Stock picks for 2023

Unless there is a proper stock market collapse, the future returns are likely to be low, and the risks too high. The stock market is dominated by speculators, which cause share prices to reach extremely high and low levels. The only sensible strategy left, is to buy after a market collapse, and to hold until the next bubble.

Saturday 31 Dec 2022

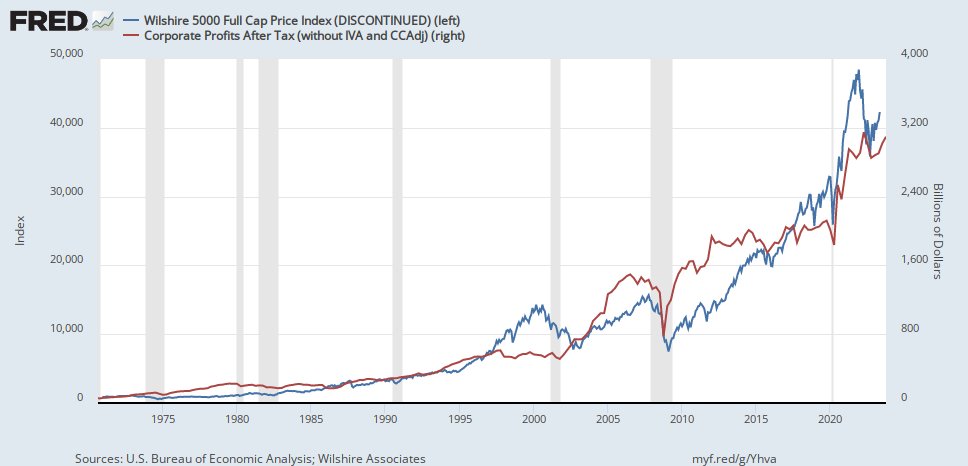

The US stock market (blue) has returned to the level of corporate profits (red) on this arbitrary scale. Corporate profits seldom fall. It did in 2008, and recovered the next year. If the recession of 2009 is repeated, profits should fall, and the stock market follow along. Inflation always wins out in the end. The price of products and services increases permanently.

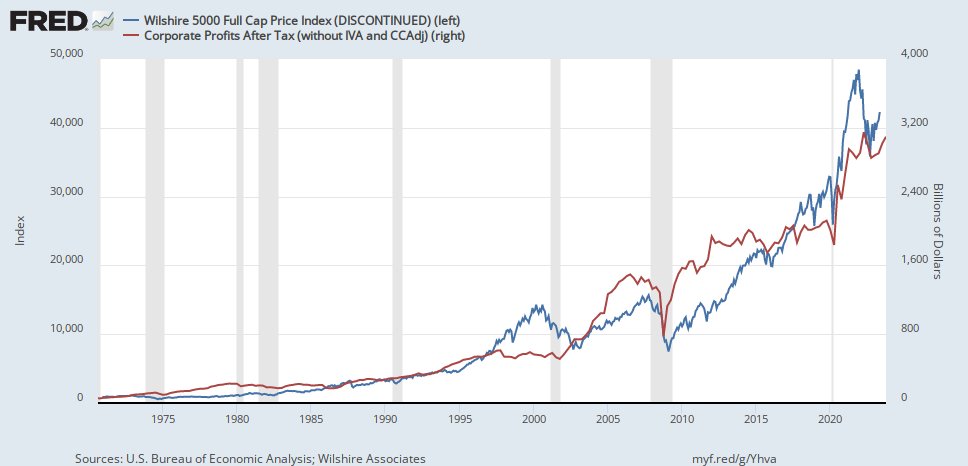

The question for the stock market is whether profit margins will remain higher than in the past, as shown here as the ratio of corporate profits to GDP (Gross Domestic Product):

Stock picks for 2022

Amongst the thousands of unattractive stocks, it is a battle to come up with 10 stocks at a reasonable valuation. The list below is based on past performance. Future performance is unknown. If US interest rates are increased in 2022, and the stock market falls, most stocks will go down with it.

