Vrydag 30 September 2016

Op die internet

OPEC Meeting is Overblown: Here's What That Means for You - Daily Reckoning.

Here’s Why You May Want To Tiptoe Out Before The Party Ends - Wall Street Examiner. Waardasies van VSA aandele word deur beleggers en deur TV kanale geïgnoreer. Dit lyk of daar 'n nuwe geslag is wat dink aandele kan net opgaan.

JSE aandele

Die JSE was vandag -1.4% laer. Die Rand is sterker na R13.73. Brent olie is dieselfde op $48.88. Die goudprys is op na $1321.30.

Groot stygings: Northam +3.8% na R51.89, Kumba +3.7% na R123.94, Harmony +3.0% na R48.50, Sibanye +2.1% na R49.46.

Groot dalings: BarWorld -5.2% na R83.27, Telkom -3.9% na R60.49, Remgro -3.9% na R229.56, Nampak -3.8% na R19.44, Standard -3.7% na R140.67, EOH -3.6% na R167.66, Pick n Pay -3.2% na R68.58, Massmart -3.1% na R118.71, RMIH -3.1% na R41.40, Glencore -3.1% na R37.80, Barclays Afr -3.0% na R151.00, MTN -2.9% na R117.46 (R1.77B verhandel), Steinhoff -2.9% na R78.55.

Eqstra (EQS) se inkomste vir die jaar tot Junie was -69% laer, of +6% hoër op voortgesette besigheid. Die wesens VPA was 'n verlies van -30c, waarvan -17.1c voorgeset. Prys/verkope is 0.38.

Donderdag 29 September 2016

Op die internet

2016 Paris motor show: All the new cars including Mercedes' Maybach concept, specs and talking points - Telegraph UK.

The Paris Motor Show opens amid a war on cars - The Verge. "And unlike previous Paris shows, where new diesel models took center stage, much of the buzz this year centers around hybrids and electric vehicles"

Paris motor show 2016 review: A-Z of all the new cars - Car Magazine.

Scientists Just Discovered a Major New Source of Carbon Emissions - Gizmodo.

Jobless Claims Joke Of The Day - ZeroHedge.

Op die internet - Suid Afrika

SABC posts R411m net loss - Fin24.

JSE aandele

Die JSE was vandag +1.8% hoër. Die Rand is swakker na R13.89. Brent olie is op na $48.90. Die goudprys is laer na $1317.50.

Groot stygings: BHP Billiton +6.2% na R207.50 (R1.37B verhandel), Sasol +5.8% na R379.32 (R1.51B verhandel), Anglo +5.3% na R173.04 (R1.35B verhandel), South 32 +5.1% na R26.05, ARM +4.7% na R81.07, Glencore +4.7% na R39.00, Capitec +4.3% na R647.26, Exxaro +4.0% na R83.12, PSG +3.9% na R203.69, Kumba +3.1% na R119.53.

Groot dalings: Datatec -7.2% na R48.65, Truworths -2.6% na R72.75, SunInt -2.1% na R88.50.

ELB Group (ELR) se verkope vir die jaar tot Junie was -30% laer, en vwVPA 'n verlies van -519c teenoor 'n wins van 320c die vorige jaar.

GlaxoSmithKline (“GSK”) het hulle oorblywende aandele in Aspen Pharmacare (APN) verkoop. (Iemand het duur aandele gekoop)

Datatec (DTC) verwag vir die 6m tot Aug dat inkomste -7.6% laer sal in $, en wesens VPA -24.2% laer na $0.091. 'n Beter onderliggende VPA word vir die volle jaar tot Feb verwag as verlede jaar se $0.32.

Zeder Investments (ZED) se waarde van beleggings gehou was R8.38 per aandeel op 26 Sep. Vir die 6m tot Aug word 'n herhalende wesens VPA van beleggings van 20.1c tot 21.1c verwag.

Astrapak (APK) se inkomste vir die 6m tot Aug was +15.2% hoër, en vwVPA 4.5c (voortgeset -4.7c) teenoor 'n verlies van -6.5c 'n jaar gelede. Lae handel.

Capitec is now the third biggest bank in South Africa - BusinessTech.

Property: Malls begin to pall - Financial Mail.

Richemont: Losing its shine - Financial Mail.

Market Watch: Distell — In cider trade - Financial Mail.

Woensdag 28 September 2016

Op die internet

Rare flu-thwarting mutation discovered - ScienceDaily.

OPEC Reaches Understanding on Output Cut - Wall Street Journal. Hulle kan niks doen nie, want VSA en Kanada se produksie sal toeneem as die olie prys styg.

EU Banking Mayhem, One Bank at a Time, then All at Once - Wolf Street.

Op die internet - Suid Afrika

Pharmacy price war: Dischem vs Clicks vs Checkers vs Pick n Pay vs Spar - BusinessTech.

EDITORIAL: Sham public consultation - Business Day.

JSE aandele

Die JSE was vandag +1.7% hoër. Die Rand is swakker na R13.68. Brent olie is op na $46.13. Die goudprys is laer na $1319.40.

Groot stygings: Steinhoff NV +6.7% na R81.05, Fambrands +5.4% na R164.79, Aveng +4.7% na R7.38, Exxaro +4.7% na R79.94, Shoprite +4.4% na R196.25, Resilient +4.4% na R118.47, Tsogo Sun +4.0% na R31.50, Implats +4.0% na R68.48, Amplats +3.4% na R383.57. (Die groot styging in hierdie aandele in een dag maak nie sin nie).

Groot dalings: PPC -6.8% na R5.20, MMI -2.5% na R22.65, Remgro -2.0% na R236.94.

Met die verwydering van SAB Miller uit die JSE, sal Implats by die Top 40 gevoeg word, AVI by die Industriële 25 Indeks gevoeg word, Fortress by die Finansiële en Industriële 30 Indeks gevoeg word, ens.

Steinhoff Int (SNH) reik 332 miljoen nuwe aandele uit, wat 8.5% van die totale aandele verteenwoordig.

MTN ontken ten sterkste bewering van onbehoorlike wisselkoers transaksies.

Dinsdag 27 September 2016

Op die internet

Real Estate Bubbles: The Six Cities at Risk of Bursting - Visual Capitalist.

The Endpoint of Automation - Wolf Street.

Op die internet - Suid Afrika

New Explora, HD channels from DStv - TechCentral. Waarom sal gebruikers nog 'n dekodeerder koop, en dit sonder 4K Ultra Hoë Definisie? Hoe meer die sein saamgepers word, hoe meer fyn detail gaan verlore wanneer daar beweging is. Dit sou meer koste doeltreffend gewees het vir alle diensverskaffers om een kabel na huise te gebruik vir internet en 4K TV.

Cell C targets home users with 200GB LTE broadband data packages - BusinessTech.

Clicks launches click-and-collect delivery - BusinessTech.

Govt departments spent whopping R35bn despite Gordhan's cost cut plans - Fin24. R35.2B is +15% meer as R30.58B.

JSE aandele

Die JSE was vandag -1.1% laer. Die Rand is sterker na R13.52. Brent olie is laer na $45.73. Die goudprys is laer na $1326.50.

Groot stygings: Assore +7.3% na R140.00, Pinnacle +6.6% na R16.20, Raubex +3.7% na R24.88, Cashbuild +3.2% na R412.58, EOH +2.9% na R166.75, Nampak +2.7% na R19.96, Supergroup +2.5% na R43.50, Netcare +2.1% na R32.75.

Groot dalings: M&R Hold -5.9% na R11.35, Sibanye -4.5% R46.48, RMIH -3.7% na R41.84, MMI -3.7% na R23.25, MTN -3.4% na R119.78 (R999M verhandel), Implats -3.2% na R65.87, Gold Fields -3.1% na R66.41, Sanlam -2.6% na R62.61, Richemont -2.6% na R81.38.

Remgro (REM) reik 48.11 miljoen nuwe aandele uit teen R192.50 elk.

York Timber (YRK) se inkomste vir die jaar tot Junie was +15% hoër, en die wesens VPA op van 29c na 73c, of kern op van 19c na 31c. Lae handel.

Netcare (NTC) verwag vir die jaar tot Sep 'n wesens VPA wat ten minste -20% laer is.

