Saturday 30 Mar 2024

"The cover of this week’s edition of @TheEconomist." - Twitter.

Friday 29 Mar 2024

Microsoft Says Copilot Users Would Love It More If They Wrote Better Prompts - Extremetech. The Microsoft diagnostic function never finds the problem.

China’s Xiaomi joins the crowded EV race with ‘dream car’ to take on Tesla - CNN. "EVs in China are priced much lower than in the rest of the world. For example, BYD’s most affordable model, the Seagull hatchback, costs only 69,800 yuan ($9,658)."

"A must watch! This is my hero! He is Mohamed Irfaan Ali, President of Guyana" - Twitter. People argue about the mythical impact of carbon dioxide on global warming.

"On Thursday, Bruce Carnegie-Brown, chairman of Lloyd’s of London, said that the Baltimore (USA) bridge collapse will likely be “the largest-ever marine insured loss,” potentially totaling up to $4bn." - Twitter.

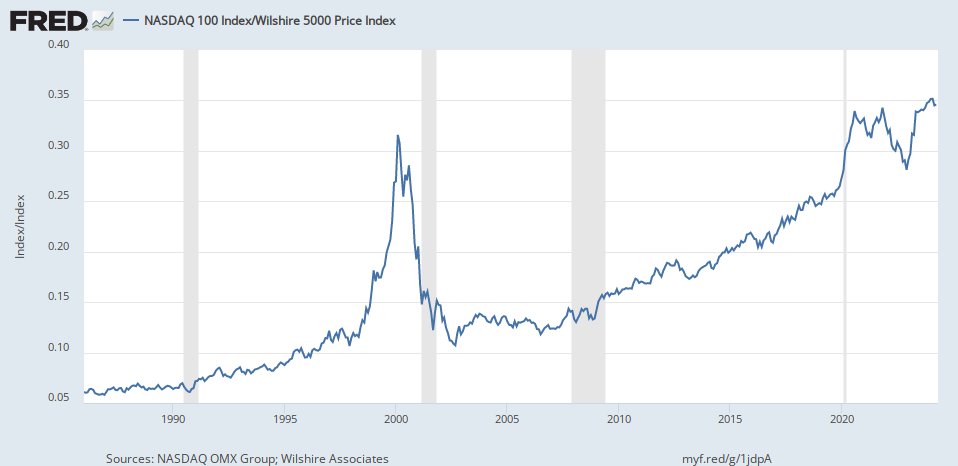

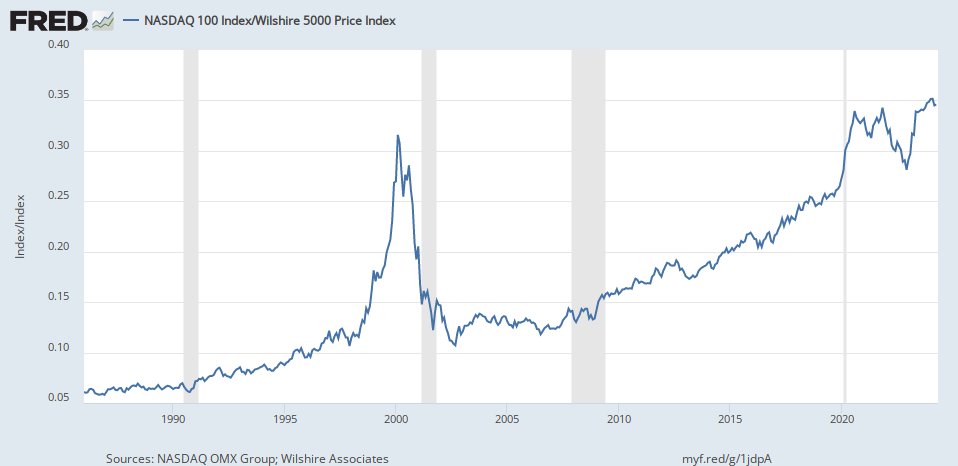

The Nasdaq 100 relative to the whole stock market. The present bubble started at 10.7% in 2002, and is now 34.6%. Some of it could be due to a change in the composition.