With US money supply growth of around 25% from May 2020 to April 2021, and at 12.8% the rest of 2021, a stock market investment must beat the potential inflation. This requires revenue or profit growth plus dividend yield of more than 12 to 25%.

(1) Alibaba (NYSE: BABA). Each ADS represents eight ordinary shares in HK. The stock price has fallen to a price/earnings of $118.79/(CNY45.3/6.39) ~ 16.8. Sep 2021 revenue growth was +29%, en EPS peaked at CNY55.92 for March 2020, and is CNY45.3 for the last 12 months.

24 Feb 2022: Alibaba (BABA) third quarter revenue growth was down to just +9.7%, and the net profit margin to 8.4%. The growth rate of these Chinese big tech companies has slowed down. The price/earnings is $100.60(~4xRMB7.52/6.32) ~21.

25 Oct 2022: Alibaba (BABA) share price has fallen further after Xi Jinping stayed in power for a third term: Investor Relations: Q1 revenue growth 0% (year to March +19%), dEPS per ADS RMB8.51 ($1.27) compared to RMB16.40 ($2.54) last year, or adjusted RMB11.73 ($1.75) compared to RMB16.60 ($2.57). The price/earnings ~ $64.30/~4x$1.75 ~9.2.

It started the year at $120.38, and ended at $88.09.

(2) Anthem (ANTM) managed Health Care. Last revenue growth was 15%. The price/earnings is high at $463.54/$22.32 = 20.8.

Anthem (ANTM has been rebranded as Elevance Health (ELV). It started the year at $464.86, and ended at $512.97.

(3) Atlas Air Worldwide (AAWW) Airfreight. Last revenue growth was +25%. The price/earnings is $94.12/$16.64 = 5.7. Consumer demand has shot up, and won't continue.

It started the year at $94.81, and ended at $100.80. It is to be acquired by Investor Group at $102.50 per share.

(4) Berry Global Group (BERY) Container & Packaging. Last revenue growth was +18%. The price/earnings is $73.78/$5.30 = 13.9.

It started the year at $72.87, and ended at $60.43.

(5) Carnival Corp (CCL), Hotels, Resorts & Cruise Lines. Recovery from lockdowns due to the Coronavirus.

25 May 2022. The share price has dropped again, just like for the Covid lockdowns. The company has issued more share which dilutes past Earnings per Share (EPS) performance by 0.609 times. The best EPS was $4.44 in 2018, which translates to $2.70. They are buying back shares. During the 2009 Great Recession their revenue declined -10.2%, and recovered the next year. Profits declined -22.8%, and partially recovered the following year. Most of their passengers are older people who probably live on pensions, and are not affected by the economy. It is unclear whether they will fully recover, but revenue was very consistent before Covid, which suggests people want to go on cruises.

20 Sep 2022: Third quarter revenue recovered to $4305M, compared to $6532M in 2019 before the Covid pandemic. The quarter revenue per share is $3.633, loss per share -$0.65, and the share price $7.24.

It started the year at $21.41, and ended at $8.06.

(6) IES (IESC), Technology. Last revenue growth was +29%. The price/earnings is $50.64/$3.15 = 16.1.

29 April 2022: Investor Relations: Q2 revenue growth +51%, EPS down from $0.58 to -$0.30 loss. Share price has been declining for months already. Wait for a return to profit.

IES (IESC) 6 Dec 2022: Investor Relations: Q4 revenue growth +28%, EPS down from $1.07 to $0.72. PE ratio $38.30/~4x$0.72 ~13.

It started the year at $92.50, and ended at $43.00.

(7) Ingles Markets (IMKTA) food retail. Last revenue growth was +8.2%. The price/earnings is $86.34/$12.73 = 6.8.

Ingles Markets (IMKTA) supermarkets, 23 Nov 2022: Q4 revenue +8.8%, EPS down from $3.78 to $3.69. Growth is too low.

