Wednesday 31 Jan 2024

High gold price reflects strong demand - World Gold Council. There is no growth in demand, but even at constant demand the gold ore becomes more difficult to extract. Reserves of 50,000 tons divided by annual demand of 4448 tons leaves 11 years of gold production. According to the internet it is more like 25 years. There is a lot of gold ore in the earth's crust but you have to mine deeper and deeper to find it. Taking gold out of the ground to store it above ground is not productive. If the people elected better governments there would be no need to invest in gold.

Elon Musk’s $56B Tesla pay deal is unfair, judge rules - Techcrunch. "McCormick described the process leading to the approval of Musk’s compensation plan as “deeply flawed,” largely because of his deep ties to the people, including board members, who were supposed to be negotiating on Tesla’s behalf."

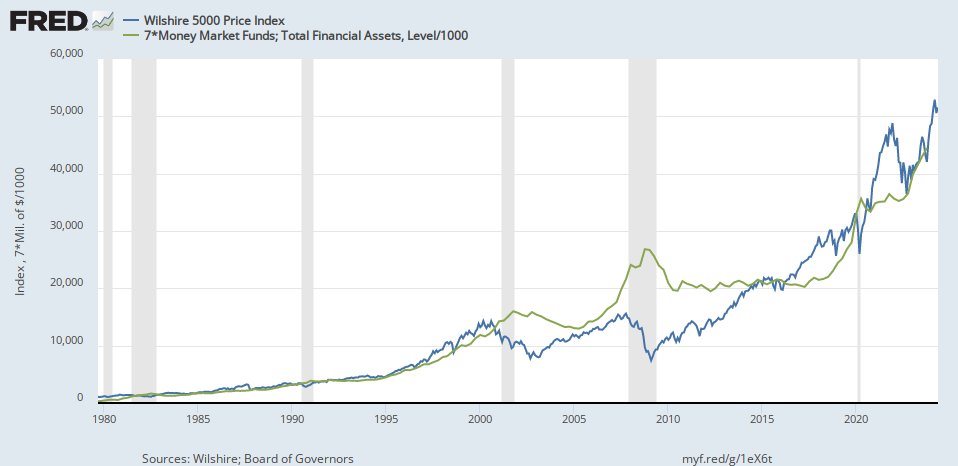

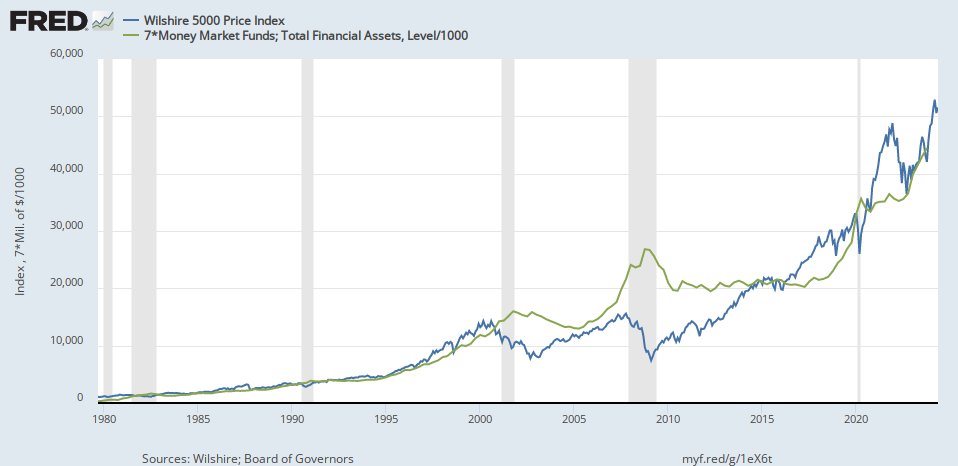

Comparing 7x US Money Market Funds (green) with the Wilshire 5000 stock market index (blue). The money market funds reach a peak level during recessions (grey bands), as the stock market crashes. It could be sellers putting their proceeds in a money market account. Money market funds have risen to all time high levels, which would typically would indicate a recession. The stock market did fall in October 2022, but have returned to new highs. Based on money market funds, the stock market should be down, or a fall is imminent.