Thursday 28 Mar 2024

"The Department of Justice, 15 states, and Washington D.C. sued Apple on antitrust grounds, alleging the company holds a monopoly in high-end smartphones." - Twitter.

Sam Bankman-Fried has been sentenced to 25 years for crypto fraud. Sam handled crypto currency like a banker, and now his goose is cooked.

Wednesday 27 Mar 2024

The Japan Yen is likely weak because interest rates (blue) are too low for the rate at which money is created (red), which determines the nominal inflation rate. If lenders dry up, they will have to print more money. Japan has mostly had a current account surplus since 1985, which implies a net capital outflow (Trading Economics).

Tuesday 26 Mar 2024

The internet is a vast source of information: Francis Scott Key Bridge through the years | PHOTOS - Baltimore Sun. The bridge never had barriers around the piers to protect against ship collisions. The US president who didn't have relations with Monica Lewinsky made a speech there in 1995.

US compensation of employees relative to household net worth (blue) rose slightly with rising interest rates (red), but has halved as interest rates came down. Most of the household net worth is held by the wealthiest 10%. Lower interest rates to achieve "full employment" have enriched the wealthy and impoverished workers.

Monday 25 Mar 2024

"Titanic door which Kate Winslet and Leonardo DiCaprio clung to in iconic film sells for whopping $718,000" - Twitter.

Yet another study shows plug-in hybrids aren’t as clean as we thought - Electrek.

Nissan to make EVs more affordable, plans to slash costs to reach EV/ICE price parity - Electrek.

The global use of coal has increased to all time highs, despite the West having switched from coal to natural gas. The US, which have unlimited gas reserves, wants other countries to stop burning coal, ignoring the energy sources they have available.

.... From 17 Nov 2023: Global coal output through 2030 will be impacted by coal phase-outs by top miners - Mining-technology. "Global Coal production is expected to increase to 8,917.3 million tonnes (mt) in 2023, a growth of 1.9% over 2022, with China and India contributing to the growth".

.... From 12 Sep 2022: India’s coal output to grow by 6.6% in 2022 backed by output from Coal India Ltd - Mining-technology. "After a 6.8% increase in 2021, India’s Coal production is expected to grow by 6.6% to 864.8 million tonnes (Mt) in 2022".

Global copper reserves is estimated to be 886 million tons (Natural Resources Canada). Annual usage is 28 million tonnes (Copper Alliance). Recycled is about 8.7 million tons (Copper Alliance). Thus the world will run out of copper in 46 years.

Here Are the Best Places to View the 2024 Total Solar Eclipse on 8 April - Scientific American. It would have scared primitive people. It still feels like the world is coming to an end, even when you understand the cause.

Saturday 23 Mar 2024

"$SPX is expected to report Y/Y earnings growth of 3.4% for Q1 2024, which is below the estimate of 5.7% earnings growth on December 31." - Twitter.

Friday 22 Mar 2024

"Huawei and a secretive chipmaking partner in China have filed for patents on new methods of producing advanced semiconductors" - Twitter. US sanctions may work against small countries, like South Africa, but all they have done now is to speed up China's development, and the decline of the semiconductor industy in the West.

Banning TikTok Would Do Basically Nothing to Protect Your Data - Scientific American. They should be more concerned about the decline of civilization, as illustrated by TikTok content.

"U.S. shale oil production could be facing some challenges due to well depletion and a shift in company priorities, potentially leading to higher oil prices." - Twitter.

The US volume of gasoline sold has declined since 2015, but is still at historically high levels, despite electric vehicles:

Thursday 21 Mar 2024

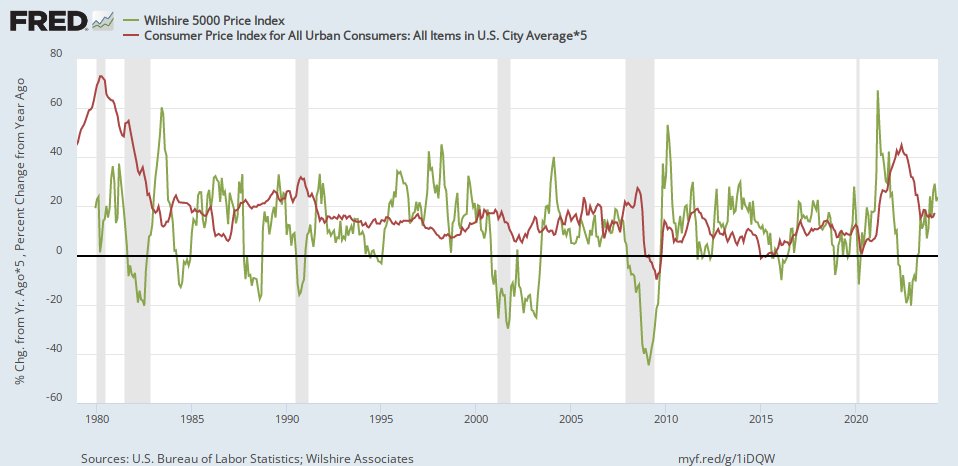

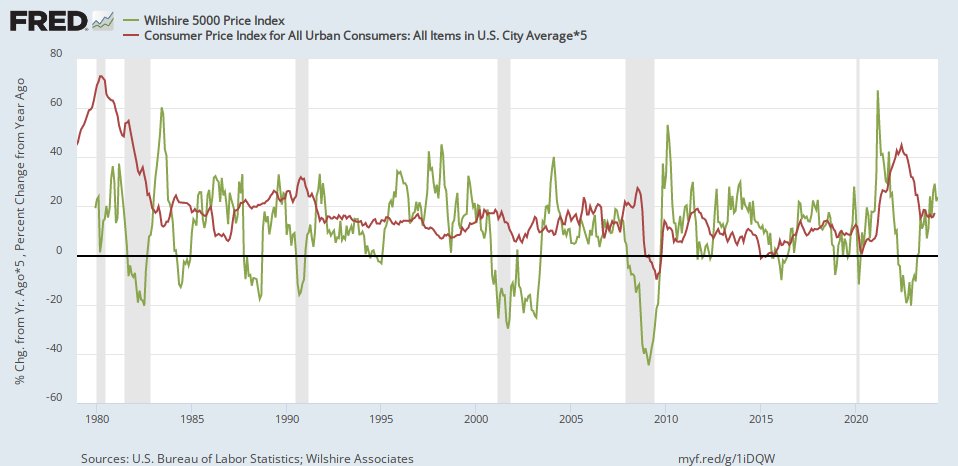

Asset appreciation, like an increase in house prices (blue) leads to an increase in general inflation (red). It increases the money in circulation, if there is debt involved. The official inflation rate measures the inflation rate of poor workers, and not where the big increase in money is, amongst the wealthy.

Likewise rise in the stock market (green) contributes to general inflation (red). The present rise in the stock market (green) could lead to another rise in inflation (red).

Wednesday 20 Mar 2024

"The "new" Volcker (Powell) will have to write a book about how he tamed inflation by cutting rates during a stock mkt. bubble, with wild speculation evident (cryptos, NVDA, SMCI), with house prices at record levels & with oil, gasoline & other commodities lifting. A best seller!" - Twitter.

US price of bread (blue) and eggs (red) compared to the average wage (green). At least you can have your eggs on toast without working harder.

Tuesday 19 Mar 2024

From 29 Dec 2023: 200 Years of Global Gold Production, by Country - Visual Capitalist.

Monday 18 Mar 2024

One reason for the weakening economies in Europe would be increased government spending, as suggested by the European Debt to GDP Ratios - Wikipedia. Greece went from 20% in 1980 to 200% in 2021, France from 20% to 114%, Spain from 36% in 1990 to 140%, etc.

Saturday 16 Mar 2024

Doctors are turning medical generative AI into a booming business - CNBC.

The NAR settlement could slash home prices for many Americans - CNN Business. Most real estate agents work for an agency, which sets the commission. Agents need to be compensated for all the hours they put in, depending how high the demand is.

....What Is the Average Time to Sell a House? - Zillow. "In 2020, homes spent an average of just 25 days on the market before going under contract, down from 30 days in 2019 .... 2021 continues to buck typical selling trends; in April, nearly half (47%) of homes were on the market in as little as a week before going pending."

Friday 15 Mar 2024

LIVE: Concorde returns to New York after refubishment - Youtube.