Raubex (RBX) verwag vir die 6m tot Aug dat die wesens verdienste per aandeel +20% tot +25% hoër sal wees.

Capitec Bank (CPI) se inkomste van bedrywighede vir die 6m tot Aug was -22% laer of +16% hoër, en vwVPA +19% hoër na R15.11. Dan is die prys/verdienste R609.70/(R15.15 + R15.11) = 20. Die dividend opbrengs is (680c + 450c)/R609.70 -15% = 1.6%

MTN facing fresh allegations of misconduct in Nigeria - BusinessTech.

Maandag 26 September 2016

Op die internet

What can you make from one barrel of oil? - Visual Capitalist.

JSE aandele

Die JSE was vandag -1.0% laer. Die Rand is dieselfde op R13.66. Brent olie is dieselfde op $47.65. Die goudprys is dieselfde op $1341.10.

Groot stygings: Tawana +9.4% na R1.52, Stenprop +4.9% na R21.50, Finbond +4.0% na R2.60, Wesizwe +3.7% na 56c, Adcorp +3.5% na R15.34 (R454M verhandel), Invprop +3.5% na R15.57, Trustco +3.1% na R3.35, Mixtel +3.0% na R3.40, Sirius +2.8% na R8.45, Emira +2.5% na R14.23 (R475M verhandel), Texton +2.3% na R8.95 (R1081M verhandel).

Groot dalings: Pinnacle -17.4% na R15.20 (R3872M verhandel), Assore -6.1% na R130.52, PPC -4.2% na R5.70 (R4564M verhandel), Astoria -3.6% na R10.85, Grindrod -3.6% na R12.21 (R1852M verhandel) Pan-Af -3.5% na R3.58, ARM -3.4% na R79.93 (R5994M verhandel), Zeder -3.4% na R7.03 (R783M verhandel), DRD Gold -3.3% na R6.97, Aspen -3.3% na R311.31 (R49.56B verhandel), Onelogix -3.2% na R3.03, Stellar -3.0% na R1.30, Trencor -3.0% na R32.60, Cashbuild -2.9% na R400.00 (R663M verhandel), Brait -2.9% na R109.57 (R17.72B verhandel).

Sovereign Foods (SOV) verwag vir die 6m tot Aug 'n wesens verlies per aandeel van -47.5c tot -56.5c sonder sekere transaksies, of -38.5c tot -47.5c met die transaksies. Gewoonlik lae handel.

Jasco Electronics (JSC) se inkomste vir die jaar tot Junie was -4.2% laer, en die vwVPA op van 2.4c na 6.3c. Lae handel.

Saterdag 24 September 2016

Op die internet - Suid Afrika

Renovation tips to help you add value to your home - BusinessTech.

This is how much the average residential estate home costs in South Africa - BusinessTech.

Vrydag 23 September 2016

Op die internet

Canadian Housing Bubble, Debt Stir Financial Crisis Fears - Wolf Street.

Op die internet - Suid Afrika

Govt Puts Measures in Place to Curb Corruption - EWN. "More than 3,500 civil servants have been found guilty of corruption-related misconduct over the past 12 years".

JSE aandele

Die JSE was vandag +0.2% hoër. Die Rand is dieselfde op R13.68. Brent olie is dieselfde op $47.72. Die goudprys is dieselfde op $1339.40. Die yster erts prys (China fyn ingevoer) het die afgelope week van $55 na $56.7 gestyg.

Groot stygings: Nampak +6.3% na R19.55, Curro +6.1% na R45.20, Calgro M3 +3.5% na R18.45, Anglo +3.2% na R168.08, Medclinic +2.7% na R169.80, Netcare +2.2% na R32.46.

Groot dalings: Pick n Pay -3.5% na R71.69, PPC -3.3% na R5.95, South32 -2.8% na R25.08, Exxaro -2.4% na R77.07, Barloworld -2.1% na R89.02.

PPC (PPC) berig vir die eerste 5m van die finansiële jaar vir SA volume groei van +6%, maar -5% laer verkoop pryse. Internasionale verkope was +8% hoër.

Trans Hex (TSX) aandeelhouers word 394c per aandeel aangebied deur Cream Magenta, Metcap and RAC. Onafhanklike deskundiges Snowden Mining Industry Consultants Pty beskou 800c (345c tot 1287c) 'n regverdige en redelike aanbod. Daarvolgens beveel die onafhanklike raad van Trans Hex aan dat aandeelhouers nie die aanbod aanvaar nie.

Donderdag 22 September 2016

Op die internet

Time to “Be Alarmed” about Emerging Market Debt: UN - Wolf Street.

Youthful DNA in old age- Science Daily.

Columbia Scientists Unlock Big Perovskite Solar Cell Mystery - CleanTechnica.

WTO says EU failed to rein in Airbus subsidies - Reuters.

The world's best university costs just $12,000 a year - CNN Money.

Op die internet - Suid Afrika

University funding in numbers Financial Mail.

10 tips for managing buy-to-let properties - Fin24.

Best and worst medical aid schemes in South Africa – with prices - BusinessTech.

The real tragedy behind “student” riots – we all lose, but Africa the most - Biznews. Dit was nog altyd duidelik dat die beskawing wat die blankes gebring het nie sou voortbestaan nie.

JSE aandele

Die Monitêre Beleids Komitee het rentekoerse onveranderd gelaat.

Die JSE was vandag +2.2% hoër. Die Rand is sterker na R13.63. Brent olie is op na $47.72. Die goudprys is op na $1340.60.

Groot stygings: Glencore +6.9% na R37.80, Implats +6.3% na R68.77, Anglo Gold +5.3% na R230.66, BarloWorld +4.8% na R90.95, Bidvest +4.7% na R156.62, Bidcorp +4.6% na R264.45, Capitec +4.5% na R627.98, BHP Billiton +4.3% na R194.64, Standard +3.9% na R143.13, Pick n Pay +3.8% na R74.25, Redefine +3.5% na R11.56, Barclays Afr +3.4% na R153.75, Truworths +3.3% na R76.00, Anglo +3.1% na R162.91.

Groot dalings: ELB -2.9% na R17.00, WBHO -2.4% na R154.80.

ELB (ELR) verwag vir die jaar tot Junie 'n wesens verlies per aandeel van -482c tot -546c, teenoor 'n wins van 321c 'n jaar gelede.

Bell Equipment (BEL) se inkomste vir die 6m tot Junie was +6.9% hoër, en vwVPA -34% of -25% laer na 67c . Baie min handel.

Woensdag 21 September 2016

Op die internet

UN Declares SA as the Most Corrupt Country in the World - African News Updates.

JSE aandele

Die JSE was vandag -1.1% laer. Die Rand is sterker na R13.70. Brent olie is op na $46.80. Die goudprys is op na $1325.40.

Groot stygings: Harmony +4.8% na R47.90, Pan-Af +4.6% na R3.45, Anglo Gold +4.4% na R219.04, Northam +4.3% na R48.96, Sibanye +3.0% na R48.37, Anglo +2.6% na R158.00, Gold Fields +2.4% na R68.14.

Groot dalings: Balwin -9.5% na R7.98, Astral -6.2% na R122.48, PPC -5.7% R6.00, Growthpoint -5.0% na R24.15 (127c geval weens 94.3c uitkering), Discovery -4.4% na R114.37, NEPI -4.0% na R150.57, Santam -3.7% na R224.00, MMI -3.7% na R23.49, Richemont -3.0% na R80.16, Naspers -3.0% na R2298.54 (R4.81B verhandel), Medclin -3.0% na R165.00, Ascendis -2.9% na R27.78, Woolworths -2.8% na R77.62, Shoprite -2.4% na R183.11.

Balwin Properties (BWN) verwag vir die 6m tot Aug 'n wVPA van 36c tot 39c, wat -33% tot -38% laer is.

Argent (ART) verwag vir die 6m tot Sep 'n wesens VPA van 38.6c tot 45.3c, +15.4% tot +35.4% hoër. Dan is die prys/verdienste omtrent R4.30/(29.3c+~42c) ~ 6. Min handel.