Tuesday 30 Jan 2024

US gross domestic product per capita (blue) has outperformed other developed countries in US dollars: Germany (red), UK (purple) and Japan (green). It happened before 1980-1985.

Monday 29 Jan 2024

"The trailing 12-month P/E ratio for $SPX of 24.2 is above the 5-year average (22.8) and above the 10-year average (21.1)" - Twitter.

"JUST IN - Amazon terminates iRobot deal, vacuum maker to lay off 31% of staff — CNBC" - Twitter.

"Abuse of power isn't limited to bad guys in other nations. It happens in our own country if we're not vigilant." – Clint Eastwood - Twitter. Power has been abused many times without consequences.

Eklund Gomes Reveals $3.77B in Real Estate Sales in 2023 (Exclusive) - The Hollywood Reporter.

" 'Ghostbusters: Frozen Empire' Trailer Teases Original Cast's Take Down of "Tall, Dark and Horny" Enemy" - Twitter.

"Reese Witherspoon, 47, and her mini-me daughter Ava Philippe, 24, look like TWINS as they drink white wine together at a bistro in Paris after PFW" - Twitter.

Sunday 28 Jan 2024

"Julius Baer may write off around 400 million Swiss francs related to its exposure to bankrupt property mogul Rene Benko’s Signa empire" - Twitter. When you are rich, investments are just written off. Reminds one of Donald Trump's four bankruptcies. Enrich yourself, and let the creditors pay for it.

The Great Growth Hoax - Zero Hedge: "The essential ruse comes down to unfathomable amounts of government spending that is being recorded as productivity and output, and interpreted by media as growth. “In the past 12 months the federal deficit increased by $1.3 trillion. Yet we only got half that in GDP—about $600 billion. In other words, everything else shrank."

The annual increase in US nominal GDP (blue) compared to the annual increase in total debt (red). In the periods leading up to recessions (grey bands) there is a big increase in debt with little impact on economic output.

Friday 26 Jan 2024

Shown below is the Federal Funds Effective Rate multiplied by total US debt, which represents the interest cost on debt. Every recession (grey band) interest rates fall. Based on this chart a recession seems likely, although actual interest rates differ from the Federal Funds Effective Rate depending on the type of debt.

For a long time the theorectical home loan interest payments based on total mortgage debt, and the 30 year mortgage interest rate (red) was below the actual Mortgage Debt Service Payments (blue), but has caught up with it after 36 years. For most of this period interest rates declined. As interest rates decline, some home owners are still locked into an old rate, and therefore pay more (blue) than the new rate (red). Since Q4 2022 they have paid less than the new rate.

Thursday 25 Jan 2024

The US has a century of natural gas left, but apparently only 5 years of oil. Nevertheless U.S. Field Production of Crude Oil (EIA) was at record levels in October.

From July 2016: Reserve Estimates - The American Oil & Gas Reporter: "Ranked by proved plus probable reserves (P2), Saudi Arabia holds 120 billion barrels, followed by Russia with 77 billion, Iran with 59 billion, Canada with 41 billion and the United States with 40 billion."

US real industrial production: manufacturing (blue) stayed the same proportion of real gross domestic product from 1929 to 2008, but has since deviated.

The real industrial production: manufacturing of motor vehicles and parts, per domestic auto produced has shot up. Statistical services do explain the basis of their calculations well. Has local manufacturing shifted towards luxury cars for the wealthiest 10%, or is the inflation rate on cars much higher than deflator used for production?

Wednesday 24 Jan 2024

"State-level unemployment rates were just released and they continue the string of bad news from the household survey." - Twitter.

