What causes inflation? The various ways inflation can be created, are characterised by one underlying phenomenon: more income without an increase in production. That is another version of the familiar inflation description, namely an increase in the price of products. This article shows the two main source of inflation are: government spending and declining interest rates resulting in asset appreciation.

First we need to look at a basic principle:

Money created by debt

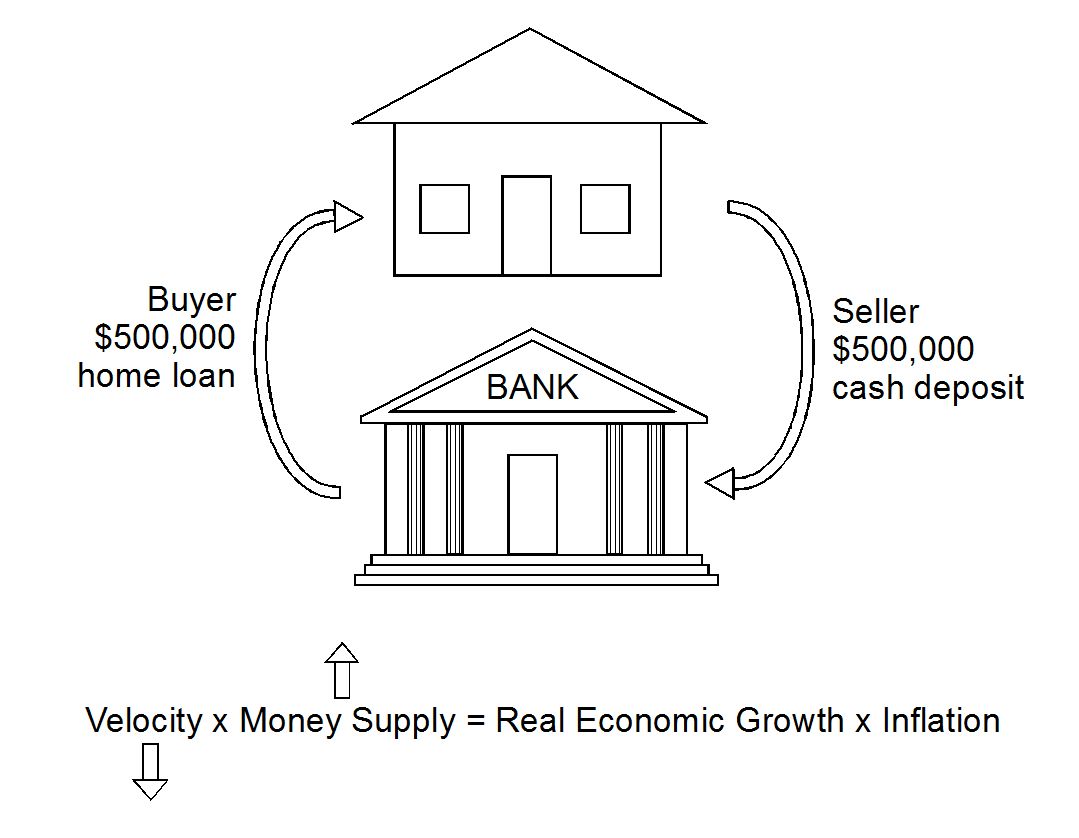

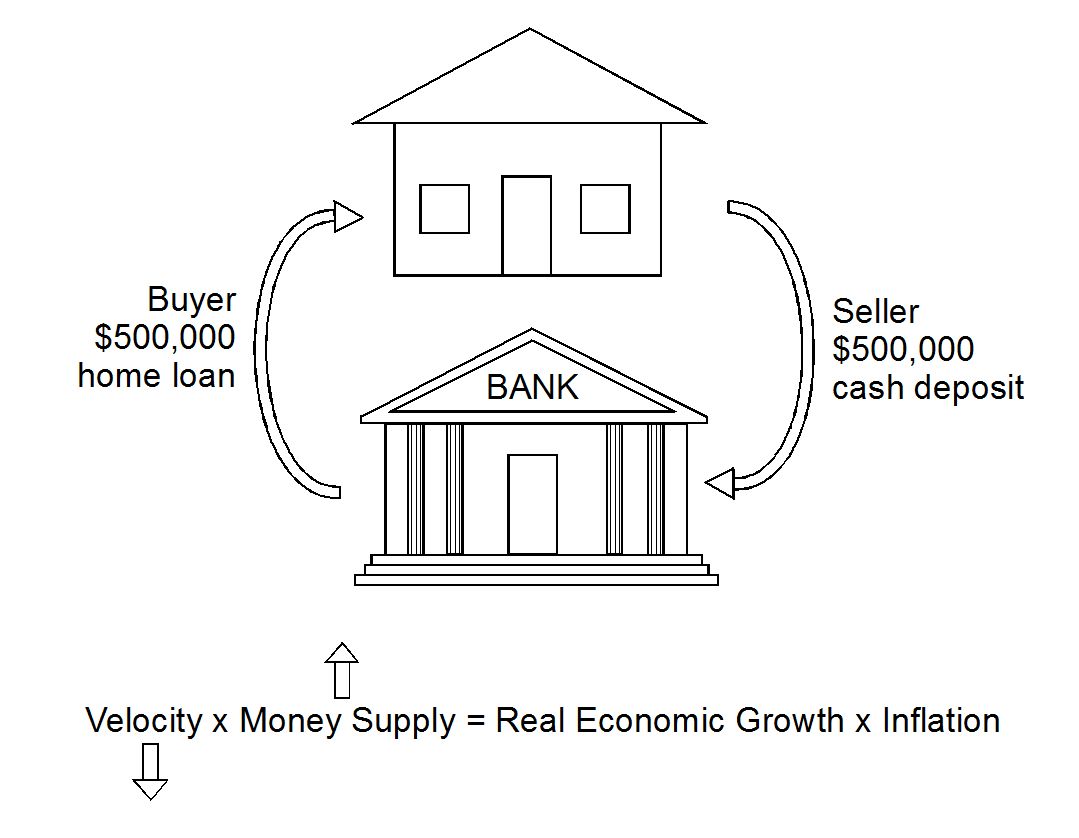

Money supply equals debt. That is because banks wants to lend out the money they receive as deposits as illustrated below, because they have to pay interest on it. For most countries M3 money supply equals total debt, but there are some countries that report a lower money supply, to give the impression that inflation is lower than what it actually is.

The borrower spends the loan from the bank, and gives it to a seller who deposits it into another bank account. Thus the same amount can go through several banks, known as the multiplier effect. Each time a new set of money supply and debt is created. The depositor doesn't spend his money, so the actual amount of money in circulation does not increase, although it is counted as an increase in money supply. The spending increases with the increase in money supply, keeping velocity = GDP/money the same.

Just because money supply and debt increase, does not necessarily mean it is inflationary, as long as economic production increases with it. We can tell from long term commodity prices like gold and oil that real economic growth in developed economies is very low. A nation develops fast in the beginning, but ends with large government and socialism.

There are four ways inflation is created:

1. Government printing money

This is what everybody knows causes inflation. Money supply is typically used as a measure of the money that was created.

In a cash economy (with no debt) the money supply can only increase if the government prints money, but you could still have inflation due to lower efficiency. Money can also flow through the economy faster, which increases nominal economic output (GDP), which either creates real economic growth or inflation.

Money printed by the US government should appear as the difference between (1) total receipts + in the annual increase in debt (blue), and (2) total expenditure (red). The gap between them is small. No sign of printed money. The money the government borrowed from the Federal Reserve as QE (Quantitive Easing) was in effect created from nothing, but the amounts are small compared to the total debt, and are supposed to be paid back.

So how is it possible for money supply to increase 1000x over a century even without the government printing money? It is growth of 7.2% per year.

In the drawing below, government borrows money as bonds, and then deposits it in a bank account until they need it. Obviously the government borrows from one group of people (bond holders), and hands it out to another group (government beneficiaries). The drawing just illustrates the principle that bond issuance increases the money supply and debt. The deposit and loan paring is like matter and antimatter – you start with nothing, and separate it into two mirror universes. It is like the song Dire Straits - Money For Nothing (Official Music Video). The deposits could pay off the debt, and you would again have nothing. Can the same amount of money be multiplied 1000x over a century? You start with $10 billion in 1900, and you multiply it to $10 trillion by 2000?