Pan African Resources PLC (PAN) se inkomste vir die jaar tot Junie was +20.1% hoër, en vwVPA op van 0.65p£ (11.67cR) na 1.41p£ (30.19cR). Dan is die prys/verdienste 346c/30.19c = 11.5. Die dividend opbrengs is 26.91c/346c -15% = 6.6%.

Massive increase for Discovery medical aid premiums in 2017 - BusinessTech.

Dinsdag 20 September 2016

Op die internet

Fungus in humans identified for first time as key factor in Crohn's disease - Science Daily.

Recession Watch: US Freight Drops to Worst Level since 2010, “Excess of Capacity” Crushes Rates - Wolf Street.

Op die internet - Suid Afrika

Over 20 years, only 11 companies have kept their place in the Top 40 - Moneyweb.

SAA’s losses keep climbing - BusinessTech.

JSE aandele

Die JSE was vandag -1.2% laer. Die Rand is sterker na R13.86. Brent olie is af na $46.07. Die goudprys is op na $1314.60.

Groot stygings: Coronation +5.0% na R71.90, Santam +3.3% na R232.50, NEPI +2.9% na R156.98, Richemont +2.1% na R82.67.

Groot dalings: Lonmin -7.1% na R33.37, Kumba -3.8% na R114.00, Bidcorp -3.7% na R247.50, Northam -3.5% na R46.95, ARM -3.5% na R79.98, SAB -3.4% na R778.60, Naspers -3.2% na R2370.46, Sibanye -3.2% na R46.97, Amplats -2.6% na R372.90, Harmony -2.6% na R45.72.

Remgro (REM) intrinsieke netto bate waarde per aandeel op 30 Junie was +6.1% hoër na R306.44. Verkope was +8.2% hoër, en vwVPA -26% laer na 1139.2c, of sonder eenmalige kostes -7% laer na 1434.1c. Die dividend opbrengs is 460c/R246.51 -15% = 1.6%.

Maandag 19 September 2016

Op die internet

Italy's PM Unloads On Deutsche Bank's Unfixable Problem: "Hundreds And Hundreds Of Billions Of Derivatives" - Zero Hedge.

Plug-In Electric Vehicle Sales Grew 50% In 1st Half Of 2016 - Clean Technica. Brandstof motors het so duur geword dat elektriese motors nie meer so duur lyk nie, en elektrisiteit maak dit goedkoop om te gebruik.

HP’s DRM sabotages off-brand printer ink cartridges with self-destruct date - Arstechnica. HP drukkers gee dikwels probleme.

Op die internet - Suid Afrika

Joburg property rates mess heads to court - Moneyweb.

JSE aandele

Die JSE was vandag +0.28% hoër. Die Rand is sterker na R14.00. Brent olie is op na $46.84. Die goudprys is op na $1313.20.

Groot stygings: Lewis +7.0% na R43.90, Imperial +4.5% na R166.53, Shoprite +4.3% na R188.13 (R484M het verhandel), Rolfes +4.1% na R3.80, Standard +3.9% na R140.50 (R606M het verhandel), Coronation +3.7% na R68.46, Foschini +3.5% na R140.86, Amplats +3.3% na R382.98, Implats +3.1% na R64.36, Anglo +2.8% na R157.01.

Groot dalings: Cashbuild -3.7% na R412.00, Redefine Int -3.0% na R7.66, Capco -2.8% na R51.72.

Sasfin (SFN) se inkomste vir die jaar tot Junie was +25% hoër, en die verdunde wesens verdienste per aandeel +29% hoër na 731c. Min handel.

Silverbridge (SVB) se inkomste vir die jaar tot Junie was +6.8% hoër, en die wesens VPA +21% hoër na 29.05c. Min handel.

Rolfes (RLF) se inkomste vir die jaar tot Junie was +20% hoër, en die wesens VPA +39% hoër na 53.2c, of genormaliseerd +46% na 55.9c. Laasgenoemde gee 'n prys/verdienste van 365c/55.9c = 6.5. Vir 3 jaar voor dit het die inkomste amper verdubbel, maar die wVPA min verander, van 36.2c tot 38.2c. Die dividend opbrengs is 6c/365c -15% = 1.4%. Gewoonlik lae handel.

Life Healthcare to spend up to $1bn on European acquisition - Moneyweb.

Sondag 18 September 2016

Op die internet - Suid Afrika

ANC is the reason data prices are so high in South Africa - MyBroadBand. Die hoë koste kan iets te doen het met die lae data gebruik per inwoner, en Telkom en Neotel se swak diens.

Saterdag 17 September 2016

Op die internet

"Well, That's Never Happened Before" - Zero Hedge.

Vrydag 16 September 2016

Op die internet

The Central Bankers Experiment: The Great Bust - Talk Markets.

Take a look inside France's newest high-speed train - The Local France.

Foreign Central Banks Sell A Record $343 Billion In US Treasuries In The Last Year - Zero Hedge.

WTI Crude Tumbles To One-Month Lows As Libya, Nigeria Supply Looms - Zero Hedge.

Op die internet - Suid Afrika

EXCLUSIVE: Prasa deal's European 'BEE' partner, arms deal links - Fin24.

Inside the insane R50 million Titanic-themed house in Joburg - BusinessTech.

JSE aandele

Die JSE was vir 'n derde dag -0.65% laer. Die Rand is effens swakker op R14.26. Brent olie is dieselfde op $46.12. Die goudprys is af na $1309.30. Die yster erts prys (China fyn ingevoer) het die afgelope week van $56 na $55 gedaal.

Groot stygings: Arcmittal +8.7% na R8.75, Arrow +7.2% na R8.69, Cashbuild +4.1% na R428.00, Datatec +4.0% na R50.43, South32 +3.8% na R25.00, Grindrod +3.7% na R12.79, Aforbes +2.8% na R6.32, Zeder +2.7% na R7.20, Gkencore +2.6% na R35.00.

Groot dalings: Coronation -5.7% na R66.00, Assore -5.2% na R142.07, Harmony -5.1% na R47.30, Tongaat -5.0% na R114.95, Aspen -4.7% na R322.39, Implats -4.0% na R62.40, Goldfields -3.9% na R67.58, Rockcastle -3.7% na R32.83, Hyprop -3.5% na R119.80, Amplats -3.5% na R370.67, Sibanye -3.3% na R49.00, ARM -3.1% na R81.00, Tsogo Sun -3.0% na R29.25, Investec PLC -3.0% na R85.85, LifeHealth -2.9% na R37.75, Shoprite -2.9% na R180.43.

JSE kleinhandels

Party kleinhandelaars het geval op die lae groei in kleinhandel verkope statistiek, van naby 0% in Julie. Die statistiek is relatief tot inflasie. Die inkomste groei van die sektor stem ooreen met die nominale groei van 7.5% in Julie. Die aandeel mark reageer daarop asof groei opgehou. In nominale terme kom die groei geleidelik af. Mr Price se lae 2.3% verkope groei van April tot Julie kan deels 'n warmer winter wees.

Daar is nou 'n groot wisseling in die waardasie van aandele, in terme van prys/verdienste:

Cashbuild R411/1891c = 22

Clicks (CLS) R127/~R4.32 ~ 29

Foschini (TFG) R135/1046c = 12.9

Holdsport (HSP) R60/548.7c = 10.9

Italtile (ITE) R15/85.5c = 17.5

MassMart (MSM) R123/R5.32 = 23

Mr Price (MRP) R146/991.2c = 14.8

Pick n Pay (PIK) R70/219.9c = 32

Truworths (TRU) R71/688.2c = 10.3

Shoprite (SHP) R186/R8.67 = 21

Spar (SPP) R188/R7.92 = 24

Woolworths (WHL) R79/453c = 17.5

Donderdag 15 September 2016

Op die internet

Harvard Crushes The "Obama Recovery" Farce With 9 Simple Charts - Zero Hedge.

Op die internet - Suid Afrika

We are paying too much for data communications analyst confirms - Sowetan.

JSE aandele

Die JSE was vandag weer -0.62% laer. Die Rand is sterker op R14.20. Brent olie is af na $46.04. Die goudprys is af na $1313.60.

Groot stygings: Group5 +3.9% na R28.04, Advtech +2.3% na R16.65, Trellidor +1.9% na R5.45, Curro +1.7% na R41.03.