"Netflix revenues hit a record $8.8 billion in Q4 2023, up 12.5% YoY. This was the highest growth rate since Q4 2021. 13.1 million paid subscribers were added, well above estimates of 8.8 million. Stock was up 9% in after hours trading to a new 52-week high." - Twitter. The instantaneous 9% rise in the share price is higher than the annual revenue growth of 6.7%.

The debt of nonfinancial corporate businesses as a percentage of the market value of equities is 24.2%. It was as high as 99% in 1974.

Corporate debt only makes up 14.2% of US total debt. It is probably not a good sign that so much of a country's debt is not used for business activity, to generate the profits with which the debt can be paid off.

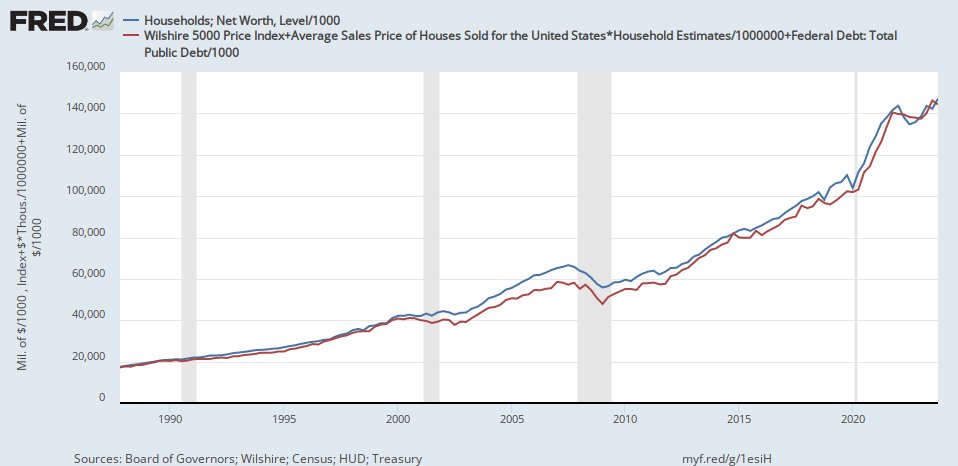

This chart attempts to show the ratio of household's net worth that is cash investments, not matched by US total debt.

Tuesday 23 Jan 2024

"TXN CEO: "Revenue decreased 10% sequentially and 13% from the same quarter a year ago. During the quarter we experienced increasing weakness across industrial and a sequential decline in automotive." TXN's Q1 revs. forecast -10% Y/Y. Q4 inventory +45 Y/Y to $4B." - Twitter.

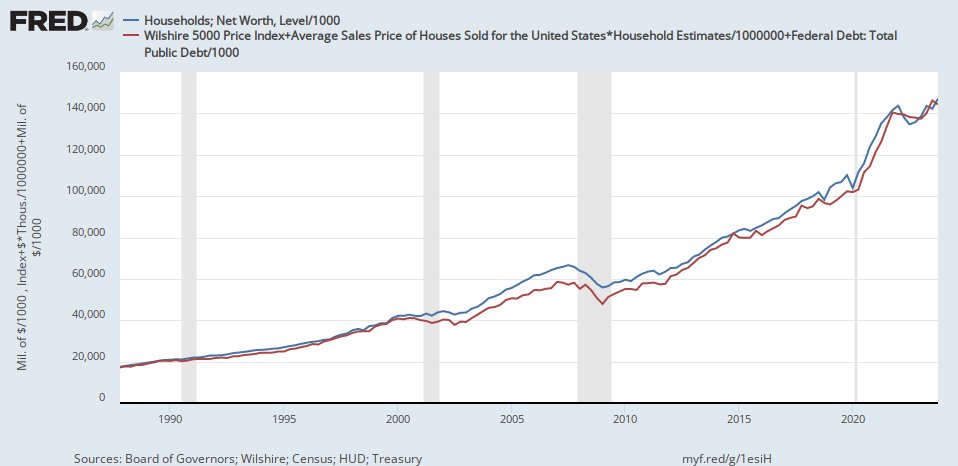

There is a number bigger than US total debt, namely household net worth (blue) at $142 trillion. That is basically the sum of the three biggest asset classes: stock market, average house price x number of households, and government bonds (red).