"JUST IN: Democratic Senators Jack Reed & Laphonza Butler have asked SEC Chair Gary Gensler to deny other crypto ETFs." - Twitter. They like to create monopolies.

Euro M3 money growth (blue) and Euro Area bond rates (red). From 2014 to 2023 savers were impoverished with very low interest rates (red) whilst money was created at about 6% per year (blue).

The economies of Italy (blue) and the Netherlands (red) grew relative to US total debt up to 1980, and have declined since. Italy has done worse. What happened? For one thing, interest rates declined (green), presumably due to the weak economies. It is possible that inflation was underreported, as a result of which interest rates were kept too low, asset appreciated, causing higher inflation and a bigger wealth gap.

Thursday 14 Mar 2024

This Breakthrough Wireless EV Charger Reaches 100 kW Speeds With Near-Perfect Efficiency - InsideEVs.

From 13 March: No Semiconductor Subsidies Discussed in Korea Compared to Its Major Rivals - Business Korea: "The United States plans to pay a total of US$52.7 billion in subsidies through the Chips Act", "This explains why China has begun to create the largest ever national integrated circuit industry investment fund of US$27 billion."

From 6 March: AI chip manufacturing subsidy leaves US officials with tough choices - Reuters: "U.S. officials have earmarked close to $30 billion in subsidies for advanced semiconductor manufacturing, aiming to bring cutting-edge artificial-intelligence chip development and manufacturing to American soil."

From 21 Dec 2023: Chinese Chip Import Concerns Prompt US to Review Semiconductor Supply Chain - VOA News. "China had provided the Chinese semiconductor industry with an estimated $150 billion in subsidies in the last decade".

The US average house price (red) has grown 2.5x more than the official inflation rate (blue) compared to 1963. The producer price of construction material (green) has increased at the same rate as CPI. The difference between the average house price and official inflation rates doesn't make sense.

....Some websites claim houses are twice as big today. According to Census.gov: "The median square footage of a single-family home built in the 1960s or earlier stands at 1,500 square feet today. In comparison, the median square footage of single-family homes built between 2005 and 2009 and between 2000 and 2004 stand today at 2,200 square feet and 2,100 square feet, respectively". That is +47% larger since 1960s.

...."In 1973, the earliest year for which U.S. Census data is currently available, the average size of a house in the U.S. was 1,660 square feet. By 2015, the average square footage of a home increased to a whopping 2,687 square feet, although since then, it’s begun to drop. In 2021, the average square footage of a single-family home fell to 2,273 square feet." - Rocketmortgage. That is +37% since 1973.

....The median pending house in metros according to Redfin is 1678 sqft - Public.tableau. That is not much larger than in the 1960s. Apparently, the wealthy built much bigger houses, pushing the average up.