Groot dalings: PPC -6.3% na R6.41, Rockcastle -3.4% na R34.10, Nampak -3.4% na R17.88, NEPI -3.0% na R157.98, Amplats -2.9% na R384.00, Imperial -2.9% na R160.51, Richemont -2.9% na R82.26, Mr Price -2.7% na R146.23, Netcare -2.5% na R32.20.

Phumelela Gaming and Leisure (PHM) verwag vir die jaar tot Junie 'n wVPA van 161.54c tot 167.39c, +38% tot +43% hoër. Dan is die prys/verdienste rondom R22.00/~R1.64. Baie min handel.

Oceana’s big freeze - Cape Business News.

Master Drilling targets doubling in market value by 2018 - Miningmx.

Woensdag 14 September 2016

Op die internet

Prostate Cancer Study Details Value of Treatments - NY Times.

As Vancouver Luxury Home Sales Plunge 65%, Chinese Buyers Move To Toronto - Zero Hedge.

Op die internet - Suid Afrika

This is how much of your money government has wasted this year - BusinessTech.

What South Africans are doing to make their money stretch further every month - BusinessTech.

Suid Afrika se kleinhandel verkope in nominale Rand het +7.5% gegroei in Julie (+0.8% reëel), en +7.7% in Junie (+1.4% reëel), teenoor 'n jaar gelede (StatsSA pdf). Die reële groei statistiek is afhanklik van die regering se verklaring van inflasie. M3 geld voorraad groei was 4.41% in Julie, en 5.70% in Junie - dalk meer aankope op skuld.

JSE aandele

Die JSE was vandag -0.58% laer. Die Rand is sterker op R14.31. Brent olie is af na $46.26. Die goudprys is af na $1323.20.

Groot stygings: PPC +8.8% na R6.84, South32 +4.6% na R24.39, Lewis +3.0% na R42.51, Sasol +2.7% na R386.50, Sappi +2.4% na R71.40, NEPI +2.3% na R162.89, Glencore +1.9% na R34.60.

Groot dalings: Mr Price -5.6% na R150.32, Richemont -4.5% na R84.69, Woolworths -4.2% na R80.00, Truworths -4.1% na R71.95, Kumba -3.9% na R120.35, Foshini -3.8% na R135.00, Standard -3.3% na R136.42, Coronation -3.3% na R70.53, Sibanye -3.1% na R52.07, Capco -2.5% na R52.52, Tsogo Sun -2.5% na R30.20.

Aspen (APN) se inkomste vir die jaar tot Junie was -2% laer, en vwVPA -23% laer na 888.8c, of genormaliseerd +10% hoër na 1263.4c. Laasgenoemde gee 'n prys/verdienste R330.05/R12.634 = 26. Die internasionale besigheid se inkomste was +19% hoër in Rand (die Rand/$ was 27% swakker), wat 53% van die totale inkomste was. Dan was die plaaslike inkomste -17% laer.

Richemont (CFR) se verkope vir die eerste 5m van Apr tot Aug was -14% laer. Die verwagte bedryfs wins vir die 6m tot Sep is -45% laer, weens eenmalige herstrukturering koste, en produk terugkope.

EOH (EOH) se inkomste vir die jaar tot Julie was +31% hoër, en vwVPA +24% hoër na 682c. Die prys/verdienste is R152.19/R6.82 = 22. Die dividend opbrengs is 185c/R152.19 -15% = 1.0%.

Ascendis Health (ASC) se inkomste vir die jaar tot Junie was +39% hoër, en wesens VPA -30% laer na 55.6c, of genormaliseerd +29% hoër na 120.1c. Laasgenoemde gee 'n prys/verdienste van R28.28/120.1c = 24.

Dinsdag 13 September 2016

Op die internet

Simone Biles and Williams Sisters Latest Target of Russian Hackers - NY Times. "...the Williams sisters received medical exemptions to use banned drugs"

The babies with no mothers: Scientists discover how to make embryos from skin cells instead of eggs, making women redundant - DailyMail.

Study: Exposure To Common Air Pollution At Home Increases Insulin Resistance Risk - CleanTechnica.

Fake ice cream van crash: Just one of 130,000 false insurance claims in the UK last year - Express UK. Die beste oplossing is vir lede om versekering eise oor tyd terug te betaal, sodat elkeen net vir sy eie eise betaal.

Your Money Or Your Life: What's Behind The Latest Government Scam To Rob You Blind? - Zero Hedge. "... this so-called “war on cash” is being sold to the public as a means of fighting terrorists, drug dealers and tax evaders." Dit gaan oor belasting wat verloor word op kontant transaksies.

"Rampant Fraud" Exposed In Obamacare Exchanges: 100% Of Fictitious Enrollees Obtained Subsidies - Zero Hedge.

Zimbabwe land claims: No winners as meagre payments to white farmers revealed - Biznews. Dit moet groot plase wees, teen R14.4M elk in 'n agterlike Afrika land.

Suid Afrika regering begroting Feb. 2016

Media skep die indruk dat die minister van finansies se begroting 'n krediet afgradering na gemors sal verhoed. Die geskatte inkomste groei vir 2016/17 is +8.3%, wat bo die amptelike inflasie koers is. Die geskatte uitgawe groei vir 2016/17 is +6.0% (staats-besitte ondernemings soos Eskom en SAA, munisipaliteite met agterstallige skuld, en universiteite gaan al meer staatshulp benodig). Meer geld word uit die ekonomie onttrek as wat die ekonomie groei, en lone styg meer as die amptelike inflasie koers. Altwee dra by tot 'n verdere verswakking van die ekonomie. Almal se inkomste belasting styg: Iemand wat R100,000 verdien het en R4743 belasting betaal het, sal na 'n 9% verhoging R6120 belasting betaal, +29% meer. Iemand wat R200,000 verdien het en R24,191 belasting betaal het, sal R28,140 betaal, +16% meer, ens. Die kapitaal wins belasting insluitings koers gaan op van 33% na 40% vir individue.

Op die internet - Suid Afrika

South Africa’s shock crime statistics: More worrying than corruption? Expert analysis - Biznews.

Cell C enters content development market - BusinessDay.

Theft ravages fruit and vegetable farms in Western Cape - BusinessDay.

Ander aandeel markte

Europese markte: FTSE100 -0.53%, CAC40 -1.19%, DAX -0.43%. VSA: S&P 500 -1.48%.

JSE aandele

Die JSE was vandag +0.06% hoër. Die Rand is dieselfde op R14.42. Brent olie is af na $47.25. Die goudprys is op na $1324.10.

Groot stygings: Cashbuild +5.4% na R419.48, Woolworths +3.7% na R83.51, Supergroup +3.2% na R42.41, Firstrand +3.1% na R47.54, MTN +2.9% na R119.00, Truworths +2.7% na R75.00, Standard +2.5% na R141.09.

Groot dalings: Kumba -5.5% na R125.25, ARM -4.8% na R85.81, Anglo -3.8% na R151.19, IntuPLC -3.3% na R54.91, PPC -3.2% na R6.30, Aforbes -3.0% na R6.38, Steinhoff -3.0% na R80.54, Anglo Gold -2.9% na R227.00, Medclin -2.6% na R178.86.

MTN raises $1.3bn in loans - Moneyweb. Geen SENS aankondiging.

Holdsport (HSP) se groei vir die 6m tot Aug is +6.5% hoër, en wesens VPA 159c tot 169.2c, teenoor 203.8c die jaar tevore, weens wisselkoers verliese. Daarsonder sou kern wesens VPA 207.3c tot 215.8c gewees het.

Comair (COM) se inkomste vir die jaar tot Junie was +1.2% hoër, en vwVPA -24% laer na 36.5c. Die prys/verdienste is 330c/36.5c = 9.0. Die dividend opbrengs is 16c/330c -15% = 4.1%. Gewoonlik lae volume.

Kumba (KIO) het nog 'n SARS brief ontvang oor 'n R1b belasting verpligting vir 2011.

Attacq (ATT) se bruto inkomste vir die jaar tot Junie was +23% hoër, en vwVPA 12.0c (2de helfte -41.8c).