The annual revenue generated by the assets, as gross domestic product over household net worth is 19.4%, down from 28.7% in 1987.

Is consumer sentiment (chart below) a predictor of the state of an economy? No, it stays high right up to the start of a recession.

From 9 Aug 2007, just a few months before the US stock market started to fall from a peak level: July consumer confidence at 6-year high - Reuters. Confidence is high when investments like the stock market is at high levels.

Monday 22 Jan 2024

The media is full of discussions about economic growth, inflation, and deflation. During the 2008 and 2020 recessions the US economy (blue) shrunk relative to total debt or money supply (red), and did not recover. After the recessions the two slopes stayed approximately the same, which means no real economic growth or decline. It is around recessions that the separation takes place.

Higher interest rates (green) cause the economy (blue) to decline, which increases poverty, but money supply (red) keeps growing, and so does the assets of the wealthy. Governments continue spending, borrowing and printing money. Politicians think they can spend their way out of economic trouble, which results in more poverty. Big businesses with limited competition are not affected, as they can raise prices or cut staff.

Interest rates (green) have shot up in 2022. Normally this would lead to an economic recession (grey band), and a dip in the stock market. Money supply (red) would either keep rising or level off for a few years. The economy (blue) has not yet recovered from the 2020 recession, and could now experience a further separation from money supply (red).

Sunday 21 Jan 2024

"The so-called Magnificent Seven megacap companies are expected to deliver combined profit growth of about 46% this earnings season" - Twitter.

How The Government Constructs Positive Economic Data - Zero Hedge.

Saturday 20 Jan 2024

According to the European Central Bank, the Outstanding amounts of debt securities issued by euro area residents was €20.415 trillion by March 2022. It doesn't say who is regarded as a resident. The data has been discontinued.

'The most expensive real estate in Brazil isn’t on the beaches of Rio de Janeiro. It’s in the small town of Balneario Camboriu, dubbed the “Dubai of Brazil.” ' - Twitter.

"Diamond giant De Beers makes big cut to prices to revive gem sales after the market ground to a halt" - Twitter. Lab grown diamonds are much cheaper.

Friday 19 Jan 2024

"The S&P 500 just closed at record levels, yet only 1 out of 11 sectors made new highs today — Technology" - Twitter.

Common mineral plays key role in cloud formation - Mining.com.

"Japan moon landing mission: space agency to attempt its first lunar touchdown – live updates" - Twitter.

"It Feels Like Something Has Gone Terribly Wrong" - 5 Swedish Cops Forced To Pay Fine To Convicted Syrian Migrant Who Brutally-Attacked Them - Twitter.

