 60,000 Visas - Time. Trump blasts 'so-called judge' who temporarily blocked immigration ban in morning tweetstorm - Business Insider UK.

Op die internet - Suid Afrika

Here’s what the average South African household budget looks like - Businesstech.Vrydag 3 Feb 2017

Op die internet

Weekly Commodities Wrap: Metals Complex Surges On Weak USD - Talk Markets.‘Personnel Is Policy’: Meet Trump’s Team of the Corrupt and Unqualified - Rewire.

Meanwhile, Over In Zimbabwe... - Zero Hedge.

Now On The Cover Of Spiegel: Trump Beheading The Statue Of Liberty - Zero Hedge. Over 100,000 Visas Revoked Due To Trump Travel Ban - Zero Hedge. Die VSA lyk nie aantreklik vir besoekers nie. Mense moet desperaat wees om daarheen te gaan.

Tip of the iceberg: lettuce rationing widens to broccoli and cabbage (UK) - The Guardian. "an almost unprecedented cold and wet weather in southern Spain has hit supplies".

Toronto faces ‘serious’ housing crunch as prices soar 22% and supply drops by half - Financial Post.

JSE aandele

Die JSE het -0.86% laer gesluit. Die Rand/$ is sterker op R13.23. Brent olie is dieselfde $56.83. Die goudprys is dieselfde $1219.40.Groot stygings: Hudaco +11.5% na R127.06, Phoenix +9.8% na 45c, Tharisa +8.7% na R25.00, Datatec +3.5% na R57.40, PSG +2.2% na R237.00.

Groot dalings: Kumba -8.0% na R196.05 (R250M), Implats -6.6% na R51.20, Glencore -5.5% na R51.85, Anglo -4.6% na R222.35 (R637M), Exxaro -3.9% na R103.75, BHP Bill -3.9% na R232.31 (R1216M), Sibanye -3.7% na R30.00, AForbes -3.7% na R7.08, Amplats -2.7% na R353.42, ARM -2.6% na R117.99, Coronation -2.3% na R65.05.

Assore (ASR) verwag vir die 6m tot Des 'n wesens VPA van R18.66 tot R21.61, teenoor R7.15 'n jaar gelede. As dit herhaal sou die prys/verdienste R291.00/~R40.27 ~ 7.2 wees. (Die beste VPA was R40.98 vir die jaar tot Jun 2014, met die aandeel prys wat rondom R400 verhandel het).

Hospitality (HPB) verwag 'n huur uitkering van 54.00c tot 58.00c vir die 4m tot Des. (Die ekwivalente jaar opbrengs is 3x56c/R13.97 ~12.0%).

Gold Fields (GFI) verwag vir die jaar 2016 'n wesens VPA van US$0.25 tot US$0.27. Dan is die prys/verdienste rondom R47.00/~$0.26xR13.44 ~ 13.5.

Sibanye (SGL) het vir die 6m tot Des soortgelyke goud produksie gehad as die 6m voor dit, en goud prys was -6% laer.

Hudaco (HDC) se omset vir die jaar tot Nov was +5.8% hoër, en vwVPA +5.0% hoër na R12.19, of vergelykbaar +0.1% hoër na R11.68. Die prys/verdienste is R126.50/R12.19 = 10.4, en dividend opbrengs 525c/R126.50 -15% = 3.5%. Lae handel.

Op die internet - Suid Afrika

Armyworm outbreak damaging crops in southern Africa – FAO - Engineering News.Why Cell C terminated its agreement with Makro, Dion Wired, and Game - Mybroadband.

Donderdag 2 Feb 2017

Op die internet

Should Dollar Rise or Fall? The Trump Team’s Message Is Garbled - NY Times.The End of Trump’s Market Honeymoon - Nouriel Roubini, Project Syndicate. "The president may have “saved” 1,000 jobs in Indiana by bullying and cajoling the air-conditioner manufacturer Carrier; but the US dollar’s appreciation since the election could destroy almost 400,000 manufacturing jobs over time".