Clover (CLR) se inkomste vir die jaar tot Junie was +6.0% hoër, en vwVPA hoër +11.3% na 184.7c. Die prys/verdienste is R19.06/184.7c = 10.3. Die dividend opbrengs is 65.15c/R19.06 -15% = 2.9%. Lae handel.

Grand Parade (GPL) se inkomste vir die jaar tot Junie was +54% hoër, en vwVPA 2.0c.

Dit lyk of Pick-n-Pay 'n kop-en-skouer patroon gemaak het, wat die prys kan terugneem na R59. Kop-en-skouer patrone is net van belang in so verre tegniese analiste die prys beweeg omdat hulle hul eie idees navolg. Daar was ook een in April-Junie wat nie gewerk het nie.

Sasol to splurge on capital projects in face of weak oil prices - BusinessDay.

Aspen’s Chinese drive gets a boost - BusinessDay. Aspen gaan beide GlaxoSmithKline en AstraZeneca se narkose middels verkoop. As ek 'n vervaardiger is, soek ek eerder 'n verspreider wat my produkte onverdeelde aandag sal gee.

Super group: Super performance - Financial Mail. (Die vwVPA vir die 6m tot Junie was -1.7% laer, en kern +3.5% hoër).

Maandag 12 September 2016

Op die internet

Paralyzed man regains use of arms and hands after experimental stem cell therapy - Kurzweil AI.

Monkey Types 12 Words per Minute With Brain-to-Keyboard Communication - IEEE Spectrum.

Op die internet - Suid Afrika

South Africa’s Major Cities Are Owed Almost $4 Billion: Chart - Bloomberg.

SA parastatals are losing billions while being used for personal ends - Businesstech. Dieselfde sou in ander Afrika lande van die instellings geword het.

JSE aandele

Die JSE was vandag -1.0% laer, na dit kort na die opening met -2% geval het. Die Rand is dieselfde op R14.41. Brent olie is op na $48.40. Die goudprys is af na $1323.00.

Groot stygings: Aspen +2.0% na R335.48.

Groot dalings: Assore -5.2% na R146.92, Kumba -4.1% na R132.50, Implats -4.0% na R65.15, Sanlam -3.7% na R62.50, Goldfields -3.7% na R72.51, PPC -3.4% na R6.51, Ascendis -3.2% na R27.75, Tsogo Sun -3.1% na R30.52, Sibanye -3.0% na R53.37, Hyprop -2.9% na R124.24, Imperial -2.9% na R135.01, JSE -2.8% na R145.80.

Remgro (REM) verwag vir die jaar tot 'n wVPA van 1119.6c tot 1181.8c, -24% tot -28% laer. Dan sal die prys/verdienste rondom R252.03/~R11.51 ~ 22 wees.

Astral (ARL) verwag vir die jaar tot Sep 'n wesens VPA van 605c tot 1008c, -50% tot -70% laer. Dan sal die prys/verdienste rondom R124/~807c ~ 15.4 wees.

Aspen (APN) se oorkoop van 'n GSK Portfolio sou 75c bygedra het tot genorm. wesens VPA vir die volle jaar tot Junie 2017. Met die verwagte VPA vir die jaar tot Junie, sou die prys/verdienste rondom R336/~R9.55 ~ 35 gewees het.

Rand Merchant Investments (RMI) se inkomste vir die jaar tot Junie is dieselfde as 'n jaar gelede, of +8.9% hoër op die herverklaarde bedrag. Die vwVPA is -10.7% laer na 194.7c, of genormaliseerde vVPA +5% hoër na 222.0c. Laasgenoemde gee 'n prys/verdienste van R42.58/222.0c = 19.2. Die dividend opbrengs is (53c+65c)/R42.58 -15% = 2.4%.

SASOL (SOL) se omset vir die jaar tot Jun was -6.7% laer (+3.4% hoër vir die 2de helfte), en die vwVPA -16.7% laer na R41.40 (-4.1% vir die 2de helfte). Die prys/verdienste is R370.30/R41.40 = 8.9. Die dividend opbrengs is (570c + 910c)/R370.30 -15% = 3.4%.

AVI (AVI) se inkomste vir die jaar tot Jun is +8.4% hoër, en die vwVPA +11.1% hoër na 458.8c. Die prys/verdienste is nou R92.71/458.8c = 20. Die jaar se dividend opbrengs is (150c+220c)/R92.71 -15% = 3.4%.

More Starbucks stores for SA - BusinessTech.

Van die konstruksie aandele het skielik opgeskiet. Sedert Augustus is Wilson Bayly Homles-Ovcon (WBO) op van R120 na 'n prys/verdienste van R166/R12.94 = 12.8, en Raubex (RBX) van R18.50 na R24.20/231.8c = 10.4. Group Five (GRF) is op van 'n Januarie laagtepunt van R14.50 na R26.80/2x204c = 6.6. Die waardasie van die res: Aveng (AEG) R6.40/-74.4c, Basil Read (BSR) R2.53/2x53.39c ~ 2.4, Calgro M3 (CGR) R18.41/136.85c = 13.5, Murray & Roberts (MUR) R12.61/175c= 7.2, Stefanutti Stocks (SSK) R4.60/115.83c = 4.0.

Web soek enjins

Dit is die moeite werd om die resultate van web soek enjins te vergelyk. Bing gee beter resultate as Google. Die oorheersing van tegnologiese maatskappye hou nie vir ewig nie. Dit lyk of Google se soek algoritme verander was, of nie op datum gehou word nie. As 'n mens www.yahoo.com intik word 'n mens na webblad herlei wat al die mislikke Suid Afrikaanse nuus bevat. Die land kan verander met die vlag ikoon, maar daar is geen internasionale soek blad nie. Nog 'n besigheid wat opgeneuk is.

Sondag 11 September 2016

Op die internet

Robert Mugabe unveils new statue of himself as Zimbabwe endures economic crisis - The Telegraph.

Op die internet - Suid Afrika

Where does Makwakwa's mystery R1.2-million come from? - Business Day. (South African Revenue Services chief officer).

Saterdag 10 September 2016

Op die internet

Time To Get Real, Part 1: Central Banks - Zero Hedge.

Exposing How China "Cheats On Trade" In The Aluminum Industry - Zero Hedge. Eintlik moet die VSA meer invoer van China, wat die Yuan sal versterk relatief tot dollar, wat invoere duurder sal maak. Solank China nie hulle wisselkoers kunsmatig beheer met kapitaal uitvloei nie.

Deutsche Bank: The US May Now Be In A Recession - Zero Hedge.

Zimbabwe will sink into horror and depravity unless Mugabe quits now - Spectator.

Op die internet - Suid Afrika

SAA’s going concern guarantee ‘poses a significant risk’ - Business Day.