Wedesday 13 Mar 2024

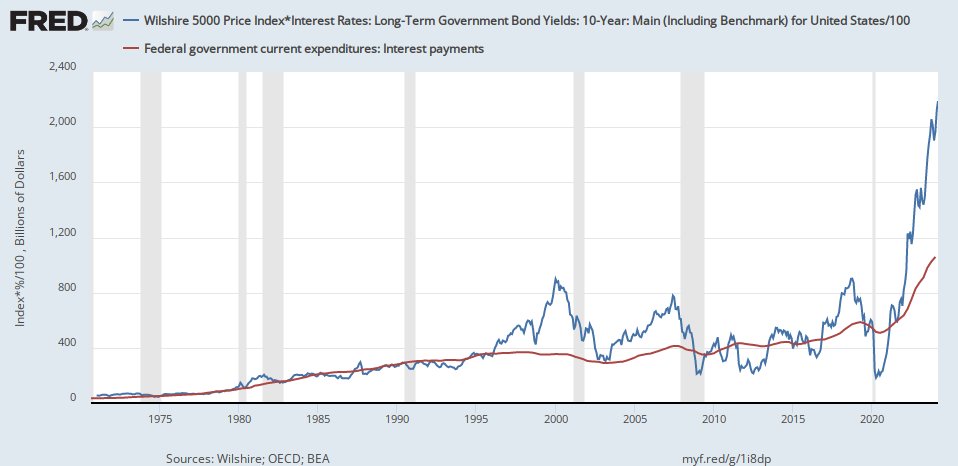

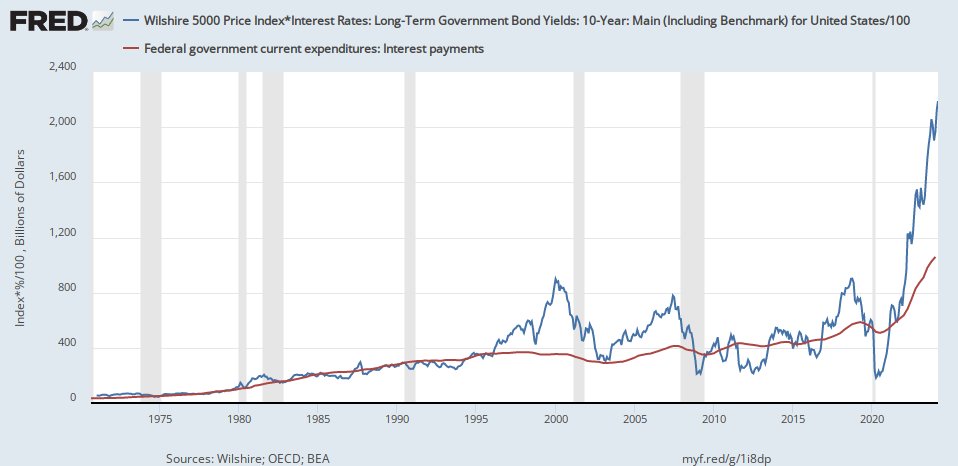

In principle a stock market should decline when ruling interest rates rise, to increase the earnings yield. The product of market cap and interest rates should remain relatively constant. If all shareholders borrowed money to invest in the stock market, and paid the same interest rate as the government on bonds, their payments have shot up to $2.06 trillion last year (blue), compared to the $1.03 trillion the federal government pays on its debt (red). The two lines strangely coincided for a long time. Clearly the stock market (blue) is expensive when it wanders far away from government interest payments (red).