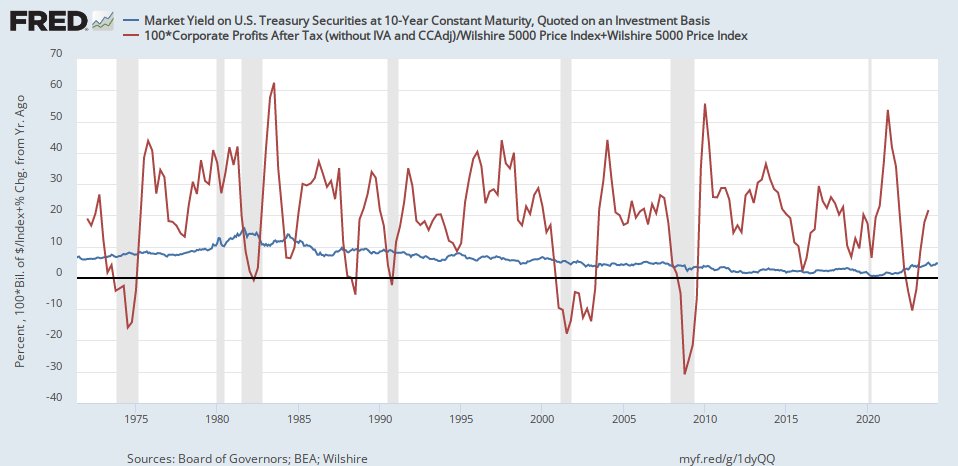

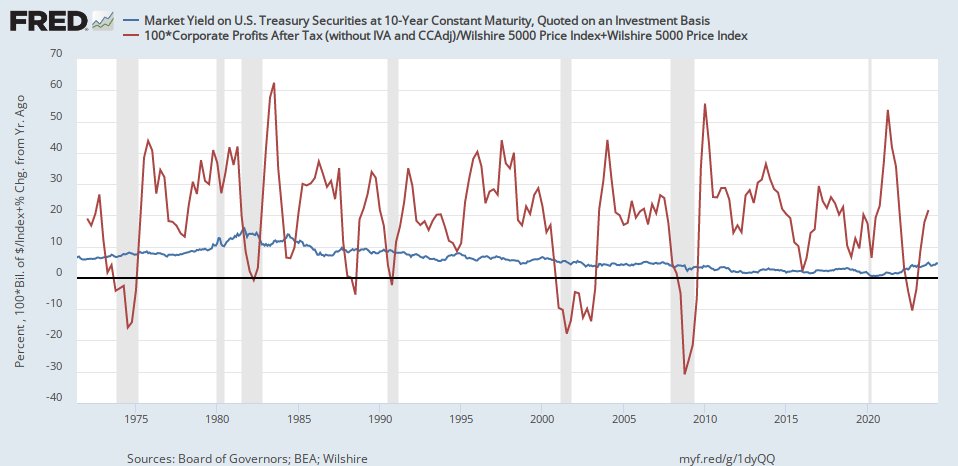

When interest rates (red) are low, company profit margins improve, shown here as corporate profits over gross domestic product (blue).

Which means that the product of profit margins and interest rates should stay around a constant level (below). At this point interest rates could either decline, or proft margins decline, based on what happened the last 40 years.

Thursday 18 Jan 2024

"Milei's 2024 Davos talk, directly translated to English by AI (by heygen), in his own accent. Better than the dubbed version imo." - Twitter.

"HP is facing a class action lawsuit on printers being disabled after third-party ink replacement. "For us, it's important to protect our IP," says

HP CEO EnriqueJLores" - Twitter. The HP ink printers are just as bad as Canon. Ink runs out after a few pages, or the cartridges leak.

Everything else looks small compared to the US total debt of $96.86 trillion in Q3 (red), including gross domestic product (purple), bank deposits (green) and money market funds (blue). Such big debt seldom ends well for the currency, and the lenders/savers. Japan's total debt was $12.06 trillion in Q4 of 2022.

FRED no longer has the gold price. The present US total debt is equal to 1,485,000 tons of gold. In 1970 the debt was equal to 1,389,000 tons of gold. All the gold mined in history is about 209,000 tons. If the gold price reflects inflation, then the US total debt increase has only created inflation, and no economic growth.

This chart shows the China stock market relative to economic output (blue left), and Wilshire 5000 stock market index to US economic output (red right). The China stock market represents the profit from manufacturing, and the US stock market the profit between expensive branded products and cheap manufacturing.

The China stock market in US$ (blue left) shot up in 2007, and remained flat since. The US stock market (red right) has risen since 2009.

Wednesday 17 Jan 2024

Climate change isn't producing expected increase in atmospheric moisture over dry regions: Study - Phys.org. Vegetation is required to supply the moisture. The benefit of forests is the supply of moisture. Humans have eliminated a lot of forests, and vegetation in cities.