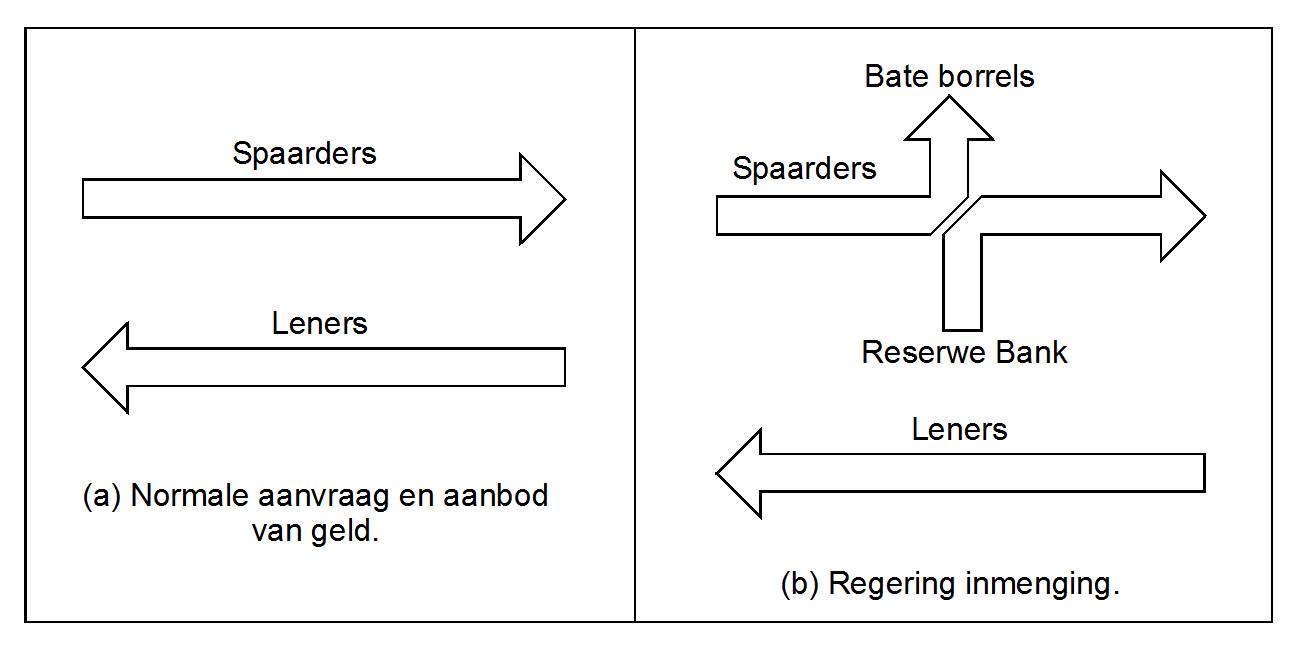

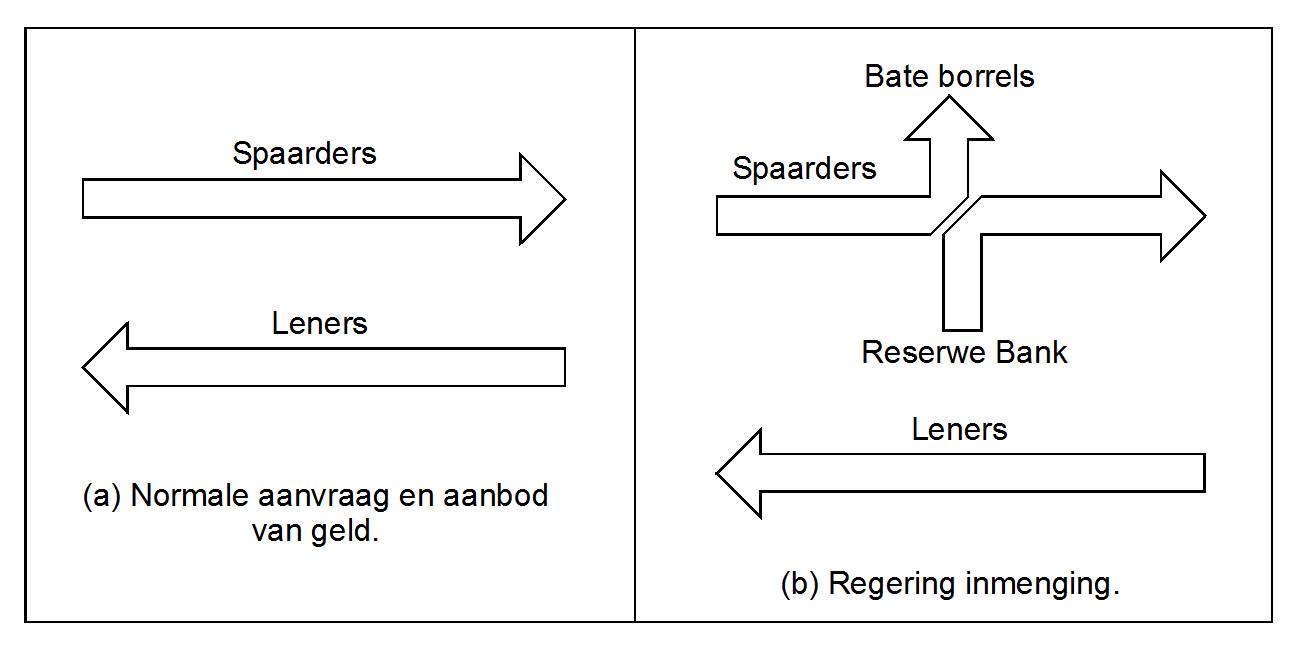

Lae rentekoerse

Rentekoerse is baie laag in ontwikkelde lande omdat mense meer wil spaar as geld leen. Reserwe Banke probeer om ekonomiese groei te kry deur ook geld beskikbaar te stel, wat die spaarders forseer om hulle geld elders te belê. Dit motiveer nie spaarders om besighede te begin nie. In plaas van ekonomiese bedrywigheid aan te wakker, skep dit bate borrels. Die aanvraag na geld het klaarblyklik nie verander nie.

Vrydag 9 September 2016

Op die internet

Comcast to FCC: Your set-top box plan is illegal - ArsTechnica.

New drug clears malaria from mice in a single dose - ArsTechnica.

Second Asteroid In A Month Sails By Without Us Detecting It First - Popular Science.

Protein In Your Hair Is Better Than DNA At Identifying You - Popular Science.

Zim public workers reject govt job cuts plan - Fin24.

Op die internet - Suid Afrika

Herbst: What they don’t want you to know. Quotas, John Jeffery and the UN. - Biznews.

Ander aandeel markte

Die Europese markte was laer: DAX -0.95%, CAC -1.12%, en FTSE -1.19%. Die S&P 500 het -2.45% getuimel. Dalk het die VSA mark geval weens die val na die 11 Sep 2001 aanval op die World Trade Centre.

JSE aandele

Die JSE was vandag +0.18% hoër. Die Rand is swakker na R14.42 ('n val in VSA aandeel markte gaan gewoonlik gepaard met ontrekking van geld uit ander lande). Brent olie is af na $47.88. Die goudprys is af na $1327.80. Die yster erts prys (China fyn ingevoer) het die afgelope week van $57.5 na $56 gedaal.

Groot stygings: Dawn +8.6% na R2.40, Master Drill +5.4% na R14.75, Petmin +5.2% na R1.21, Rhodes +5.1% na R26.50, South32 +4.0% na R24.12.

Groot dalings: Discovery -3.8% na R117.38, Advanced Health -3.4% na R1.69, Pick n Pay -3.3% na R70.53, Afrox -3.0% na R19.90, Omnia -2.8% na R169.51.

Mas Real Estate (MSP) se uitkering vir die 6m tot Junie is +34% hoër. Die jaar se opbrengs is €0.045xR16.04/R19.00 = 3.8%. Lae handel.

Mediclinic Middle East verwag inkomste groei vir die jaar tot Maart 1017 van lae tot middel enkel syfer, en onderliggende VVRBWA (verdienste voor rente, belasting, waarde vermindering en afskrywings) marge van middel tot hoë tiene. Die aandeelprys het alreeds gister -5.0% geval.

Donderdag 8 September 2016

Op die internet

This Battery-free Generator Is Made From Fish Scales - Popular Science.

Op die internet - Suid Afrika

Tax on your investments in a nutshell - Moneyweb.

SA car industry to avert strike: report - IOL. "A Numsa source said the deal would see workers receive a 10 percent pay increase in 2016 and an 8 percent increase in each of the following two years". Ver van die regering se beweerde inflasie koers. Volgende jaar sal hulle weer 'n drie jaar ooreenkoms teken.

Leaked documents reveal shocking plunder in South African municipalities - BusinessTech.

JSE aandele

Die JSE was vandag -0.39% laer. Die Rand is swakker na R14.11. Brent olie is op na $49.60. Die goudprys is af na $1339.60.

Groot stygings: Aveng +8.7% na R6.24, PPC +4.3% na R6.99, Steinhoff +4.0% na R85.16, RB Plat +3.0% na R51.60, ARM +2.4% na R93.99, Telkom +2.4% na R60.72, Assore +2.1% na R152.05.

Groot dalings: Aspen -5.8% na R340.83, Mr Price -2.7% na R158.56, Sanlam -2.6% na R65.15, Kumba -2.4% na R134.01, Sappi -2.3% na R70.32.

Sanlam (SLM) se netto inkomste vir die 6m tot Junie was +7.3% hoër, en die wesens VPA -8.1% laer na 214.1c, of genormaliseerd 208.0c. As dit herhaal is die prys/verdieste R66.87/2xR2.08 ~ 16.1. Nuwe besigheid volume was +15% hoër. Die groep ekwiteits waarde is R52.12 per aandeel.