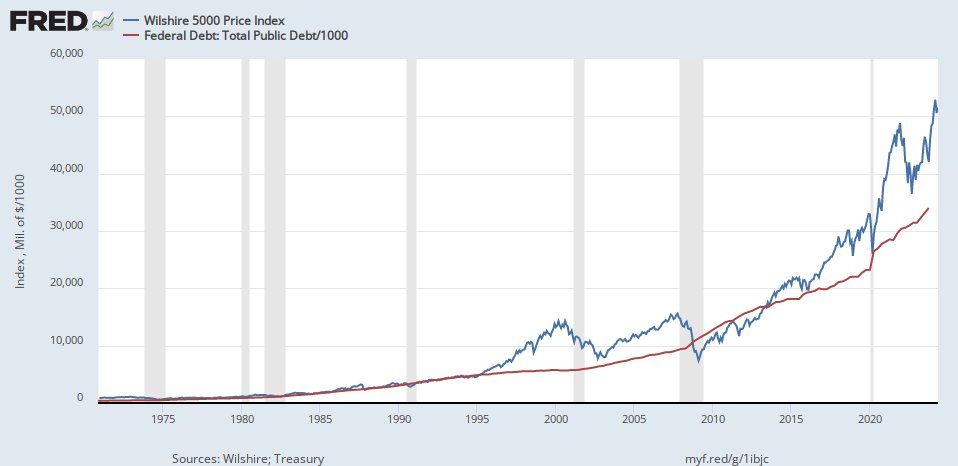

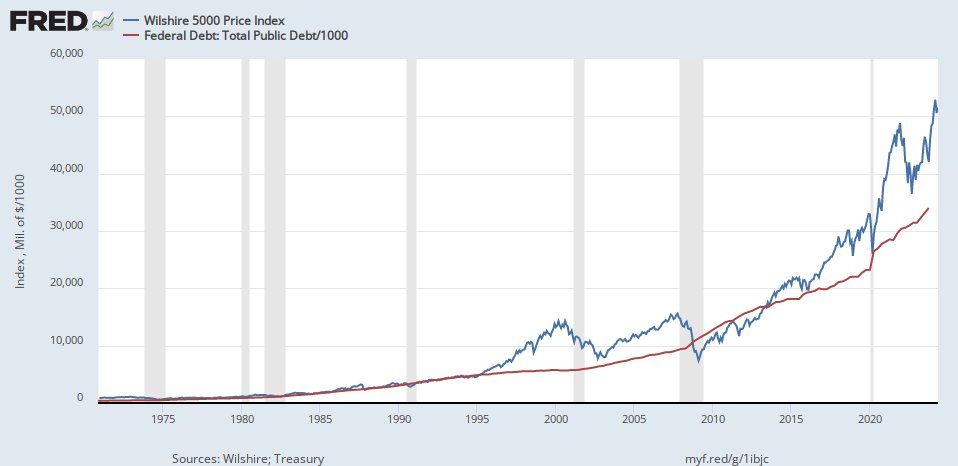

US federal government debt (red) is typically as big as the whole stock market (blue). What a shocker. It could either be politicians realising they can borrow more as the economy grows, or a necessity to keep up with inflation. An increase in asset prices creates inflation, and then government must spend and borrow more to keep up with inflation.

Tuesday 12 Mar 2024

"Boeing, $BA, failed 33 of 89 audits conducted by the FAA after one of its 737 MAX 9 jets experienced a mid-flight door plug blowout, per Axios." - Twitter. The safety record of airplanes is remarkable. It has to be. One serious accident, and passenger numbers will tumble.

This chart shows US dollars relative to foreign currencies – up means a stronger foreign currency. Ten years ago you received $1.67 for £1, and now $1.27. The Euro weakened from $1.38 to $1.08. The Swiss franc strenghtened from $1.10 to $1.13. All three strenghtened since Oct 2022, which is when the US stock market dipped. The US stock market has risen since, whilst the US dollar has weakened.