The effect of government debt on real economic growth and inflation depends on what government does with the money. Government usually provides benefits without the recipients producing, and therefore it creates inflation. The question is whether government creates all the inflation. If all debt growth is inflationary, then the inflation created by government would be their debt relative to total debt. Business debt is probably not inflationary. Housing debt can be inflationary as discussed below.

2. Less efficient economy

A less efficient economy can also cause inflation, even if money supply remains constant. The opposite is a more efficient economy, which leads to lower prices, and creates real economic growth. Nominal economic growth (Gross Domestic Product) = real economic growth + inflation.

Government causes inflation by collecting more taxes or import duties. Not only are higher taxes passed onto consumers, the money collected is usually handed out as free benefit without production. Even if government uses the money to pay government workers, those workers then provide a free service to government customers. If the money is used as subsidies, then the customers of the subsidised business receive a benefit without production.

Monopolies cause inflation, because they have the pricing power to increase prices without increased production. When a monopoly increases the price of essential products, their customers have to cut back on other items with the limited income they have available. Those items would be left out of the inflation basket, and the inflation on the remaining items increase, and thus inflation rises. The government is a gaint monopoly, which can arbitrarily raise prices.

3. Asset appreciation

To creat such an enormous increase in money supply requires something of big value, like real estate and the stock market. An increase in asset prices causes inflation because it generates wealth without production. Home owners benefit from the asset appreciation, whilst the rest of the population pays for it through inflation. Their wages do not keep up with the rise in inflation. It creates a wealth gap.

An asset, unlike consumable items which end up worthless, is a way of saving income received for economic production. The asset can be converted back into income in the future. If the asset sells at the original price, there is no inflation. Why do assets appreciate in value? Is it a cause of inflation, or a result of inflation created elsewhere?

House prices are determined by what the average worker can afford. Mortgage debt payments are limited to about a third of the average wage, so house prices are limited by wages and interest rates. Wages increase due to inflation, primarily caused by government. When interest rates decline, house prices rise. Real estate inflation is a combination of government creating money, and lower interest rates.

If a couple spends a third of their average wages on the mortgage interest (red) they can afford the average house price (blue). House prices could have been much higher between 2007 to 2022.

Take for example a house that sell for 10x its original price after 50 years. The seller deposits the money with a bank, and the bank lends the money to the buyer (drawing below). Viewed in isolation, you start with nothing, but after the transaction, money supply and debt increased by $500,000.

At the moment the transaction takes place, it provides no economic growth, and no inflation (A new house would add to GDP, but not the sale of an existing house). Since the Money Supply increases, the Velocity of money flow falls. How does the increase in the house price cause inflation? The seller has money to spend without producing. The buyer needs to earn more to pay off the more expensive house, and pushes up the price of his services, without necessarily producing more. That leads to inflation.

4. Alternate currencies

Digital currencies like cyptocurrencies, and gold adds to the money in circulation, but is not officially counted as money supply. The mining and processing of gold do contribute to economic output, so not inflationary, but does not improve the standard of living. Basically any purchased product that is tradeable becomes currency, including real estate and stocks.

Results

The mechanism may be unclear, but we can observe the results. When interest rates declined between 1980 and 2010, house prices rose (red), and the velocity of money flow declined more than usual, shown here as economic output over total debt (blue):

An increase in house prices (blue) is followed by an increase in the official CPI (Consumer Price Inflation - red). The official CPI statistic understates the actual inflation rate since 1980:

The stock market is also a major source of inflation. Normally the stock market would rise by the overall inflation rate created by government, but occasionally monopolies cause market bubbles. The link between between corporate profits (blue) and federal debt (red) is clear:

This chart shows the big increase in the net worth of US households and nonprofit organizations (blue) and total US debt (red).

End of page .

CONTACT INFORMATION

Corrections to: slandrp@gmail.com

This website is: www.slrp.co.za/inflation

Disclaimer: No responsibility is accepted for wrong information, or for losses as a result of any information on this website. The contents should not be regarded as financial advice. Website visitors should consult with their own financial advisors before reacting to information.

Copyright @2025