Firstrand (FSR) inkomste uit bedrywighede vir die jaar tot Junie was +5.8% hoër, en wesens VPA +4.7% hoër na 399.2c. Die prys/verdienste is R47.12/399.2c = 11.8. Die dividend opbrengs is R2.26/R47.12 -15% = 4.1%.

Spur Corp (SUR) se inkomste vir die jaar tot Junie was -16.7% laer, of +3.4% hoër op voortgesette besigheid. Die vwVPA was +11.8% hoër na 170.86c, of voortgeset +16.8% hoër na 189.98c. Die prys/verdienste is R31.75/190.0c = 16.7. Die dividend opbrengs is 140c/R31.75 -15% = 3.7%.

African Rainbow Minerals of ARM (ARI) se inkomste vir die jaar tot Junie was -6.1% laer, en vwVPA -39% laer na 487c. Dan is die prys/verdienste R91.76/487c = 18.8. Die dividend opbrengs is 225c/R91.76 -15% = 2.1%.

Woensdag 7 September 2016

Op die internet

Space Age Solar Cells, Coming Soon To A Rooftop Near You - Clean Technica.

Stock Trading Based On Mainstream Media Perfect Recipe For Losses - Talk Markets.

"It Won't Be Long Now" David Stockman Warns "The End Game Of Central Banking Is Nigh" - Zero Hedge.

"It's Worse Than The Great Depression" - One In Six Prime-Aged Men Has No Job - Zero Hedge.

Crude Oil Freight Rates Plunge to Record Lows - Wolf Street.

Op die internet - Suid Afrika

Fire at UKZN law library destroys rare and valuable books - Business Day.

JSE aandele

Die JSE was vandag -0.42% laer. Die Rand is effens sterker na R14.02. Brent olie is op na $47.48. Die goudprys is op na $1344.40.

Groot stygings: WBHO +4.5% na R166.55, Ascendis +4.4% na R27.99, MMI +3.7% na R24.18, Supergoup +3.3% na R43.00, Clicks +3.1% na R127.80, EOH +3.0% na R149.20, Barlo World +2.8% na R86.35, Imperial +2.8% na R170.10, Pinnacle +2.7% na R17.35, Coronation +2.4% na R72.50.

Groot dalings: Steinhoff -6.2% na R81.90, Emira -75c na R13.63 (ex div), DRD Gold -3.5% na R7.84, Fortress B -3.4% na R32.80, Fortress A -3.1% na R16.00, Harmony -3.0% na R54.28, Nedbank -2.9% na R212.69, Barclays Afr -2.8% na R148.50, Resilient -2.7% na R117.00, Kumba -2.6% na R137.32.

Aspen (APN) verwag vir die jaar tot Junie 'n wesens VPA van 851.0c tot 908.4c, -21% tot -26% laer. 'n Vergelykbare genormaliseerde wesens VPA van 1184.0c tot 1237.4c word verwag.

Afrox (AFX) se inkomste vir die 6m tot Junie was -2.4% laer, en wesens VPA 105% hoër na 76.5c (maar laer as die 101.8c vir die 6m tot Des). As die 2de helfte wins herhaal, is die prys/verdienste R19.80/(~2x76.5c) ~ 12.9. Die dividend opbrengs is (51c+38c)/R19.80 -15% = 3.8%.

Capitec Bank (CPI) verwag vir die 6m tot Aug 'n wesens VPA van 1487c tot 1525c, +17% tot +20% hoër. Dan is die prys/verdienste rondom R596.01/(1515c + ~1506c) ~ 20.

Assore (ASR) se inkomste vir die jaar tot Junie was -12.4% laer, en vwVPA -11.7% laer na 1690c (+2% hoër vir die 2de helfte). As die 2de helfte wins herhaal, is die prys/verdienste R146.68/(2x975c) ~ 7.5. Die dividend opbrengs is 700c/R146.68 -15% = 4.1%.

Steinhoff's $3.8 billion American dream seen as risky by some - Reuters.

Steinhoff NV (SNH) se inkomste vir die jaar tot Junie was +33% hoër in €, en vwVPA +11% hoër, of -3% laer op voortgesette besigheid, of verstel -3% laer na €0.295. Dan is die prys/verdienste R87.35/€0.295xR15.73 = 19. Geen dividend word betaal weens 'n verandering in die jaar einde.

Ascendis Health (ASC) verwag vir die jaar tot Junie 'n wesens VPA van 52c tot 57c, -28% tot 34% laer, of genormaliseerd 116c tot 121c, +25% tot +30% hoër. Dan is die prys/verdienste omtrent R26.80/~119c ~ 23.

MMI (MMI) se netto inkomste vir die jaar tot Junie was -0.8% laer (netto versekering premies +5.7% hoër), en wesens VPA -27% laer na 132.2c, of kern wesens VPA -17.4% laer na 199.9c. Dan is die prys/verdienste R23.31/199.9c = 11.7. Die dividend opbrengs is 5.7%.

Suid Afrika ekonomiese groei

Die M3 geld voorraad groei was: April 7.28%, Mei 6.16%, en Junie 5.70%. Die amptelike inflasie koers naby 6%, is eintlik die minimum koers waarteen die meeste items opgaan, behalwe petrol wat nou -3.7% laer is. Kaapstad se munisipale eiendoms belasting is +21% hoër. Die gemiddelde inflasie is moontlik rondom 9%. Dan het die ekonomie in die 2de kwartaal met omtrent -3% gekrimp.

Dinsdag 6 September 2016

Op die internet

Television providers set to defend skinny TV packages at CRTC hearing following consumer complaints (Canada) - Financial Post. "By December, providers must offer channels a` la carte, both individually and in small packages of up to 10 channels, so people can tailor their services".

5 Reasons To Be Worried About US Stock Markets - Zero Hedge.

Op die internet - Suid Afrika

Investment just got a lot harder - Business Day.

30-hour water shutdowns, restricted usage in KwaZulu-Natal - Timeslive. As hulle rugby speel sal dit reën.

JSE aandele

Die JSE was vandag +0.11% hoër. Die Rand is sterker na R14.06. Brent olie is af na $46.65. Die goudprys is op na $1340.30.

Groot stygings: ARM +4.9% na R89.61, Hyprop +4.9% na R129.67, Pioneer F +4.8% na R176.90, Resilient +4.5% na R120.25, SA Corp +4.2% na R28.75, Pinnacle +4.1% na R16.89, Grindrod +4.1% na R12.57, City Lodge +4.0% na R166.90, Implats +3.7% na R69.50, Foshini +3.6% na R140.56, WBHO +3.% na R41.40, Growthpoint +3.5% na R26.13.

Groot dalings: Redefine Int -3.0% na R7.88, BHP Billiton -2.2% na R188.24.

Pinnacle (PNC) se inkomste vir die jaar tot Junie was +37% hoër, en vwVPA +8.1% hoër na 197.8c, of kern +12.1% na 205.1c. Die prys/verdienste is R16.89/205.1c = 8.2. Die dividend opbrengs is 20c/R16.89 -15% = 1%.

Anglo American (AGL) De Beers diamant verkope was $630M vir die 7de siklus, teenoor $528 vir die 6de siklus.

Wilson Bayly Holmes-Ovcon (WBO) se inkomste vir die jaar tot Junie was +3.8% of +6.3% hoër, en wesens VPA +10.6% hoër na 1294c. Die prys/verdienste is R153.69/1294c = 11.9. Die dividend opbrengs is 2.5%.

Discovery (DSY) se netto inkomste vir die jaar tot Junie was +11.1% hoër. Die vwVPA is -35% laer na 566.7c, of genormaliseerd -0.2% laer of +1% hoër na 671.1c. Die prys/verdienste is R126.50/671.1c = 18.9. Die dividend opbrengs is 1.3%.

Maandag 5 September 2016

JSE aandele

Die JSE was vandag +0.23% hoër. Die Rand is sterker na R14.38. Brent olie is op na $47.35. Die goudprys is op na $1327.00.