It started the year at $87.35, and ended at $96.46.

(8) Innoviva (INVA) pharmaceutical. Last revenue growth was +10%. The price/earnings is $17.25/$3.12 = 5.5.

27 April 2022: Innoviva (INVA) Investor Relations: Q1 revenue +5.3%, dEPS down from $0.84 to $0.20. Growth is too low, and profits fell.

It started the year at $17.45, and ended at $13.25.

(9) Investors Title (ITIC) Insurance. Last revenue growth was +19%. The price/earnings is $197.15/$34.11 = 5.8. Low trade.

It started the year at $202.30, and ended at $147.55.

(10) MarineMax Inc (HZO). Last revenue growth was +37%. The price/earnings is $59.04/$6.78 = 8.7. Consumer spending might have peaked.

3 May 2022: Investor: Q2 revenue +16.6%, dEPS up from $1.69 to $2.37. Price/earnings = $43.22/$8.00 =5.4. Sales growth is slower, still good profits, and share price is cheap.

28 July 2022: Investor: Q3 revenue +3.3%, dEPS up from $2.59 to $3.17. Price/earnings = $40.95/$8.58 =4.8, NAV = $33.50. If the recession gets worse, their sales could tumble.

27 Oct 2022: Investor: Q4 revenue +16%, dEPS up from $1.45 to $1.73. Price/earnings = $30.38/$8.84 = 3.4. Cheap.

It started the year at $58.86, and ended at $31.22.

(11) Medifast (MED) weight and disease management products. Last revenue growth was +52%. The price/earnings is $209.43/$13.34 = 15.7.

2 May 2022: Medifast (MED) Investor Relations: Q1 revenue +22.6%, dEPS up from $3.46 to $3.59. Price/earnings $187.54/$14.02 = 13.4. Sales growth has slowed, and profits are flat. If this continues growth would be too low.

3 Aug 2022: Medifast (MED) Investor Relations: Q2 revenue +15%, dEPS down from $3.96 to $3.42. Price/earnings $128.50/~4x$3.42 = 9.4, dividend yield 4x$1.64/$128.50 = 5.1%. Sales growth has slowed, and profits are flat. Growth is too low to beat inflation.

3 Nov 2022: Medifast (MED) Investor Relations: Q3 revenue -5.6% lower, dEPS down from $3.56 to $3.27. Price/earnings $110.87/~4x$3.27 = 8.5, dividend yield 4x$1.64/$110.87 = 5.9%. Total return is too low to beat inflation.

It started the year at $215.83, and ended at $115.35.

(12) Regeneron Pharmaceuticals (REGN), biotechnology. Investor Relations. 4 Nov 2021 Third quarter results:

REGEN-COV $804M, EYLEA US +12% to $1.47B, Dupixent +55% to $1.66B. Price/earnings $631.52/~4x$14.33 ~11.0.

4 May 2022: Regeneron Pharmaceuticals (REGN), Biotechnology. Investor Relations Q1 revenue +17%, dEPS down from $10.09 to $8.61, or non-GAAP up from $9.99 to $11.49. The price/earnings is $647.80/$70.60 = 9.2. Revenue growth still good.

3 Aug 2022: Regeneron Pharmaceuticals (REGN), Biotechnology. Investor Relations Q2 revenue -44% (ex REGEN-COV), dEPS down from $27.97 to $7.47, or non-GAAP down from $25.80 to $9.77. The price/earnings is $641.49/~4x$9.77 = 16.4. Growth without REGEN-COV was +20%.

It started the year at $627.10, and ended at $721.49.

Previous year

2021

CONTACT INFORMATION

Commentary to: slandrp@gmail.com

This website is: www.aandele.co.za/US_stocks_2022

Disclaimer: No responsibility is accepted for wrong information, or for losses as a result of any information on this website. The contents should not be regarded as financial advice. Website visitors should consult with their own financial advisors before reacting to information.

Copyright @2022