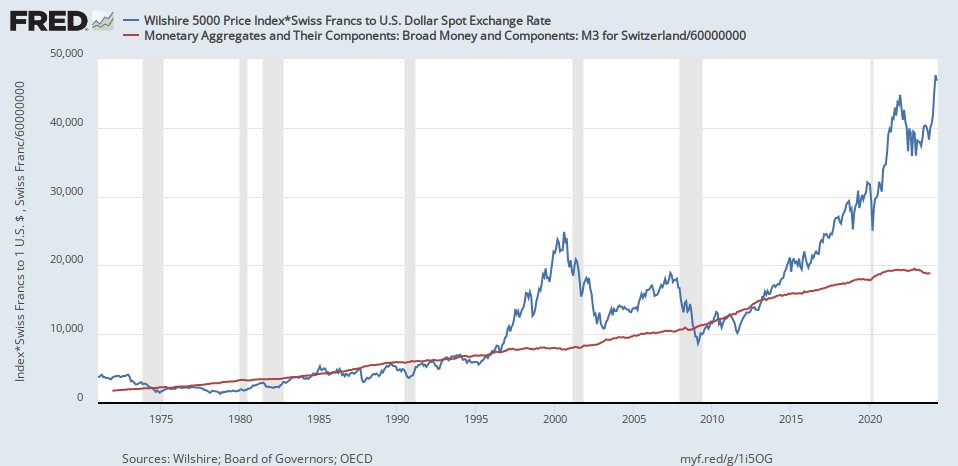

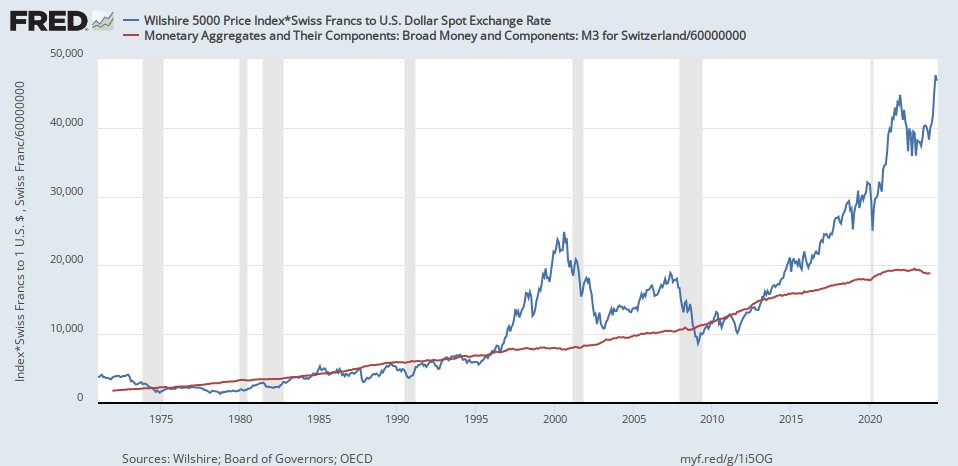

The US stock market in Swiss franc (blue) compared to Switzerland's M3 money supply (red). The stock market bubble of 2000 was only eliminated by the Great Recession of 2009. The present double top stock market bubble could take a decade to correct.

Monday 11 Mar 2024

FRED has the US Currency in Circulation back to 1917. This chart shows the Dow Jones Industrial Stock Price Index (DJIA) (green) relative to the currency in circulation (red) during the 1929 stock market collapse. You don't need the currency reference. The market fell back to were it was.

The present Wilshire 5000 stock market index (green) relative to the currency in circulation (red). The currency in circulation today is only $2,328 billion compared to M1 money supply $18,009 billion, and total debt $98,373 billion.

The ratio of the Wilshire 5000 stock market index to the currency in circulation up to Feb 2024:

Sunday 10 Mar 2024

SpaceX-Backed Flying Car Startup Gets FAA Nod - Zero Hedge.

Saturday 9 Mar 2024

Australian farmers rip out millions of vines amid wine glut - CNN.

"Wasn’t long ago this was a $1mm home in Joshua Tree and it sold with multiple offers. Now it’s a $600k-700k home - below replacement cost" - Twitter.

Friday 8 Mar 2024

"S&P 500 Q3 2023 buybacks were $185.6 billion, up 6.1% from Q2 2023's $174.9 billion and down 12.0% from Q3 2022's $210.8 billion" - PR Newswire. The S&P 500 market cap is $42.795 trillion (Slickcharts). Annualized the buybacks were 1.7% of the market cap. The share price should increase by 1.7% in a year, and the price/earnings stay the same. This has little effect on the share price. Due to the high P/E ratio they buy back few shares. The earnings yield is only 4.3% (Ycharts).

Buying back shares does not change the market cap. An increase in the share price is negated by having fewer shares in issue. The total wealth of shareholders does not increase. Some sold their shares back to the company, and now have cash instead.

The ICE BofA BBB US Corporate Index Effective Yield is now 5.55% (below). The earnings yield on the S&P 500 is 4.3%. Depending on what the actual S&P 500 corporate bond rate is, it would be better for companies to use their profits to pay back debt rather than buy back shares at these levels.

Thursday 7 Mar 2024

'The race is heating up from both sides: Per the @WSJ below, China continues to accelerate its journey towards #tech self-sufficiency and, in the process, "muscling U.S. #technology out of the country—an effort some refer to as “Delete A,” for Delete America."" - Twitter. A country that manufactures already has a major benefit in terms of supply chains.

The US working age population from 15 to 64 years old (blue) at 209M is levelling off. The population 65 years and over at 57M in 2022 is rising. The ratio of working age to over 65 has fallen from 5.6x in 1977 to 3.6x 2022. Pension payments are either funded by contributions from present workers, or from pension funds invested in the stock market and bonds. If the working age population declines, the economy and stock market would probably too.

Pension fund assets to GDP increased to 150% in 2019.

Wednesday 6 Mar 2024

"Foreign investors’ allocation in US equities is currently as extreme as they were at the very peak of the tech bubble." - Twitter.

Argentina fights against vast swarms of mosquitoes blamed for dengue surge - The Guardian.

....From 22 April 2023: Argentina dengue: Record fever outbreak kills over 40 - BBC.

....From 13 Sep 2019: GM mosquitoes in Brazil - DW. "About 18 months after the end of the experiment, the mosquito population returned to what it had been before".

Government debt (red) often shoots up during or after a recession (grey bands) as interest rates decline, whilst other debt (blue) increases slowly. An apparent attempt to stimulate a weak economy. Government spending leads to lower productivity.