"As Las Vegas prospects improve, this casino giant's stock gets an upgrade" - Twitter. Too late. It is getting close to the end of the recovery from the Covid lockdowns.

The US Federal Deficit per worker (blue) for 2023 was 21% of the average wage in Jan 2023. In 2020 it reach 51%. Those were good times.

Tuesday 16 Jan 2024

"Iowa Caucus Results" - Twitter.

The average house price in the US (red) compared to Ireland (blue) and New Zealand (green). The average house size varies from country to country, and prices vary from city to city. All you can tell from this chart is that Ireland house prices (blue) have returned to the normal discount, and were much cheaper in New Zealand (green) before the sharp rise from 2002. Something caused a shift in value.

Monday 15 Jan 2024

"A single dose of urea-powered nanorobots reduces bladder tumors by 90% in mouse study" - Twitter.

US freight shipments have grown very little over 34 years, whilst the population increased 35%. In terms of goods, the standard of living has apparently not increased.

People are paying more for services (green) especially medical (purple) than for durable goods (blue) and non durable goods (red). Despite the lower price, the population is not able to buy a greater volume of goods based on freight shipments.

Friday 12 Jan 2024

Volvo CE and Rolls-Royce develop wood-burning charger for off-grid EVs - Electrek.

Disney gets good news about its lawsuit against Ron DeSantis - TheStreet.

In the 1970s US total debt (money supply) growth made three waves (blue), resulting in inflation (red) rising three times. There was a fourth debt wave in 1985 but miraculously did not cause inflation.

Ronald Reagan was the US president from 1981 to 1989, during the period that debt growth (blue) peaked at 16.5% in 1985. Government spending (red) was reduced relative to money created. House price growth (green) did reach a peak of 15.5% in Q4 1987, but is not reflected in overall inflation which was 4.3% at the end of 1987.

The inflation wave (red) from the 2020 money creation (blue) has occurred. Before 2008 there were also inflation waves (red) after money creation (blue) picked up. The inflation appears much smaller than the money created, probably due to the under-reporting of inflation.

Thursday 11 Jan 2024

"OIL MARKET: Hertz plans to sell a 1/3 of its US electric vehicle fleet and reinvest in gasoline-powered cars due to weak demand and high repair costs for its battery-powered options" - Twitter.

How dependent are US company profits (blue) on cheap Chinese manufacturing, as indicated by China's quarterly gross domestic product in US$ (red)?

US corporate profits (blue) are closely link to US imports (red) and exports (purple). Imports from China (green) are small.

Monday 8 Jan 2024

Blastoff! ULA's Vulcan rocket launches moon lander on first mission - Youtube.

"Ranked: The World’s Top 10 Electronics Exporters (2000-2021)" - Twitter. The USA went from first (16%) to 4%. Japan went from second (13%) to 4%.

Sunday 7 Jan 2024

"France says it will aim to reduce the share of fossil fuels in its energy consumption mix to 40% from more than 60% by 2035" - Twitter. The way its GDP is falling, that should not be difficult.

India's population (red) at 1.42B in 2022 has started to exceed China (blue). Africa's population was 1.46B in 2023, and doubles in 30 years.

Saturday 6 Jan 2024

"41% of the Russell 2000 = unprofitable companies" - Twitter.

"The Tesla Cybertruck is more American-made than most other pickup trucks; right up there with the Honda Ridgeline!" - Twitter. Past and present owners of Ford and GM cars question the advantage.

Friday 5 Jan 2024

In a first, FDA says Florida can import prescription drugs from Canada - LA Times.

China Gross Domestic Product (blue) and Japan (red) as ratio of US economy. China could fall to 64% in 2023.

Germany (blue) and France (red) GDP relative to the US:

US manufacturing has picked up, but not relative to GDP:

Thursday 4 Jan 2024

The Vultures Are Circling: Who Will Walk Away With Paramount? - Hollywood Reporter.