How Currencies Depreciate And Gold Appreciates Over Time - Talk Markets.

Markets Are Experiencing Cognitive Dissonance - Daily Reckoning. "Again, the U.S. debt-to-GDP ratio is currently at 105%, as stated, and heading higher. Under any standard, the U.S. is at the point where more debt produces less growth rather than more."

China’s Demand for Gold Can’t be Met - Daily Reckoning. Goud is aantreklik in lande met hoë inflasie.

The Uncanny Similarities Between President Trump And FDR - Zero Hedge. As 'n mens wou, kon 'n mens ooreenkomste kry tussen 'n VSA president en 'n Muppet.

This new liquid crystal can triple the sharpness of tv and computer screens - Science Alert.

E-Cigarette Smoking May Be Bad for Your Heart - Live Science.

Ikea designed an ultra-durable shelter for refugees that goes up in under four hours - Business Insider.

Everyone should cook with MSG, says food scientist - Business Insider.

Scientists turned cooking oil into a material that's 200 times stronger than steel - Business Insider.

America’s Student Debt Problem Is Much Bigger Than Anybody Realized - Zero Hedge.

Here Is The "Open Letter" Google, Apple, Facebook And Others Are Sending To Donald Trump - Zero Hedge.

Human stem cells hunt down and kill brain cancer - Futurity.

New meat company claims to produce products without slaughtering animals - Twisted News.

6 Insane Laws That Make China A Goddamn Nightmare - Cracked.

JSE aandele

Die JSE het -0.7% laer gesluit. Die Rand/$ is sterker op R13.34. Brent olie is op na $56.85. Die goudprys is op na $1220.20.Groot stygings: RCL +5.3% na R14.00, Datatec +4.8% na R55.44 (Laaste aankondiging was omsigtigheid 25 Jan), Harmony +4.2% na R35.41, Amplats +4.0% na R363.21, ArcMittal +3.9% na R14.50, Sibanye +3.8% na R31.15, AngGold +3.6% na R176.00 (R777M), GFields +2.7% na R47.61, Dis-chem +2.0% na R24.99.

Groot dalings: Phoenix -21% na 41c (R46M), CityLodge -4.9% na R144.99, M&R Hold -3.7% na R10.60, Clicks -3.6% na R120.29, Spar -3.5% na R184.63 (R319M), Kumba -3.2% na R213.00, Assore -3.1% na R281.00, BHP Bill -2.4% na R241.66 (R630M), Truworths -2.3% na R77.85.

OM Asset Management PLC (OMAM), 'n filiaal van Old Mutual (OLM), se VSA GAAP verdienste vir die 3m tot Des was $25.3M ($0.21 per aandeel), -31.4% laer as 'n jaar gelede, en die jaar 2016 $126.4M ($1.05 per aandeel), -18.7% laer.

PPC (PPC) se sement verkoops volume in SA vir die 3m tot Des was effens laer, en vir die 9m was volume +4% op, en prys -4% laer.

AngloGold Ashanti (ANG) verwag vir die jaar 2016 'n wVPA van $0.25 tot $0.28, teenoor 'n verlies van -$0.18 die jaar tevore. (Met $0.23 vir die 1ste helfte, is die 2de helfte wVPA rondom $0.035).

Resilient (RES) se uitkering vir die 6m tot Des van 270.22c is 'n jaar ekwivalent opbrengs van 2x 270.22c/R117.00 ~ 4.6%. Die maatskappy verwag steeds groei in uitkering van +15% tot +17% vir die jaar tot Junie. Netto rente en verwante inkomste was +7.1% hoër. Inkomste uit beleggings was +35% hoër. Wesens verdienste per aandeel was 230.3c teenoor 680.0c 'n jaar gelede.

Curro (COH) verwag vir die jaar 2016 'n wesens VPA van 43.1c tot 47.1c, teenoor 28.3c die jaar tevore. Dan is die prys/verdienste rondom R49.27/~45.1c = 109.

Glencore (GLN) produksie groei vir jaar tot Des: koper -5%, sink -24%, nikkel +20%, steenkool -5%, olie -29%.