Groot stygings: Vukile +4.3% na R17.47, Rebosis +3.2% na R10.99, South32 +2.9% na R22.52, Harmony +2.9% na R56.27, Rhodes +2.7% na R26.70, Kumba +2.7% na R137.60, Goldfields +2.6% na R79.00, Tsogo Sun +2.6% na R31.37, Fortress A +2.6% na R16.46, First Rand +2.6% na R45.53. Naspers was +1.2% hoër na R2519.90, nadat Tencent +4.2% hoër was na HK$210.20, en 'n prys/verdienste van omtrent HK$210.20/~(4x RMB1.194 x HK$1.16) ~ 38.

Groot dalings: Adcorp -5.0% na R15.56, Assore -4.9% na R145.90, Amplats -4.3% na R400.97, Redefine Int -3.9% na R8.12, Intu PLC -3.0% na R58.09, Mr Price -2.4% na R163.01.

Buildmax (BDM) het 'n voorwaardelike aanbod ontvang vir 'n beherende aandeel posisie. Baie min handel.

Master Drilling (MDI) se inkomste vir die 6m tot Junie was -10.8% laer in $, en vwVPA +30% hoër na R0.95. Lae handel.

Altron (AEL, AEN) verwag vir die 6m tot Aug ten minste 1c wVPA. Lae handel.

Petmin (PET) se inkomste vir die jaar tot Junie was +0.7% hoër (-3.1% laer vir die 2de helfte), en vwVPA -3% laer na 23.7c (-41% laer na 9.38c vir die 2de helfte). As die 2de helfte herhaal, is die prys/verdienste R122/~(2x9.38c) ~ 6.5. Die dividend opbrengs is 5c/122c -15% = 3.5%.

Sondag 4 September 2016

Op die internet

Labor Day Summary: Wage Earners Have Taken A Beating - Talk Markets. "It's really very simple: wage-earners have seen their real earnings (as measured by purchasing power) stagnate or decline while those chosen few with access to near-zero interest borrowed capital have seen their net income and wealth explode higher."

"Everyone's On The Same Side Of The Boat Again" - Hedge Funds Have Never Been More "All-In" - Zero Hedge.

Saterdag 3 September 2016

Op die internet

Obese people and smokers 'banned from routine surgery' as NHS attempts to cut spending costs - Independent UK.

Op die internet - Suid Afrika

South Africa has introduced racial quotas for its cricket team - BusinessTech.

Vrydag 2 September 2016

Op die internet

The data that says the stock market is set to fall - The Telegraph UK.

What it took to buy an electric car in Texas: the good, the bad, and the ugly - Green Car Reports.

Vancouver home sales plunge for second straight month in wake of new foreign-buyer tax - Financial Post.

FDA bans antibacterial soaps; “No scientific evidence” they’re safe, effective - Arstechnica.

There Are 9.93 Million More Government Workers Than Manufacturing Workers - Wall Street Examiner.

Op die internet - Suid Afrika

OPEC output rises to record - Moneyweb.

Numbers don’t lie – SA moving backwards under Zuma’s leadership - Fin24.

Confusion over visa processing huge hurdle for SA tourism - Fin24.

JSE aandele

Die JSE was vandag +1.65% hoër. Die Rand is sterker na R14.49. Brent olie is op na $46.84. Die goudprys is op na $1318.50. Die yster erts prys (China fyn ingevoer) het van verlede Vrydag se $58.9 na $57.5 gedaal.

16 Sep 2020: Hammerson PLC dag 1? verhandel teen R115.25

Groot stygings: PPC +7.9% na R6.58, Implats +6.9% na R66.10, Amplats +5.1% na R419.15, Nedbank +4.7% na R213.42, Standard +4.2% na R135.66, Barclays Afr +4.0% na R148.65, Capitec +3.8% na R601.94, Remgro +3.7% na R259.97, Foschini +3.5% na R135.62, Bidvest +3.5% na R157.70, ens.

Groot dalings: Holdsport -2.5% na R60.85, Hyprop -1.9% na R123.00, Capco -1.9% na R56.40, Intu PLC -1.8% na R59.90.

Hyprop (HYP) se huur uitkering vir die jaar tot Junie van 619.9c is groei van +14.2% (die vwVPA is +4.3% hoër na 567.3c). Die opbrengs is 619.9c/R125.40 = 4.9%. Vergelykbare inkomste en verspreibare verdienste op beleggings eiendom was +7.3% meer. Totale inkomste en verspreibare verdienste van Suid Afrikaanse beleggings eiendom was onderskeidelik +8.6% en +8.7% meer. Die maatskappy verwag omtrent +10% groei vir die komende jaar.

Mr Price sales slump: The Cotton On elephant in the room - Moneyweb.

Massmart: Betting on food and liquor - Financial Mail.

Donderdag 1 September 2016

Op die internet

Elon Musk's SpaceX Falcon 9 rocket EXPLODES on the launch pad at Cape Canaveral - two days before it was due to send Facebook's first satellite into orbit - DailyMail.

Fury and fear in Paris: Wealthy residents outraged as huge wooden migrant camp is built directly opposite £3million apartments in elite neighbourhood of French capital - DailyMail.

USDA Sees 2016 Farm Income Crashing As Farmer Leverage Spikes to 34 Year Highs - Zero Hedge.

Op Twitter: Donald J. Trump @realDonaldTrump: "Mexico will pay for the wall!"

Op die internet - Suid Afrika

Water: There’s trouble ahead - Financial Mail.

Vehicle exports bounce back strongly - Business Day.

How much sugar do we drink in South Africa? Here are the facts - BusinessTech. "A 330 ml can of Fanta Grape contains nearly 10.5 teaspoons of sugar ... A can of Coca-Cola (just more than 8 teaspoons of sugar) ..."

JSE aandele

Die JSE was vandag -0.19% laer. Die Rand is effe sterker na R14.67. Brent olie is af na $45.72. Die goudprys is op na $1311.70.

Groot stygings: Implats +9.5% na R61.84, Raubex +5.2% na R23.50, Harmony +4.9% na R55.00, Glencore +3.4% na R34.30, WBHO +2.9% na R153.13, PPC +2.7% na R6.10.

Groot dalings: Mr Price -8.7% na R168.50, Sun Int -4.2% na R90.07, Barclays Afr -4.0% na R143.00, Barloworld -3.9% na R80.00, Massmart -3.4% na R125.00, Vukile -3.1% na R16.52, Pick N Pay -3.0% na R71.49, Bluetel -2.8% na R18.52, Steinhoff -2.8% na R85.79.

Petmin (PET) verwag vir die jaar tot Junie 'n wesens VPA van 23.7c, -3% laer. As die 2de helfte wVPA herhaal, is die prys/verdienste 126c/(~2x 9.38c) = 6.7.

Tsogo Sun (TSH) neem 'n beherende aandeel in Hospitality. Die A aandele word in B omskep op 28 Sep.

Growthpoint Properties (GRT) se 6m uitkering maak die jaar opbrengs 183.8c/2485c = 7.4%. Groei van 6% word vir volgende jaar verwag.

Implats (IMP) se inkomste vir die jaar tot Junie was +10.6% hoër, en die vwVPA 12c (2de helfte -41c verlies). Die prys/verkope is R56.46/R52.5 = 1.1.

Famous Brands (FBR) koop GBK Restaurants Ltd (“Gourmet Burger Kitchen”) vir £120M (~R2.1B teenoor Fambrands se inkomste van R4.3B). Hulle verdienste voor rente, belasting, waarde vermindering, en afskrywings was omtrent £9.6M.

Will Steinhoff shop till it drops? - Business Day. Die besighede wat Steinhoff koop, het verkopers wat ontslae wil raak daarvan.

MTN seeks to raise billions through IPO - Business Day. Dit verdun seker die bestaande aandeelhouers.

Ouer webjoernaal

Regstellings na: slandrp@gmail.com

Hierdie webwerf is: www.slrp.co.za/webjoernaal

Ontkenning: Geen verantwoording word vir verkeerde inligting aanvaar nie. Die inhoud moet nie as finansieële raad beskou word nie. Web blad besoekers moet hulle eie finansieële deskundige raadpleeg voor hulle op die inligting reageer.

Kopiereg @2016