"The Federal Register keeps a daily record of new federal gov't rules & regulations. It wrapped up 2023 with a whopping 90,402 pages – the 2nd most pages on record, only behind Pres. Obama in 2016." - Twitter.

Wednesday 3 Jan 2024

The total return on an investment is the sum of income, like dividends, and the capital growth (including share buybacks). Holding government bonds for the full term (from issuance to maturity) gives no capital growth. Bonds are only attractive when interest rates decline. The interest rates on government bonds typically do not compensate for the actual inflation rate. With government being a big borrower, and with indirect control over the "independent" Federal Open Market Committe (FOMC) savers will not be offered inflation beating interest rates.

The chart show the sum of the earnings yield on US stocks, and the annual growth of the stock market (red), compared to the yield on 10 year government bonds (blue). Share buybacks is included in the earnings yield, but not in the stock market growth, since the latter index is based on total market capitalization, which in principle should not increase with share buybacks.

To compete with the stock market since 2009, bond rates should have been 15% to 25%.

Tuesday 2 Jan 2024

"92.5% of equities are held by the top 10% wealthiest Americans. A record high concentration" - Twitter.

"US reportedly halted ASML's chipmaking machine shipments to China weeks before ban" - Twitter. This will likely hasten China's dominance of semiconductor manufacturing, at a much lower cost. What little comparative advantage the Netherlands has left, is being undermined by the US Empire.

BYD Sales Hit Massive Record In December, Overtaking Tesla - InsideEVs. BYD sold 942,651 in Q4 (526,409 battery only), and 3,012,906 in 2023. "Q4 tesla $tsla Almost 5000 more S and X delivered than produced. Inventory sales" - Twitter. Tesla delivered 484,507 in Q4, and 1,809,581 in 2023.

How does the growing wealth inequality end? During the Middle Ages or medieval period (500 to 1500 AD) there was the wealth divide between the wealthy landlords and poor peasants. Today wealth is also invested in properties and businesses. Centuries ago there was serfdom (Wikipedia): "Serfdom as a system provided most of the agricultural labour throughout the Middle Ages", "The era of the French Revolution (1790s to 1820s) saw serfdom abolished in most of Western and Central Europe ...".

A revolution would not make sense in democratic countries. Instead a different government is elected. In Argentina government expenditure was 37.28% of GDP, compared to 36.26% in the US, and 58.34% in France (IMF). Money supply growth rate: Argentina +113%, France -0.61%, USA -3.61% (The Global Economy). US total debt grew 5.1% per year the last 10 years. The Euro M3 grew 4.9% per year the last 10 years. A high rate of money printing is required for voters to realize they are being impoverished.

Poor people were uplifted by mass education starting in the late 1800s. It was often made compulsory - Wikipedia: "In 1852, Massachusetts was the first U.S. state to pass a compulsory universal public education law". "In 1918, Mississippi became the last state to enact a compulsory attendance law".

Education led to economic development through technology, the Industrial Revolutions - chart from The Fifth Industrial Revolution: How Harmonious Human–Machine Collaboration is Triggering a Retail and Service [R]evolution - Science Direct. Each revolution reduces the need for human labour. Some countries do not develop due to poor education.

In the US, the total net worth of the wealthiest 10% (red) follows total debt (blue). The wealth of the bottom 50% is near zero (purple). Total wages (green) is an annual figure whilst the others are capital amounts.

The annual increase in the total net worth of the wealthiest 10% (red) compared to total wages (green):

Previous webpage

Previous webpage

CONTACT INFORMATION

Commentary to: slandrp@gmail.com

This website is: www.aandele.co.za/AandeleVSA

Disclaimer: No responsibility is accepted for wrong information, or for losses as a result of any information on this website. The contents should not be regarded as financial advice. Website visitors should consult with their own financial advisors before reacting to information.

Copyright @2024