OneLogix (OLG) se inkomste vir die 6m tot Nov was +12% hoër, en vwVPA 0% hoër na 16.5c, of kern wVPA 20.9c. Lae handel.

Harmony (HAR) se inkomste vir die 6m tot Des was R9868M, teenoor R9627 vir 6m tot Jun, en R8707M tot Des15. Prys/verkope is R34.00/R43.4 = 0.78. Die wesens VPA was R1.50 ($0.11) teenoor R3.24 ($0.21) vir vorige 6m tot Jun. As dit herhaal is die prys/verdienste R34.00/2xR1.50 = 11.3. 'n Dividend van 50c word betaal.

Dawn (DAW) bied aandeelhouers ekstra aandele teen R1.00 per aandeel.

Op die internet - Suid Afrika

Miss SA 2017 Finalists announced - IOL.Strong semigration push to W Cape, Gauteng - Fin24.

Supermarket seeks interdict against angry residents - IOL.

Moody’s finds positives in update on SA - BusinessLive. Soos ons die Minister van Finansies ken, sal belasting in die opkomende begroting verhoog word, en sal die ekonomie daarom verder verswak.

Woensdag 1 Feb 2017

Op die internet

China iron ore imports off to strong start; support rally: Russell - Reuters.The Oil War Is Only Just Getting Started - Zero Hedge.

Challenges to Trump's immigration orders spread to more U.S. states - Reuters.

Harry Dent: Stocks Will Fall 70-90% Within 3 Years - Zero Hedge.

It now takes 20 years for the average Brit to save for a deposit on a house - UK Business Insider. Die aanbod word beperk deur 'n gebrek aan grond.

Op die internet - Suid Afrika

Ten things you need to know about tax-free savings - Fin24.Trump's executive order on immigration: Is it legal? - News24. Vlugtelinge wil wegkom van geweld. Ware vlugtelinge sal nie geweld pleeg nie.

Eskom reveals which countries will bid for nuclear deal - Fin24.

Will rival clip Clicks’ wings? - BusinessLive.

Op Twitter: Tom Robbins @BaragwanathBiz: "Why doesn't South Africa's Rainbow Chicken export breasts, that are so prized in the US & EU? Our breasts for their thighs. White for brown."

SA and EU spar over chicken meat ‘dumping’ - BusinessLive. Die mark kan die prys van hoender dele bepaal. As verbruikers nie bereid is om meer te betaal vir die borste nie, kan plaaslike produksie gestaak word.

Cape Town’s speaker cracks whip over law-flouting councillors - BusinessLive. Weet enigiemand wat die 231 raadslede doen?

R4 for a stamp – new prices for sending mail and packages in South Africa - Businesstech.

JSE aandele

Die JSE het +0.6% hoër gesluit. Die Rand/$ is dieselfde op R13.45. Brent olie is op na $56.05. Die goudprys is af na $1200.60.Groot stygings: Kumba +6.3% na R219.98, ArcMittal +5.6% na R13.95, Assore +4.8% na R290.05, Santam +3.7% na R249.00, Steinhoff +3.6% na R67.10 (R720M verhandel), AForbes +3.5% na R7.40, Exxaro +3.5% na R110.00, Naspers +2.9% na R2200 (R2653M), PSG +2.2% na R231.99.

Groot dalings: Oceano -3.8% na R114.00, CashBuild -3.7% na R334.52, Woolies -2.6% na R72.23 (R357M), MrPrice -1.9% na R159.65.

Italtile (ITE) verwag vir die 6m tot Des 'n wesens VPA van 46.0c tot 47.3c, +6% tot +9% hoër. Stelsel-wye omset was +14% hoër. As dit herhaal, sou die prys/verdienste rondom R13.81/~93.3c = 14.8 wees.

Vodacom (VOD) se inkomste vir die 3m tot Des was +1.2% hoër. Vodacom’s effective voice, data prices tumble - TechCentral.

Glencore mulls bid for Implats unit - IOL.

Ouer webjoernaal