Tuesday 5 Mar 2024

Why Dakota Johnson Says She'll "Never Do Anything” Like Madame Web Again - Enews. The Dakota didn't take off.

Is US economic output (blue) determined by M3 money supply (red) or by total debt (green)? In Q4 GDP (blue) was still climbing whilst money supply (red) has declined. Total debt (green) is climbing like GDP, and is 3.5x bigger.

The increase in interest rates up to 5.33% in Aug (red) might be enough as debt growth is coming down (blue). The debt decline (blue) during the Great Recession of 2009 was exacerbated by those nasty subprime loans. Before 2009, debt growth (blue) never fell below 5%, which meant that inflation was never brought under control. Interest rates were lowered due to recessions, which caused debt to grow more than 5% every time. The question is why debt growth of more than 5% was required to prevent a recession. The recessions could be the result of the delayed inflation caused by the previous increase in debt.

You start with an economy that has no real growth, and then you create ups and downs for the illusion of real growth at times.

Monday 4 Mar 2024

"JPMorgan & Chase will join France’s Cartes Bancaires, giving the payment network more heft to compete with US rivals Visa and Mastercard" - Twitter. Perhaps pressure on the high profit margins of Visa and Mastercard.

Apple Hit With $2B EU Fine for “Abusing Dominant Position” in Market for Music Streaming Apps - The Hollywood Reporter.

According to Macrotrends the Nasdaq price/earnings ratio of 26.6 is not particularly high relative to previous peaks. The EPS (Earnings Per Share) has declined for the last 2 years. The EPS grew by 15.5% per year from 2009 to 2021, well above the rest of the economy, which is not sustainable forever.

On this chart US corporate profits (blue) at 13.0% of GDP (Gross Domestic Product in red) in Q3 are near peak levels, which suggests more downside risk than upside potential. Profits as a percentage of economy is limited. However, GDP (red) is still climbing, at 5.8% in Q4. The interest rates increases have not yet stopped debt increasing, and economic growth which is mainly inflation. The primary function of interest rates is to regulate the supply and demand for credit. Looking at the way the economy (red) shoots up, how higher must interest rates rise to slow it down?

The ratio of corporate profits to GDP (red) at 13.0% has risen back to the 1947 level, whilst total wages to GDP (green) has declined to 43.2%.

Saturday 2 Mar 2024

"EXCLUSIVE: Taylor Swift has already written multiple love songs about Travis Kelce, a source tells Us exclusively." - US Weekly, Twitter. That poor guy.

The price of cacao beans has shot up. Now inflation is getting serious.

Friday 1 Mar 2024

The American revolt against green energy has begun - The Telegraph. Wind turbines do spoil the landscape, besides being an intermittent and useless power source.

US personal consumption expenditure on package tours as percentage of GDP (gross domestic product) was high in the 1930s, very low after the second world war, and high since 1990 (chart below). "We're all going on a summer holiday" (Cliff Richards). What mode of transport was used for tours in the 1930s? Airplane passengers increased from nothing in 1945 to 4500 million in 2019 (Eesi). They did not travel by plane.

The Cult of the Cruise – A Look at the History of the Cruise Holiday - The British Newspaper Archive. "So in this special blog, we dive into the history of cruising, from its Victorian infancy to its Golden Age in the 1930s, using pages taken from the British Newspaper Archive Perhaps ships". This despite the Titanic incident of 1912.

The transition from horse-drawn carriages to cars happened in the 1910s (Researchgate). After the second world war, people probably didn't want to see Europe.

The locomotives assigned to freight and passenger service declined from 1924 to 1940.

US rail consumption (blue) declined in the 1930s. Truck production (green and red) developed up to 1929, and also declined in the 1930s during the Great Depression.

Previous webpage

Previous webpage

CONTACT INFORMATION

Commentary to: slandrp@gmail.com

This website is: www.aandele.co.za/AandeleVSA

Disclaimer: No responsibility is accepted for wrong information, or for losses as a result of any information on this website. The contents should not be regarded as financial advice. Website visitors should consult with their own financial advisors before reacting to information.

Copyright @2024